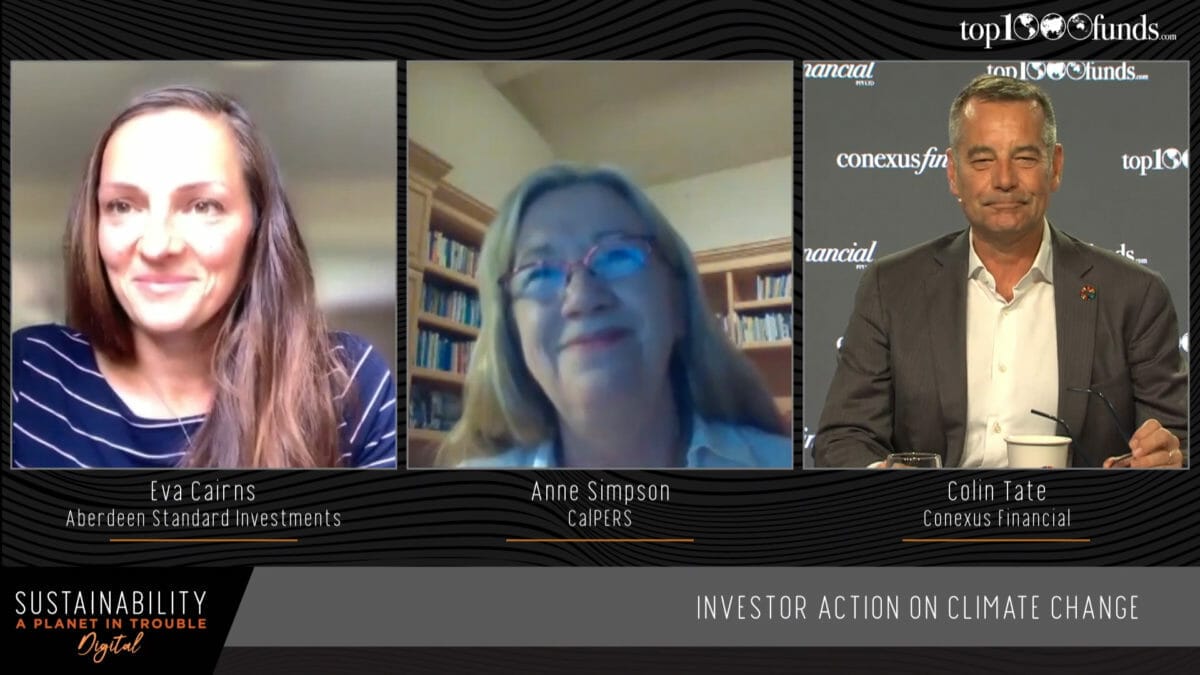

Climate Action 100+ illustrates asset owners’ ability to come together to solve the tragedy of the commons, said Anne Simpson, managing investment director, board governance and sustainability at US pension giant CalPERS. Speaking at Sustainability Digital she said because institutional investors own many of the biggest systematically important carbon emitters in the world, together they can influence change. Climate Action 100+ signatories put pressure on corporate boards to commit to net zero and ensure their corporate governance is aligned with the Paris targets in what Simpson called an often “challenging and painful” process.

The investor collaboration monitors and tracks corporate progress, checking companies do what they say. It also includes a reporting framework. Pressure from the investor alliance has seen companies from across the world make board-level commitments to meet targets and integrate them into their financials, said Simpson. She said that the emissions causing global warming don’t stop at national boarders and companies in emerging markets must work just as hard to meet the Paris targets.

“They don’t live on another planet,” she said.

Here success includes progress in India where two of the country’s biggest emitters have committed to net zero. Simpson told delegates that working with local investors and via local partnerships is key to success in many geographies. Many companies are state-owned, so we need to be in dialogue with regulators and government agencies, she said, adding. “You only make progress with partnerships.”

Simpson told delegates that because of its size, the $400 billion pension fund has “nowhere to hide” and faces systemic risk from climate change.

CalPERS’ sustainability journey began after the GFC when in a back to basics approach the pension fund examined where its value creation came from. Reviewing the evidence it “reframed the agenda” to managing three forms of capital: financial, human and natural.

“Once you realise as a fiduciary, risk and return comes from managing these three forms of capital ESG became a fundamental part of how you invest,” Simpson told delegates.

The pension fund has nearly completed carbon foot-printing its whole fund, and is currently in the last stages of carbon foot-printing the private equity allocation.

In public markets the fund tends to pursue engagement strategies. In private equity it has set out sustainable investment practices and engages with managers. In infrastructure and real estate, the pension fund physically maps climate risk while in fixed income the fund has developed a set of sustainable investment guidelines for due diligence.

“We found that taking a sustainable lens to risk and return has made us more intelligent investors,” Simpson said. Around 20 per cent of CalPERS’ assets are in unlisted investments, while 80 per cent of the fund is internally managed.

Simpson also detailed the challenge of balancing the needs of short-term cash generation to meet pension obligations and investing for the long term – the pension fund pays around $25 billion a year in benefits to its members. CalPERS’ 7 per cent return target, in addition to the cash needed to pay benefits, means financial performance “really matters.”

Committing to the Net Zero Asset Owner Alliance, another investor collaboration, goes beyond simply excluding carbon intensive sectors, said fellow panelist Eva Cairns, senior ESG investment analyst, climate change, at Aberdeen Standard Investments.

It involves monitoring carbon within investments and charting how these levels are decreasing over time with short-term and interim targets. It also involves shifting capital to low carbon solutions and transition leaders, as well as engagement.

She said that engagement is key to find out what companies are doing to navigate risk.

“A lot of companies will benefit from the transition,” she said.

Cairns also detailed the process behind TCFD reporting – the climate-related financial risk disclosures used by companies in providing information to investors. Noting it was a “good way to improve internal processes” and she said it required strong internal governance.

She noted, however, that carbon foot printing “doesn’t tell you the whole story” since it only highlights the most carbon intensive companies when, infact, investor also need to know what targets companies have set.

She also noted that different investors define Paris alignment in different ways and said that investors should recognise regional differences and the need for different net zero pathways by sector and region. In regions where policy is not supportive of net zero, achieving real economy decarbonisation is difficult, she said.

For the full recording of this session, all the conference program and white papers and stories visit the Sustainability content hub here.