How to integrate the SDGs

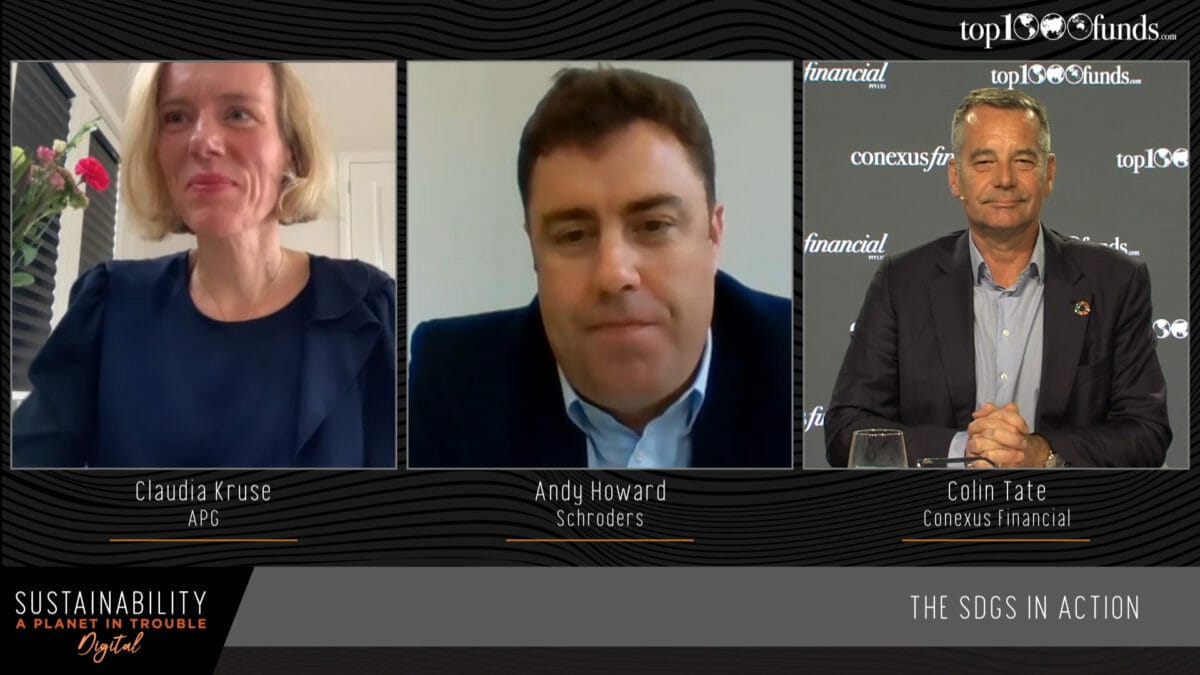

Integrating the SDGs involves analysing investee companies’ core business, the products and services they sell, and mapping that to the SDGs. Two investors, APG and Schroders, outline the indepth process.

APG, the giant Dutch asset manager, began integrating the SDGs in 2015 at the behest of its major client pension fund ABP whose beneficiaries work in the government and education sectors.

“We set a target to contribute €58 billion to the SDGs by 2020,” said Claudia Kruse, managing director global responsible investment and governance, APG. Speaking at Sustainability Digital she said because APG was already an active owner with ESG integrated across the portfolio, it needed to ensure a new strategy to align with the SDGs was “distinct.”

Working with fellow Dutch asset manager PGGM, the investors began to look at investee companies’ core business and the amount they contributed to the SDGs as well as analysing risk return targets.

“We quickly realised we couldn’t do this without research and that we needed a technological solution,” Kruse told delegates. Five years on, APG together with a cohort of other investors has launched an AI driven SDG platform providing a standard for asset owners around SDG corporate disclosure.

She also espoused the importance of communication and transparency. This includes detailing what is and isn’t contributing to solving the SDGs in APG’s reporting processes and seeking stakeholder feedback “to become a better investor.” She also pointed to more pension funds engaging with beneficiaries in another sign of “the growing credibility of the financial sector.”

It was a point fellow panellist Andy Howard, head of responsible investment at Schroders reiterated by explaining to delegates that the asset manager’s transparent communication must detail what it is trying to achieve. In a process grounded in measurement this transparency marks the industry’s transitions from “story-telling to demonstration.”

The challenges outlined in the 17 SDGs have built up over decades and were here before the pandemic, said Howard. However, he noted that the pandemic has catalysed the need for action and could trigger meaningful progress.

“The SDGs have given us a path out,” he said, also noting that countries suffering challenges flagged in the SDGs like inequality and social tension have particularly suffered from COVID-19.

Schroders’ Howard noted that there is more data available around climate than other SDGs meaning climate change gets most attention. However, he noted that the pandemic has shone the light on SDGs around healthcare and discrimination. He also told delegates that the practical process of aligning capital to SDGs is challenging.

“It’s an important goal but practically speaking difficult,” he said.

The SDGs are often characterised as an individual fund or strategy yet the real challenge lies assessing how every company contributes to the SDGs rather than a small percentage of corporates.

It involves looking at the sweeping array of products and services companies sell, and mapping them to the SDGs in a process that has required developing a bespoke framework because there is nothing “off the shelf.”

He added that the asset manager doesn’t see SDG integration as a philanthropic endeavour but a reflection of how the world is changing.

“This is an investment question; where do we deploy capital and ensure the capital we deploy is aligned,” he said.

Panellists also offered insight into how investors should pick which SDGs to integrate. Howard noted that the burden of some SDGs falls more on policy makers and governments than investors when the focus is on partnerships and the policy agenda. However, others fall on the private sector.

He told delegates that choosing which SDGs to integrate isn’t about which ones are more important or likely, but it is about what role private sector investors can play in trying to solve them.

Howard said that some parts of the capital markets will find it difficult to align the SDGs and industries will similarly struggle to transition to sustainable outcomes. There are some industries where change can happen, but it requires real effort and makes engagement critical, he said.

He noted that the world is changing and concluded that SDG alignment is turning into a robust and detailed decision making process across Schroders.

“It is an obvious step for an organisation like ours to think about the world in this way,” he concluded.

For all the conference sessions, stories and white papers visit the Sustainability content hub here.