AO talk manager selection and data gap

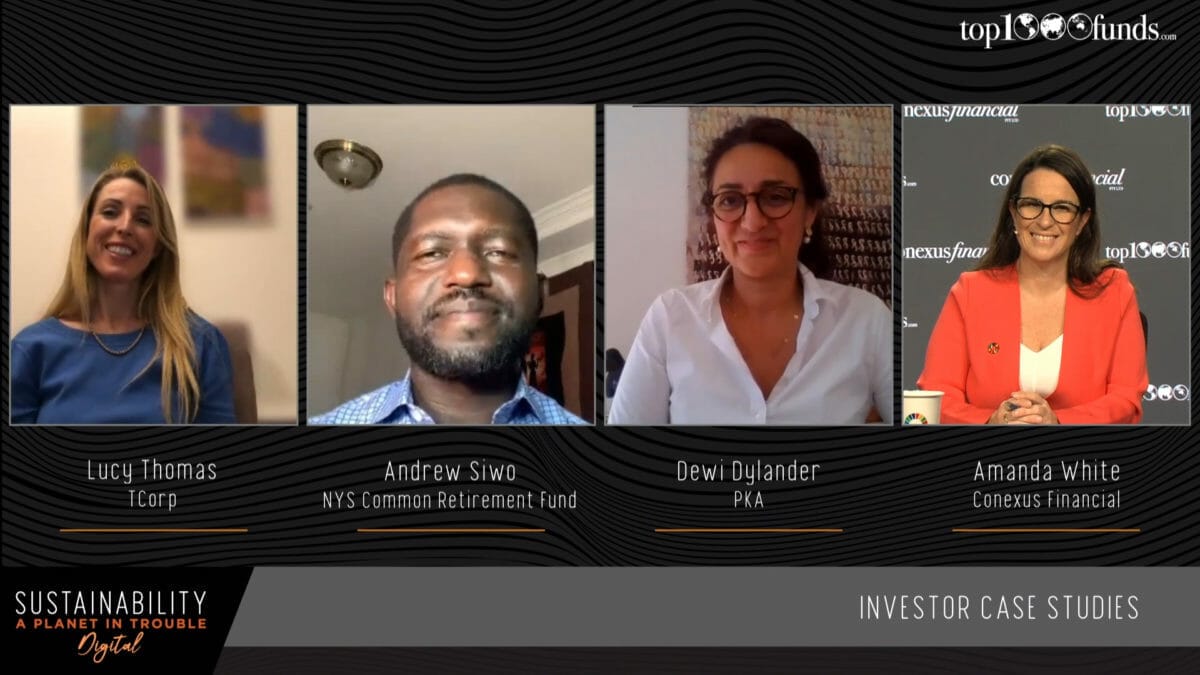

Discussing how they integrate sustainability across their portfolios investors at New York State Common Fund, PKA, and TCorp, highlight the importance of manager selection and the challenge of the data gap.

Sustainable strategy at New York State Common Retirement Fund includes at $20 billion commitment to a range of investments linked to the SDGs, said Andrew Siwo, director of sustainable investments and climate solutions at the pension fund.

His focus falls on nine areas split between three SDGs, he told delegates at Sustainability Digital. He added that New York State has exited companies perceived as “climate intensive” and “value destructive,” and actively engages with fund managers and companies. Regarding manager selection, the pension fund focuses on “identifying managers that can help the portfolio in terms of the future,” he said.

Siwo also called for asset managers to identify their source of alpha/

“Gone are the days when they could hide behind their firm’s history or signatory status,” he said. He noted that sustainable investments have been largely untested by a decade-long bull run, but now as COVID-19 reveals a new investment landscape, it is possible to assess claims made versus claims achieved.

Turning the conversation to asset class integration, Siwo urged for more cooperation between ESG ratings providers. Noting that ESG data is often unverifiable, voluntary and unaudited, he said greater standardisation was essential, and contrasted ESG data to the better correlation in fixed income ratings.

“When you think about how often we mention standardization, I don’t know how much progress we’ve made,” he said. “The variability of ESG ratings is huge; if this was reduced it would be additive to the industry.”

Lucy Thomas, head of investment stewardship at Australia’s TCorp detailed a total portfolio approach where ESG is integrated across all parts of the pension fund’s investment process.

Thomas referenced how active ownership – characterised as the degree to which stewardship can impact portfolio outcomes and ensuring TCorp isn’t “a lazy landlord” – is an important seam to strategy.

For example, directly owning an infrastructure asset gives the pension fund more control over other assets like, for example, a minimum volatility hedge fund strategy focused on the very short-term.

“We believe in active ownership over the long-term,” she said, adding that viewing sustainability across the total portfolio meant TCorp didn’t see sustainability as just another asset class.

She said that TCorp looks at the ESG risk and opportunities specific to each investment.

“We assess whether we can mitigate ESG risk or gain exposure to the benefits,” she explained, citing a recent investment in a Canadian hydro power plant as an example of tapping into the opportunity. The fund evaluates the contribution an investment brings to the whole portfolio, spanning liquidity, diversification, conviction and stewardship.

Regarding manager selection, she said that TCorp requires alignment with fund managers, particularly around culture. This is the “big one,” she said referencing a “robust framework” for assessing partners. After selection, agreements and reporting standards, plus regular reviews, follow, she said.

She added that the next five years presents a “wonderful opportunity” for clarity around purpose for the investment industry and an opportunity to build trust. It is a chance to look at what ESG infers on the portfolio and understanding the materiality of ESG for financial returns. She also said a better understanding of how issues are inter-connected would unravel in the future.

Sustainable investments at Denmark’s PKA include a large wind portfolio built up since 2011, sustainable housing and an allocation to green bonds.

“We have met our targets and will increase them going forward,” said Dewi Dylander, deputy executive director, PKA and former head of department at the Danish Ministry of Climate.

Dylander said that PKA expects all its managers to adhere to the pension fund’s policies and guidelines around sustainable investment and holds regular meetings to “explain its point of view.”

She also hailed the importance of the EU’s new taxonomy to help create standardisation in ESG and prevent greenwashing. Looking to the future, she expects the social element of ESG to move high on the agenda.

“We are seeing the shift from the E to the S and G,” she said. In a traditional approach, she detailed how the pension fund excludes sectors like weapons and tobacco and engages with companies via asset manager Hermes. Strategy also includes actively speaking with other investors and NGOs, she concluded.

For all the conference sessions, stories and white papers visit the Sustainability content hub here.