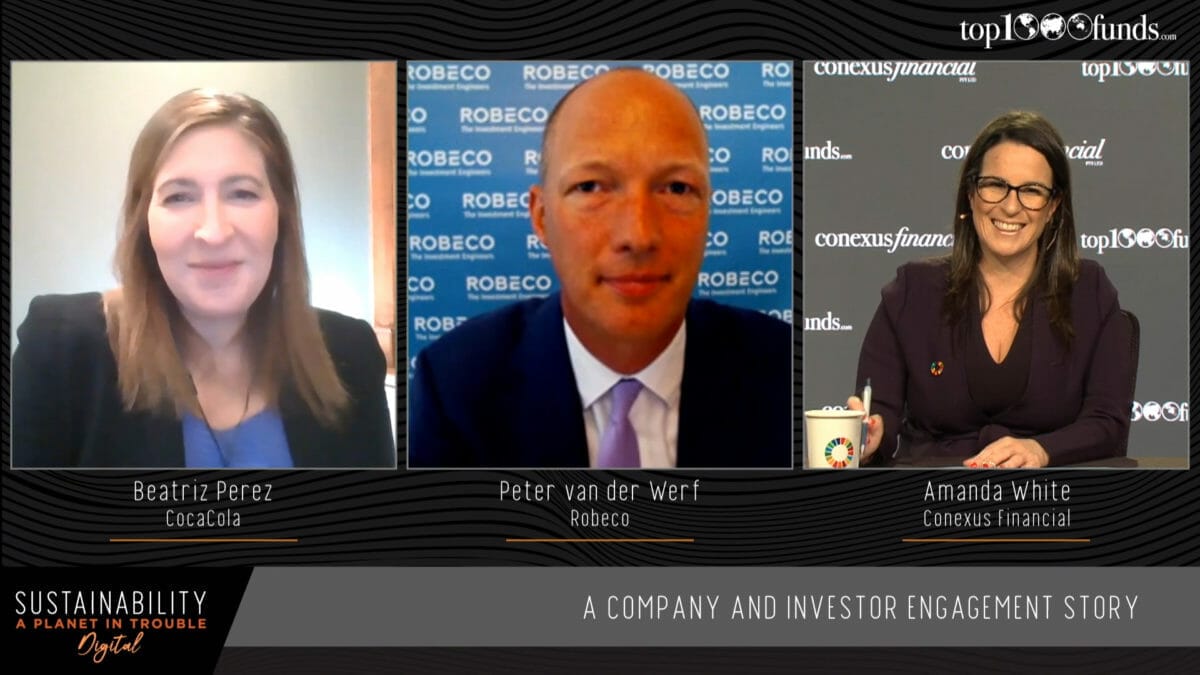

Coca-Cola and Robeco talk engagement

Engagement isn’t necessarily based on conflict. Robeco’s engagement with Coca-Cola is welcomed by the drinks giant and is helping drive long-term growth.

A combination of investor and consumer pressure has helped drive change at Coca-Cola around single use plastic, water use and the sugar content of its products, said Beatriz Perez, chief sustainability officer at Coca-Cola.

In a panel session at Sustainability Digital discussing how investors and corporates engage speaking alongside Robeco’s Peter van der Werf, team lead engagement, active ownership, Perez told delegates that she welcomed the positive “tension” and pressure for change investor relationships have ushered in at the company, saying it is helping drive long-term growth.

Perez told delegates that continuing to deliver sustainability targets through COVID-19 has been a hallmark of recent strategy. On one hand the pandemic has highlighted the importance of sustainability initiatives at the company like its ambition to be water neutral in light of the new importance of safe water supplies for hand washing. Yet the pandemic has also made reaching sustainability targets challenging, like the need to protect workers in the company’s bottle recycling plants.

“If sustainability is core to your strategy you have to continue to keep it in the business – you have to pivot,” she told delegates.

Working with investors to integrate sustainability has created a positive tension that has pushed the company to “think ahead,” she said. Coca-Cola has put in place a strategic framework and goals around sustainable agriculture and packaging with embedded targets. She also noted that integrating sustainability has changed over the last 10 years. Back then the focus was on risk mitigation. Now it is seen as “fundamental to achieving growth,” comprising measuring and tracking.

Pressure for change has also come from consumers, she said. She also noted that the company could have picked “hundreds” of areas in which to focus. Instead it chose areas where it got the best leverage for communities, staying ultra-focused on delivering results.

It’s important to have investment partners challenge us, she said, adding that investors “see things” that present a risk to the business. For example, Coca-Cola’s ‘World Without Waste’ initiative which aims to make its packaging 100 per cent recyclable by 2025 and use 50 per cent recycled material in bottles and cans by 2030, came out of dialogue with investors.

“They said you have to get “more serious” about plastic or it could be detrimental,” she recalled, adding that it has led the company to focus on the circular economy and how that works across the business.

Robeco is also engaging with the drinks company on nutrition.

“It’s been a big focus in the last three years,” van der Werf said.

The investment manager asked the company to find its “North Star” and look to the SDGs to inform a strategy that would better serve consumers. At the same time, consumers were also asking the company for similar solutions, Perez said.

“We changed and shifted strategy to deliver what consumers wanted.”

Cue a reset for the company whereby Coca-Cola signed up to the WTO guidelines on health – a move van der Werf described as crucial because it is a gold standard – and it became a total beverage company formulating new, low sugar recipes and other initiatives like the mini can.

“We took sugar out of the total portfolio and offered new brands,” said Perez.

She also detailed how sustainability strategies intertwined. For example, working on waste reduction required close partnerships based on trust and confidence garnered from the company’s progress in other areas of sustainability. Elsewhere, getting the packaging right meant reducing the carbon footprint of the company.

“These are interconnected parts of the business,” she said.

Robeco’s van der Werf said integrating sustainability meant delivering a broader set of opportunities to consumers. He also noted that investors’ role is to hasten progress and accelerate change where possible. Advocating the circular economy and supporting recycling infrastructure has been a particular focus, he said. He estimated it takes around three years to build a relationship that can “drive to the next level” and that engagement meant being in it “for the long haul.”

Perez also noted how partnerships help drive the pace of change, and scale. Targets and compensation also spur progress, she noted.

She added that solutions differ across geographies – water use issues are different in Kenya and the US for example – and local government’s ability to provide key infrastructure is also crucial in the company’s ability to deliver on societal and business objectives.

Perez said that she welcomed more challenging questions from investors, and the increased pressure for change.

“When we first started to get calls from investor relations and heard that investors wanted this conversation, I cheered,” she said.

She also noted that in the early years, not all investors were engaged or interested, and that sustainability wasn’t viewed by investors as a “discipline.”

Changes over the years include common definitions and industry alignment, and better data. In another aside, she noted that the once pervasive idea that consumers would pay more for sustainability is long outdated. She said now consumers expect sustainability.

For all the conference sessions, stories and white papers visit the Sustainability content hub here.