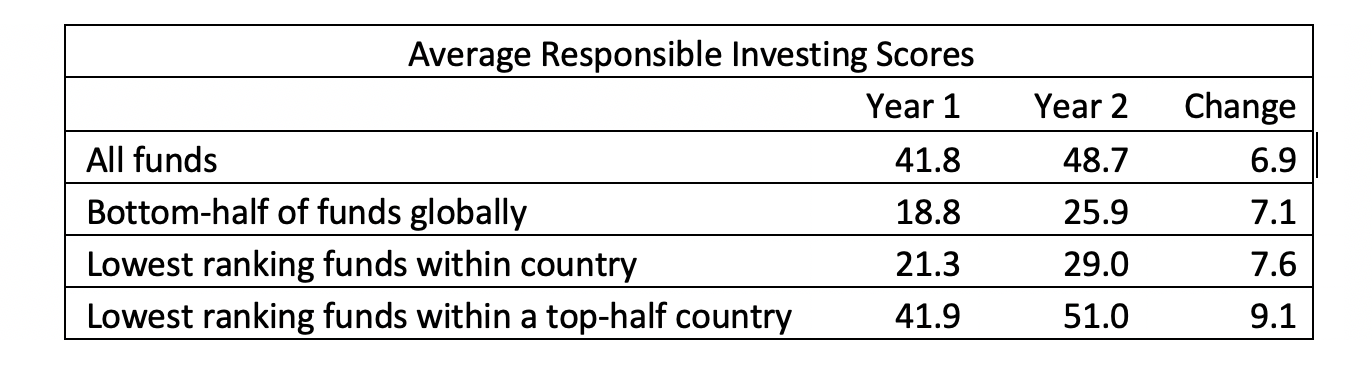

The increased adoption of RI principles was clearly visible in this second iteration of the Global Pension Transparency Benchmark. Scores within the RI factor saw the largest year-over-year increase with the average score across all funds increasing by 6.9, so where were these increased scores most evident?

Responsible investing (RI) is increasingly becoming a focus for many large funds across the world. Even funds that previous eschewed RI on the basis that their primary purpose was to deliver returns are coming round to the idea that RI is too important to their stakeholders to ignore.

For pension funds, concerned stakeholders are no longer limited to environmental activists and NGO’s , but also include regulators, plan members and their own employees. Results of early adopters of RI principles mean it is now becoming apparent that you can both focus on RI while still delivering value in the traditional sense – superior investment returns.

As more and more leading funds integrate ESG and RI principles and disclose such endeavors, stakeholders of other funds are asking why their funds don’t. This is forcing those lagging funds to catch-up. Evidence of the increased adoption of RI principles was clearly visible in this second iteration of the Global Pension Transparency Benchmark (GPTB).

Scores within the RI factor saw the largest year-over-year increase with the average score across all funds increasing by 6.9. Where were these increased scores most evident?

• Funds that scored below median in last year’s review saw slightly larger increases than funds in the upper half of last year’s rankings (an increase of 7.1 vs. 6.7).

• Within countries, the lowest scoring funds saw larger increases than average. Across all countries, the lowest scoring funds within countries improved their scores on average by 7.6 points.

• The increase in scores among the lowest scoring funds within countries was even more prevalent in countries that scored in the top half with an average increase of 9.1. Note that these funds didn’t all score poorly. Funds from top scoring countries (eg Denmark, Canada, the Netherlands) were often scored above average, even in last year’s review.

These results suggest that competition, peer pressure and comparisons between funds is driving change. Funds appear much more inclined to increase disclosures when they observe peer funds doing the same.

How are funds improving their disclosures? Here are two examples that are informative and accessible to all levels of stakeholders.

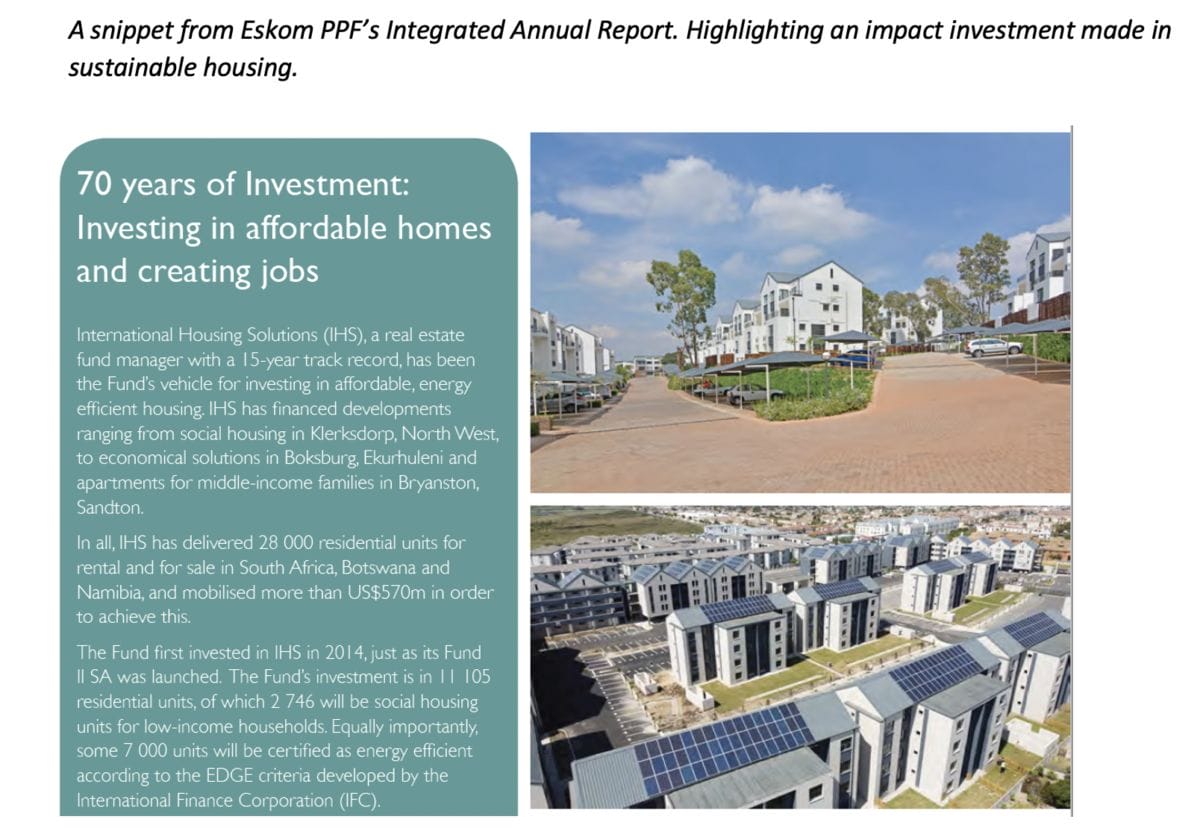

Example 1: Impact investing case studies

One way funds can increase their transparency around RI, is by using case studies to demonstrate how their impact investing initiative. Eskom PPF from South Africa included a case study on its investment in sustainable housing in its annual report. This shows stakeholders clear examples of responsible investing in action and helps connect a fund’s words to their actions in a relatable manner.

There are similar impact investing disclosures at other funds as well. Many funds are already engaged in impact investing in similar ventures, so it is just one extra step to disclose and report on these sustainable investments.

Example 2: Corporate Stewardship Case Studies

Another way for funds to increase their transparency and reporting on RI is by reporting on their corporate stewardship activities.

For many funds, this involves disclosing an active ownership policy that describes how the fund should engage with portfolio companies. To increase transparency further, some funds also provide reporting on how they engaged with companies throughout the year, including their voting records. This is often done in a summary format, although some funds provide extensive details of their voting records. These disclosures are useful, but often too technical to be accessible to all users.

Universities Superannuation Scheme (USS) from the UK published their UK voting policy in 2021, as well as a 2021 stewardship report. Its UK voting policy outlines how the fund should exercise its votes on various topics such as director elections, remuneration policies, and auditor elections. The USS stewardship report outlines its engagement activities throughout the year, including case studies on individual companies, as well as a section on significant votes. This allows stakeholders to understand the fund’s stewardship activities on a more tangible level. These two documents were the main factor in the increase in USS’s RI score this year.

The improvement in responsible investing reporting is encouraging to see and shows the need for leaders in this space. A pension fund that becomes a leader among its peers in the RI space is not only increasing long-term value for members, but is also driving positive change in the industry, and therefore increasing long-term value for members of pension funds everywhere.