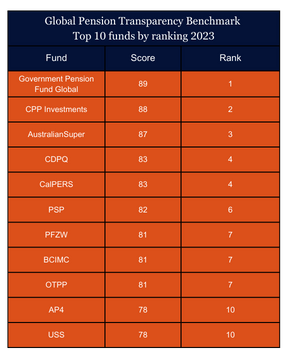

The highest scoring funds overall in the 2023 Global Pension Transparency Benchmark were also among the biggest improvers. Both Norway’s Government Pension Fund Global and AustralianSuper increased their scores by 14 points year on year and were the biggest improvers in the top 10. Other top 10 improvers of note included Canada’s CDPQ, CalPERS from the USA and the Dutch fund PFZW.

Overall the 2023 results revealed that the average fund improved by five points compared to 2022, but four of the five leading funds improved by more than 10 points, showcasing the importance the top funds put on transparency and that improvements can be made even when funds are demonstrating best practice.

The results of the GPTB this year revealed a jump in the overall quality of pension fund disclosures with 77 per cent of funds making improvements in their scores.

Outside the top 10 South Africa’s Eskom, Switzerland’s Migros, Finland’s VER, Brazil’s Itau Unibanco and Funcef, and New York City Retirement System all made significant progress in transparency and had noticeably improved scores.

The governance factor was the biggest improver of the four factors with 92 per cent of funds improving their score on this factor (see story on factor scores).

Edsart Heuberger, CEM Benchmarking’s product lead for transparency benchmarking said 58 of the 75 reviewed organisations improved their total transparency scores.

“It is great to see so many funds engaged in transparency and improving their transparency. The five leaders increased their transparency the most, with some declaring they want to be the best in the world,” he said. “Some funds have been really proactive, they want to be better. This year there has been more discussion about the importance of transparency and the benchmark has driven change and put a line on best practice.”

they want to be better. This year there has been more discussion about the importance of transparency and the benchmark has driven change and put a line on best practice.”

GPTB advisory board member Keith Ambachtsheer said it was fascinating to see the increases in both fund engagement and in the GPTB scores this year.

“The Peter Drucker observation that “what gets measured gets managed” is alive and well,” he said.

The Global Pension Transparency Benchmark, a collaboration between Top1000funds.com and CEM Benchmarking, is a world first global benchmark measuring the transparency of disclosures of 15 pension systems across the value generating measures of cost, governance, performance and responsible investments.

It ranks countries on public disclosures of key value generation elements for the five largest pension fund organisations within each country. The country rankings are now in their third year, with the scores of the 75 underlying funds published for the second time this year.

The GPTB focuses on the transparency and quality of public disclosures with quality relating to the completeness, clarity, information value and comparability of disclosures.

The overall scores and rankings are measured by assessing hundreds of underlying components and analysing more than 13,000 data points.

For all the scores and rankings by country, factor and all the 75 funds click here