Increased scrutiny on the transparency of disclosures is driving measurable improvements among some of the world’s largest asset owners, as refinements to the Global Pension Transparency Benchmark methodologies and board oversight boost attention on transparency.

The Global Pension Transparency Benchmark (GPTB), a collaboration between Top1000funds.com and CEM Benchmarking, was launched in 2021 to highlight best practice and focus asset owners on more clearly, completely and concisely disclosing what they do and how they are generating value for stakeholders.

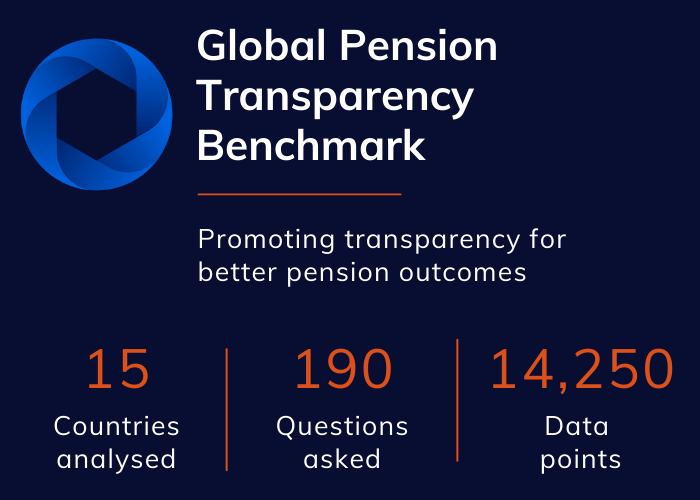

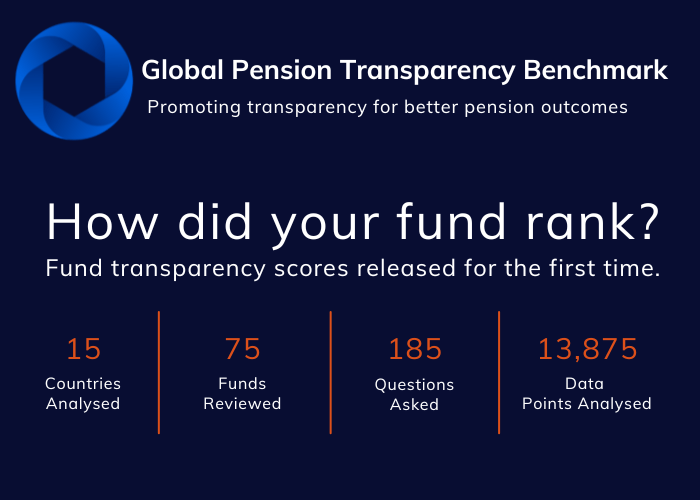

The GPTB ranks 15 countries, and 75 underlying pension funds, on public disclosures of the key value generation elements (or factors) of cost, governance, performance and responsible investing.

Since its launch the benchmark has been a facilitator for improved transparency in the industry. The results of the third annual GPTB will be launched in June with added process refinements.

“In our experience, as benchmarks mature, the performance of leading funds drive lagging funds to improve,” says Edsart Heuberger, product manager and GPTB lead at CEM Benchmarking.

“In the third year of the Global Pension Transparency Benchmark we are noticing that the leading funds in the world have improved their transparency scores the most. These are funds that have publicly declared it is their goal to be number one. We expect more of the lagging funds to embrace transparency and improve their performance in the coming years.”

New and improved process driving transparency

The GPTB focuses on the transparency and quality of public disclosures with quality relating to the completeness, clarity, information value and comparability of disclosures.

The overall scores and rankings are measured by assessing hundreds of underlying components and analysing more than 14,000 data points.

This year the process has been refined with additional governance measures to ensure better data and assessment.

“We recognise that a benchmark that publicly scores funds on their transparency creates new discussion,” Heuberger says. “We wanted to provide the reviewed funds with more transparency. Fund feedback prompted us to implement more robust governance and processes to document and validate our work. We will proactively share our insights with funds prior to the publication of their 2023 transparency scores. Funds now have the option to appeal a question score if they believe they were scored incorrectly.”

“Greater transparency promotes better understanding and trust”

The scoring process follows a four-tiered system including an initial review, factor-team review, CEM team reviews including a review by the Top1000funds.com team, and an advisory board review. Following these four steps there is also the chance for a one-on-one informational meeting with the underlying funds.

If there are any issues raised with regards to the scores, the advisory board will review these. In the event that the board cannot come to consensus,an independent arbiter will be consulted. David Atkin, chief executive of the PRI and original GPTB advisory board member, will fulfill this arbiter’s role.

new advisory board members

Given that Atkin is now taking on the role of independent arbiter a new board member, Fiona Dunsire, has been appointed to the advisory board.

Dunsire spent the past 29 years at Mercer including roles as chief executive of the UK, and wealth leader Asia, ME and LatAm. She has extensive experience invaluable to the GPTB including the Mercer CFA Global Pension Index and work with the World Economic Forum which culminated in developing a benchmark to measure progress on integrating climate factors within investment processes.

“Greater transparency promotes better understanding and trust in pension systems, ultimately encouraging higher levels of engagement and long-term savings,” Dunsire says. “Even the most sophisticated pension funds can struggle to assess their progress against peers in many areas. The GPTB provides a standard for best practice and highlights opportunities for improvement, allowing all funds to learn from the leading practices and raising quality over time.”

“I am delighted to join the Advisory Board of GPTB at this time. Throughout my career I have been motivated by supporting the delivery of high quality pensions that people can trust. Greater transparency should lead to better decision making and better long term outcomes for people in their later life,” she says.

Other members of the advisory board include Keith Ambachtsheer, Lorelei Graye, Angelique Laskewitz and Neil Murphy.

The way the industry has embraced the GPTB is a positive reflection of how seriously funds take transparency, and their drive for improvement is an indicator of the power of the benchmark which reframes the transparency narrative from a narrow and negative focus on costs to a more holistic and positive concept of transparency that includes governance and strategy, value generation and sustainability.

While overall in the past three years there has been positive momentum in the advancement of transparency across all the factors, there is still room for improvement.

“Leading countries excel in different areas. Canadians have terrific reporting on governance and investment performance. The Dutch are world-class on costs. The Nordics excel in responsible investing,” CEM’s Heuberger says. “Generally, funds would gain the most by improving their external investment cost and responsible investing disclosures.”

View the scores and ranks of the 75 funds from last year’s results.