Anne Simpson, managing investment director, board governance and sustainability tells Amanda White why transparency is so important at CalPERS and what the fund is doing to improve it.

“Sauce for the goose is sauce for the gander,” says Anne Simpson CalPERS’s managing investment director, board governance and sustainability.

She’s talking about how the fund needs to hold its own team, and its processes, to account in the same way it does the companies it invests in, specifically when it comes to corporate governance and the role of transparency.

“The whole issue of transparency is relevant to accountability which is important to performance,” she told Top1000funds.com in an interview. “That is our intuition, we see the evidence of that in corporate governance, so the question is how does that play out for investment governance.”

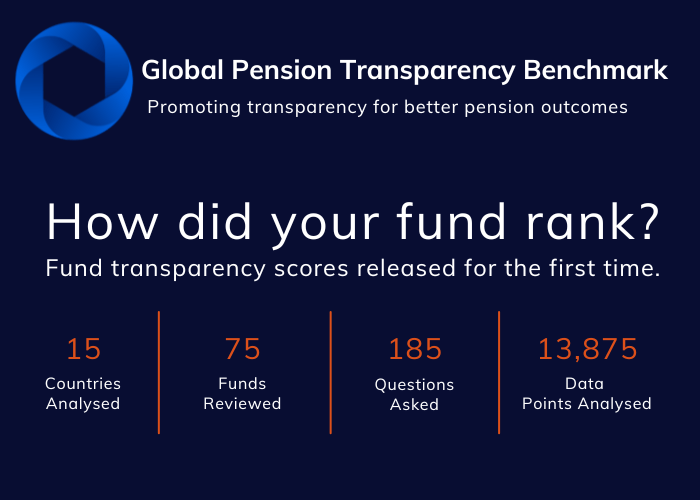

As the largest pension fund in the United States, CalPERS was one of the five funds reviewed for the Global Pension Transparency Benchmark, a collaboration between Top1000funds.com and CEM Benchmarking. The GPTB looked at the transparency of disclosure across four key areas that were determined as driving value: cost, governance, performance and sustainability. The launch of the benchmark, in February 2021, has prompted a number of funds to look more closely at their peer group and what innovation is needed to be a leader in transparency.

“The benchmarking project is important as it acknowledges that governance matters whenever there is an exercise of power. We take it as a fundamental purpose of a pension fund to look after other people’s money. The governance questions look at our own transparency and accountability and ensures performance is as good as it can be,” she says.

Simpson says as fiduciaries it is important for pension funds to understand leading practice and improve, and that the benchmarking process was valuable in gauging best practice relative to peers.

“What came out of benchmarking was incredibly valuable, one of the things we learned was just because the information has been presented to the board doesn’t mean it is in a practical published form that can be absorbed by other stakeholders.”

As a public fund CalPERS has a huge deal of transparency and publishes “99% of everything going on” including via a Youtube channel. There are some exclusions around market issues, confidentiality around any litigation and personnel matters.

“We are a full force on transparency, we are eating our own cooking, walking the talk,” Simpson says. “We had assumed the information in the public domain, like board papers, would be accessible. But the GPTB looked at published documents because that is where people find information. We are taking that back and saying we have all this information you can retrieve it but it’s not in a published form. We are being fully transparent but another step for us to take is for it to be accessible. Taking this assessment very seriously, we can change things and find the feedback helpful.”

While the process has been important and change is afoot, the fund is also cognisant that any new reporting frameworks are resource intensive. For example in sustainability alone it already does a TCFD report, a GRI report and the PRI report. It also signed up on a voluntary basis to the Council for Inclusive Capital which is a set of reporting principles for the entire enterprise, such as an internal childcare centre, not just what is in the portfolio.

It also has legislated reporting criteria such as those around Northern Ireland and emerging managers.

“A new framework is not trivial for us but this transrparency benchmark process made us more sensitive to the fact that we disclosed some things but is that being transparent, is it easy to find the information?”

“I dream of a common language, a reporting format for investors that is searchable and people can retrieve standardised metrics. But we are a long way from that,” she says.