The COVID-19 pandemic-induced paradigm of zero interest rates and coordinated monetary and fiscal policy is the new macro-economic reality. Add to that the market conditions from the US election and the ongoing pandemic, and investors head into 2021 with continued uncertainty. With this backdrop, diversification and resilience is more important than ever, but how can investors achieve that in a low interest rate environment?

Rebecca Patterson joined Bridgewater in January 2020 as director of the investment research group, where she is responsible for identifying and exploring areas of research across geographies and asset classes.

She has more than 20 years of investment management experience, and prior to joining Bridgewater served as chief investment officer of Bessemer Trust, overseeing $85 billion in client assets. During her time there, she was a member of the firm’s management committee, and helped launch their diversity and inclusion committee. Before joining Bessemer in 2012, she spent 15 years at J.P. Morgan where she worked as a researcher in the firm’s investment bank in Europe, Singapore and the US. She also served as a chief investment strategist in the asset management arm of the firm, and ran the private bank’s global currency and commodity trading desk.

Patterson is currently a member of the Council on Foreign Relations and the Economic Club of New York. She previously served on the New York Federal Reserve’s foreign exchange committee, and later the investor advisory committee for six years, and has served on the University of Florida’s Investment Corporation’s advisory board for seven years, including three years as chair. She holds an M.B.A. from New York University, an M.A. in International Relations from The Johns Hopkins University School of Advanced International Studies, and a B.S. in Journalism from the University of Florida. She has been included on American Banker’s list of Most Powerful Women in Finance for six consecutive years. She is married and has two teenage girls.

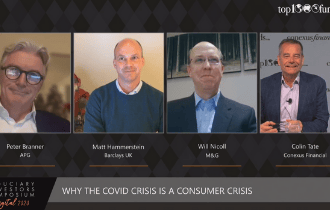

Colin Tate has been an investment industry media publisher and conference producer since 1996. In his media career, Tate has launched and overseen dozens of print and electronic publications. He is the chief executive and major shareholder of Conexus Financial, which was formed in 2005, and is headquartered in Sydney, Australia. The company stages more than 20 conferences and events each year – in London, New York, San Francisco, Los Angeles, Amsterdam, Beijing, Sydney and Melbourne – and publishes five media brands, including the global website and strategy newsletter for global institutional investors conexust1f.flywheelstaging.com. One of the company’s signature events is the bi-annual Fiduciary Investors Symposium. Conexus Financial’s events aim to place the responsibilities of investors in wider societal, and political contexts, as well as promote the long-term stability of markets and sustainable retirement incomes. Tate served for seven years on the board of Australia’s most high profile homeless charity, The Wayside Chapel; and he has underwritten the welfare of 60,000 people in 28 villages throughout Uganda via The Hunger Project.

Key takeaways

- The COVID shock accelerated the shift to a new paradigm characterized by near-zero rates and coordinated fiscal and monetary easing (MP3).

- Beyond the US election and as the vaccine gets rolled out:

- Policy certainty and economic mobility are likely to improve

- Secular changes that drive the need for the new paradigm will remain

- Policy maker willingness, ability and effectiveness at stimulating post-COVID will heavily determine asset returns.

- This environment underscores the need for diversification in all forms: environmental, geographic and alpha/beta.

- We will have close to zero rates for years to come. Fiscal and monetary policy will work hand in hand to get the economy going.

- In the case of the election and the vaccine there is a clear positive and a question mark:

- For Biden’s Presidency, the positive for investment is a return to more certain policies, which will support hiring and M&A. The question for the Biden presidency is will there be another pandemic relief package and also on January 5th will Biden’s policies get greater support.

- For the vaccine, the clear positive is the obvious link between mobility and GDP. The question is to what extent there will be outflows from COVID-focused businesses and inflows back into traditional businesses heavily impacted by the virus, and what are the implications for portfolio allocation if investors are looking for bond-like returns from equity investments given the low rate environment.

- Both debt and populism are globally high and rising. A vaccine won’t change this, therefore stimulus will be needed for years to come.

- Real yields can continue to fall so there is a place for assets like gold.

- The markets are not pricing in the possibility of higher inflation. Although there is uncertainty, the scope for inflation is greater than what we had in the past because we have not just monetary easing but also fiscal easing plus some of the forces pushing deflation (e.g. globalisation) are not as strong as they have been previously. Therefore some hedging against the risk of rising inflation may make portfolios more resilient.

- It is reassuring to know that you can have a balanced portfolio without or with reduced nominal bonds and achieve the same returns and diversification you need as an investor.

- Geographic diversification is more important than ever, which increases returns and reduces risk.

- Even when placing BREXIT to one side, the UK is likely to have one of the most depressed activity levels amongst the developed world. In the very short term, there is no good economic outcome for BREXIT, but the better news is that since the BREXIT process has been so slow prices mostly already reflect this. We are fairly anxious about sterling in this environment.