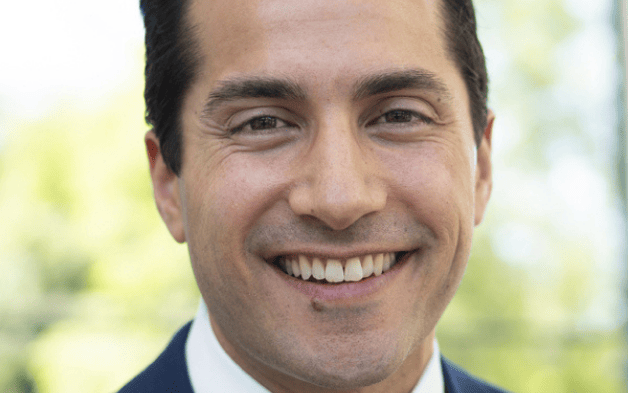

Since taking on the job of head of private equity at CalPERS two years ago Greg Ruiz has spent considerable time getting the portfolio back on track, understanding the positions and allocating capital. Now as the fund almost certainly will allocate more assets to private equity as part of a new asset allocation, Ruiz is looking to add to the sectors where the fund is underweight including venture.

For the best part of two years Greg Ruiz, CalPERS’ managing investment director of private equity, has been trying to understand the fund’s private equity portfolio, its allocations, manager relationships and history of performance.

“It’s a very early innings in terms of what we are hoping to do with the program and I have spent a lot of time trying to understand where we are and how we got there,” he told Top1000funds.com in his first media interview. “To have a go-forward strategy we need to be grounded in a deep understanding of the portfolio.”

As Ruiz and the team spent time “pulling apart the portfolio”, two key themes emerged that are now being addressed in order to bring the private equity allocation in line with best practice.

The first of those is consistency.

For the year to June 2021 private equity returned 43.8 per cent for CalPERS, but over five and 10-year reporting periods (to December 2020) the CalPERS private equity portfolio fails to beat its benchmark.

“If you have a look at the absolute performance over long time periods then private equity has delivered for us, but when you look at it compared to benchmarks then we have been way behind,” he says. “When you peel into why that is, one of the key reasons is consistency. If you graph our commitments it looks like a rollercoaster which is the opposite of what we want. And that’s something we are very focused on.”

In particular he says from 2009 to 2017 the level of commitments were slow compared to the fund size and the allocation to the asset class.

“It’s important to understand those dynamics,” he says.

Pacing is much more consistent now and continues to improve. In 2020 the $469 billion fund made 46 commitments totalling $18 billion with an emphasis on low fee separate managed accounts and co-investment.

The activity brings the capital committed in line with the portfolio allocation of 8 per cent; when Ruiz arrived the allocation was sitting at 6.5 per cent.

In analysing the portfolio Ruiz also saw some concentration particularly in large buyouts which makes up 70 per cent of the private equity investments.

“We were also under-exposed or had no exposure to some areas such as middle market, growth, and venture, so there is an opportunity to add more diversification across the portfolio,” he says.

Venture makes up only 1.5 per cent of the private equity portfolio.

Cost efficiency

In addition to the volatility in pacing commitments, Ruiz also saw some improvements to be made in the cost efficiency of the portfolio.

“When you look back at what we have got right and wrong there is a lot we have got right. For one, we have been investors in private equity for over three decades, making our first investment in 1990. And we backed a number of very high quality managers, some we have stayed with consistently for decades and they have added a tremendous amount of value. We have that history and depth of relationship and a team that has been doing it for a long time,” he says.

But the biggest misstep the fund made, he says, is not following the lead of other asset owners when two decades ago they built scale and reduced costs through co-investment.

“We have been in and out, but never did it consistently or at a scale. This has led to a more expensive portfolio, so we have spent time trying to understand that and what led to the consistent performance gap.”

In the past 20 months more than $1 billion in co-investments have been made alongside existing managers.

“This lays out the path forward for us and we have started building out processes and programs to look at diversification and co-investment. It takes time. In some ways we are ahead of where I thought we would be, but it’s going to take a number of years more.”

Like other investors private equity is the most expensive portfolio in mix.

“From a cost perspective we are focused on net returns. And when we think about driving net returns part of that is accessing managers we think will generate higher gross return and part of it is deploying capital to co-investments to see the overall reduction in spread,” Ruiz says.

CalPERS isn’t targeting a specific cost level, but Ruiz says the focus is on all the components that drive returns, including the lever of co-investments which until now has not been used effectively.

Interim chief investment officer Dan Bienvenue says the fund’s public assets are managed at a total cost of 4 basis points.

“If we wanted the fee down we would put everything in public markets but then you wouldn’t get the drivers of return,” he says. “Total fund costs are now around 24 bps and we want to see that number go up due to private market allocations which add value.”

Similarly Ruiz does not target a particular number of managers he wants to work with. Instead he views it more with the goal of building a high conviction portfolio across each of the market segments and asking what the right mix of managers is within those.

“The number of managers is something I’m always aware of but not a metric I’m tracking to. The way we think about it is by market segments we want exposure to as well as geographies and industries,” he says. “We ask ‘is this a manager that has durable competitive differentiation to generate returns across cycles?’ When we use that lens, we see we have a large legacy portfolio now and much of that will roll out over time and the total number of managers will come down. But the core managers may grow as there are areas we have lacked exposures and that will come through new managers.”

Total portfolio

CalPERS is in the middle of an asset liability modelling exercise to set a new asset allocation by June 2022 to meet the return target of 6.8 per cent. Regardless of where the final asset allocation lands, Bienvenue says there will be more private equity, private debt and real assets in the new asset allocation due to their better risk to return profile.

“Private assets have other risks, they are illiquid and there is the aspect of fees. But if we are going to get the returns we need the portfolio to generate it means choosing which risk,” he says. “We don’t have a low risk choice, we want to get exposure to compensated risks.”

He says that CalPERS is focusing on how to deploy capital at scale with cost advantage economics and private equity is an example of that.

“How to do it with conviction managers and with cost advantage economies, that will drive us to meet our return needs,” Bienvenue says.

“Scale is one of our competitive advantages but it is also a double edged sword. It can drive cost economics, but also deploying $500 million won’t move the needle for us from the total fund perspective. The other side of that from a co-investment standpoint is we can be a fund people approach when they have a scale ticket. We want to be positioned as an organisations they can call with a creative or scale situation.”

More stories on CalPERS

CalPERS’ new asset allocation to take on more risk

CalPERS reduces equities universe