September 2020 marks the fifth anniversary of the Sustainable Development Goals which have become a roadmap for investors to engage in the bold ambition of transforming the world while leaving no one behind. This session looked at the ambition of the SDGs and spurs investors into action.

Gilbert van Hassel

Chief executive, Robeco (The Netherlands)

Gilbert Van Hassel has been chief executive and chair of the executive committee of Robeco since September 2016.

He has over 30 years’ experience in the financial services industry, mainly in asset and wealth management, with broad experience in Europe, Asia and the US. Until 2013 he was global CEO ING Investment Management and member of the board Insurance and Asset Management of ING. Before joining ING in 2007, he worked for JP Morgan where he held various executive positions in Europe, Asia and the US.

Van Hassel has a Bachelor’s degree in Applied Economics from the University of Antwerp St Ignatius (Belgium), an MBA, with a major in International Finance from the Catholic University of Louvain (Belgium) and a Master of Science in Finance from Purdue University (US).

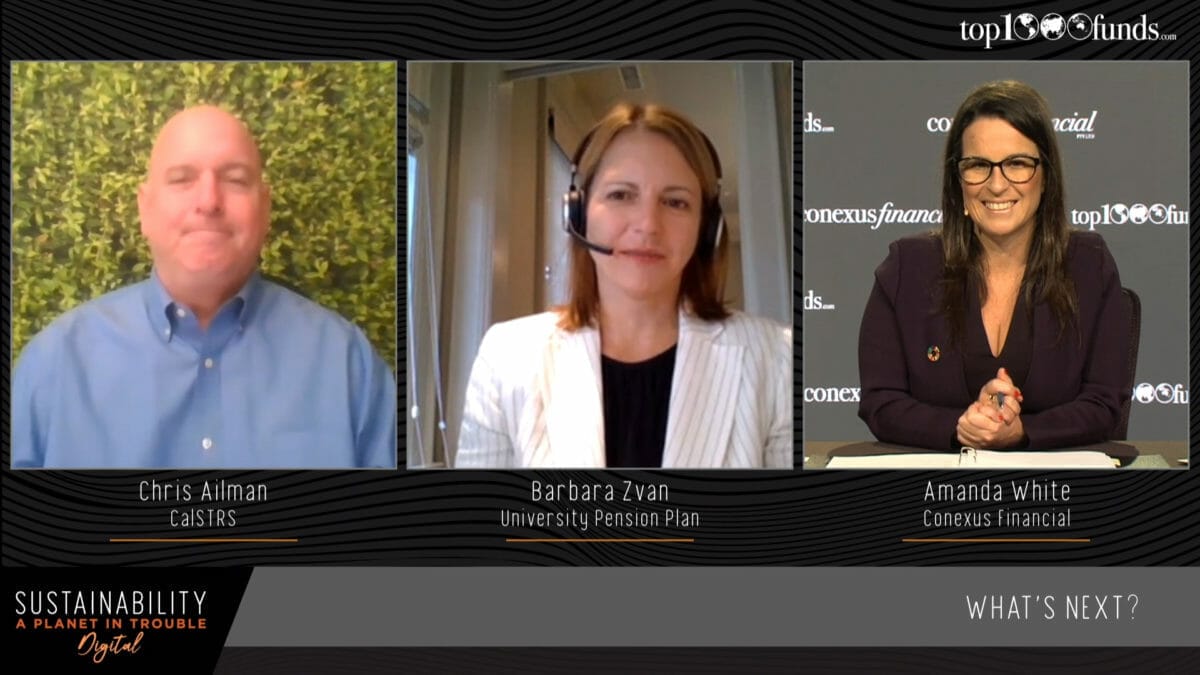

White is responsible for the content across all Conexus Financial’s institutional media and events. She is responsible for directing the bi-annual Fiduciary Investors Symposium which challenges global investors on investment best practice and aims to place the responsibilities of investors in wider societal, and political contexts, as well as promote the long-term stability of markets and sustainable retirement incomes. She is the editor of conexust1f.flywheelstaging.com, the online news and analysis site for the world’s largest institutional investors. White has been an investment journalist for more than 20 years and has edited industry journals including Investment & Technology, Investor Weekly and MasterFunds Quarterly. She was previously editorial director of InvestorInfo and has worked as a freelance journalist for the Australian Financial Review, CFO, Asset and Asia Asset Management. She has a Bachelor of Economics from Sydney University and a Master of Arts in Journalism from the University of Technology, Sydney. She was previously a columnist for the Canadian publication, Corporate Knights, which is distributed by the Globe and Mail and The Washington Post. White is currently a fellow in the Finance Leaders Fellowship at the Aspen Institute. The two-year program consists of 22 fellows and seeks to develop the next generation of responsible, community-spirited leaders in the global finance industry.

Related reading

Appointing directors of climate change

Linking economic activities with the SDGs

Navigating the ESG labyrinth

Shell escalates net-zero goal on carbon emissions

SIX magazine – So you think sustainable investing is easy? Think again.

Sustainable Investing Expertise

The big book of SI

The link between ESG and performance: SDG Credits stands the test

Key takeaways

- All of our planetary crises are inter-dependent.

- We need to take bigger and bolder actions towards a more sustainable future.

- The SDGs provide the perfect all-encompassing blueprint for economic development.

- The SDGs do not discriminate. They apply to all countries equally regardless of wealth.

- USD$2.5 trillion need to be invested into the SDGs each year if they are to be achieved.

- Urgent action is required – 1 million species are currently threatened by extinction.

- Let us not be pessimistic. There are many silver linings, for example 20 per cent of all the world’s energy production comes from renewables, 70 per cent of the world’s ocean is now protected and 70 per cent of corporations have now placed SDGs into their goals and communications. I am optimistic about the potential for a sustainable recovery and a sustainable future.

- We need more legislation, not less.

- ESG and SDGs are complex, so therefore we need to ensure we understand them and their interconnectivity better, not least because solving one could negatively impact another.

- As investors, we need to make our money speak through active engagement to ensure companies exhibit the right behaviours. Engagement requires care, consideration and collaboration.

- The biggest challenge for investors is the requirement for a material shift in mindset – wellbeing maximisation must be considered alongside wealth maximisation.

- We don’t have the luxury of picking and choosing which SDGs to tackle. We must solve them all.

- Over the past 5 years we have made a lot of progress but we need a lot more action. We have to walk the talk. Each individual investor needs to set their own goals and contribute to a better world.

Poll results

Do you think the COVID-19 crisis has accelerated the need to address the SDGs?