This is the second part in a series of six columns from WTW’s Thinking Ahead Institute exploring a new risk management framework for investment professionals, or what it calls ‘risk 2.0’. See other parts of the series here.

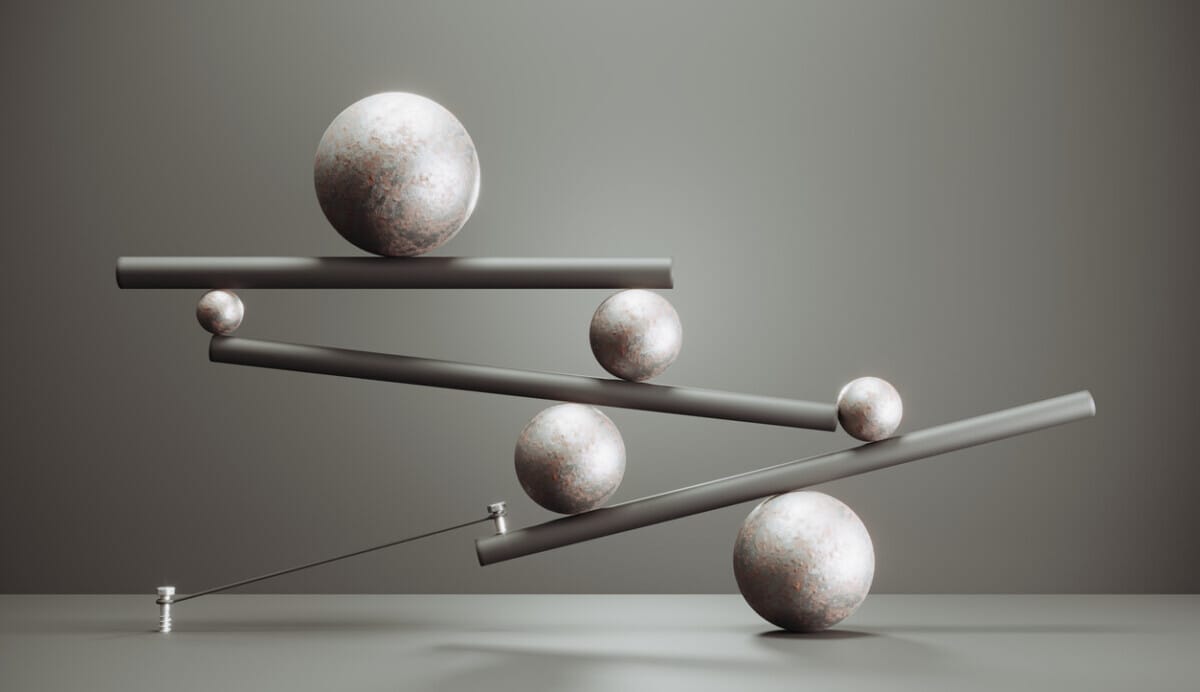

An alternative, more technical, title for this thought piece would be ‘risk has an upward-sloping term premium’. We will argue that the future is riskier not (only) because it is uncertain, but because the quantum of risk increases with time. We start by asserting that the future is unknowable [1].

Talking about the term premium of risk will therefore be tricky. Risk 1.0 gets around the problem by assuming an unchanging world so that, in each future period, we will get a new pick from the same underlying distribution. In this framing, risk does not have a term structure or, at least, not one of any interest. Once we ‘know’ (have made our assumption about) the distribution, risk through time is easy to derive mathematically. We could then push harder and talk about ‘time diversification’, which is spreading our risk budget more evenly across our investing lifetime. If there is no term structure to risk, this makes perfect sense.

Risk 2.0 assumes a complex adaptive system, and therefore we know that the underlying distribution is changing and will continue to change. Therefore, if we use a risk 1.0 model, we should introduce error bands around the output to reflect the mismatch between the assumed distribution and reality. The further into the future we wish to make projections, the wider these error bands should be, as there is more time for reality to diverge from the starting assumptions. It is also important to recognise that the increased uncertainty around the shape of the distribution as the projection horizon increases is additional to, and different from, the “widening funnel of doubt” (which is generated by “known” parameters and is part of the risk 1.0 mindset).

In addition, a complex adaptive system will exhibit ‘path dependency’. The state it goes to in the next time step is not a random and independent pick from the distribution, as per risk 1.0. Instead, the pick is from a constrained subset of the distribution, because the next possible state is dependent on the path taken through the previous states.

Now this could be interpreted as increasing the accuracy of our risk forecasting (reducing the variance of possible outcomes in the next period). However, first, we would need to be confident in our ability to determine the strength of the path dependency and to isolate the appropriate subset. And, second, we would need to be confident that the system was not about to enter a phase transition [2] and jump to another new distribution.

Finally, the transition probabilities themselves are dependent on the previous path of the system (not just the current state) and as the projection horizon increases the number of potential paths increases and therefore the degree of predictability of the system decreases. On balance, we would suggest that a further widening of the error bands is probably appropriate.

What we can know about the future

We know that systems grow in size and/or complexity unless actively constrained [3]. Bigger and more complex systems require greater amounts of energy and resources for information processing, maintenance and growth. They are also more likely to exceed carrying capacity thresholds, making them unsustainable over the longer term. In short, systemic risk rises as systems get bigger – particularly so when the system approaches resource or energy limits.

We also know that almost all politicians are committed to finding policies to promote economic growth. And we know that asset prices are underpinned by an assumption of continued growth. We further know that we face a number of problems that could affect future growth prospects:

- Falling fertility rates

- Toxicity

- Deforestation

- Biodiversity loss

- Climate change

- Planetary boundaries

- Carrying capacity.

So, if growth continues into the future, we can posit that systemic risk will rise exponentially alongside it. If growth stops (or at least slows significantly), we should expect a downward repricing of risky assets. In either case, therefore, we can expect an upward-sloping term structure for risk. Risk in the future is very likely to be higher than it is today.

Investment time horizon

The extent to which a rising term structure for risk matters will depend on the investment time horizon. The longer the horizon, the more it matters. This is partly due to the upward slope, and partly due to the higher chance of occurrence (noting that these are not independent). To illustrate, consider a 20-year-old starting a defined contribution pension account. The ‘pensions deal’, historically, has been to double the real purchasing power of contributions. Early contributions are small and late contributions tend to be large, so the average contribution is invested for about 20 years, and we can double it if we earn an average annual return of 3.5% above inflation. But note that we need to earn that return for 40 years, over the whole period of contributions.

Now, a doubling through investment returns implies a close-to-doubling in the size of the economy [4]. And we need to do this twice for the 20-year-old’s investment journey [5]. So, by the year 2065, we would need a global economy 3- to 3.5-times bigger than our current economy. If our current size of economy has produced the list of issues noted above, and breached 7 of the 9 planetary boundaries, how likely is it that we can continue to grow without triggering systemic risk? We are back to the unknowability of the future (in terms of details, timings and possible surprises).

What we have sought to do here is to set the global economy within and dependent on functioning planetary systems, and to explore the need for investment returns, the dependence on growth to achieve them, and the limits to growth on a finite planet. It is our conclusion that the term structure of risk is upward sloping into the future.

Tim Hodgson is co-founder and head of research of the Thinking Ahead Institute at WTW, an innovation network of asset owners and asset managers committed to mobilising capital for a sustainable future.

[1] The technical description would be ‘radical uncertainty’, a term popularised by John Kay and Mervyn King in their 2020 book Radical Uncertainty: Decision-Making for an Unknowable Future. Radical uncertainty differs from Knightian uncertainty as it is unresolvable – no amount of new information makes the uncertainty go away

[2] An alternative term is ‘punctuated equilibria’, yet another characteristic of complex adaptive systems. A ‘Minsky moment’ is a prime example of a phase transition / punctuated equilibrium

[3] See Systemic risk | deepening our understanding, Thinking Ahead Institute, July 2023

[4] From Thomas Piketty’s Capital in the Twenty-First Century, 2013, we learn that investment returns (r) are higher than economic growth (g), so the economy does not need to double to support a doubling in investment value

[5] More likely three times, as the trend is to maintain a reasonable weighting in growth assets during the retirement phase