This article was published in partnership with Blue Owl Capital.

This article was published in partnership with Blue Owl Capital.

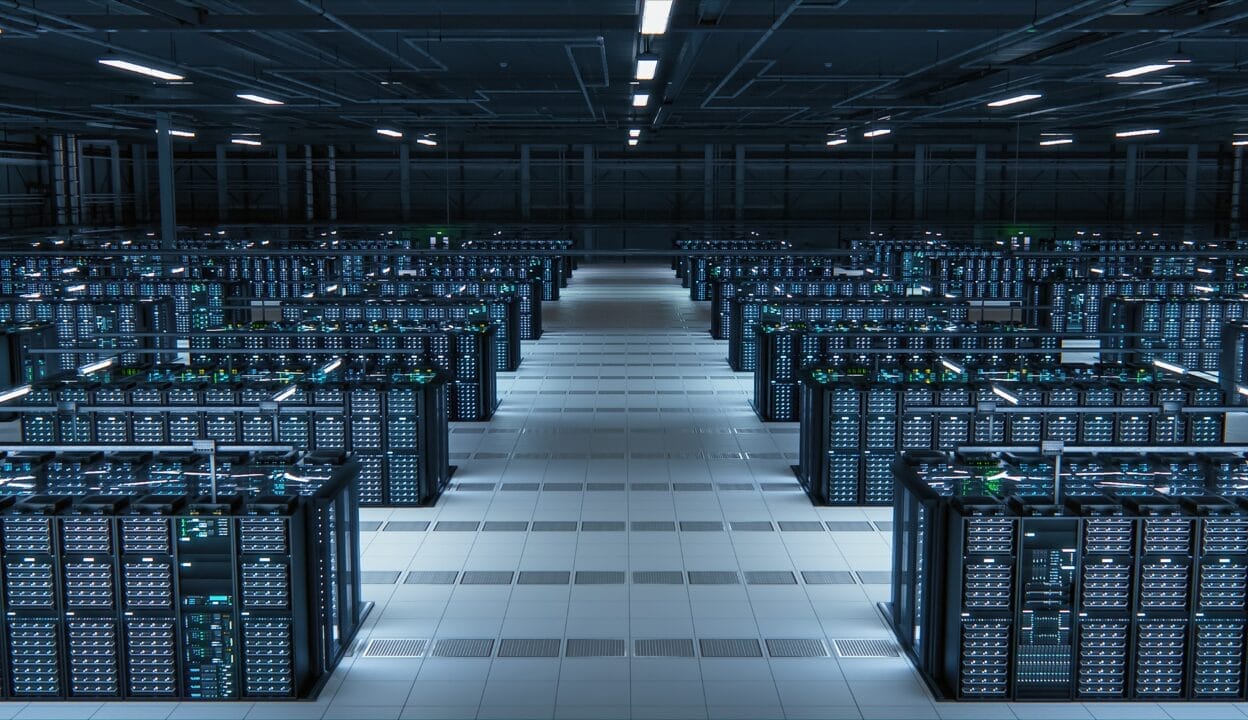

The surging interest in generative AI has triggered a technological arms race, driving demand for high-density data centres. Investors are looking to capitalize on what is often described as a generational opportunity, but as Blue Owl’s James Clarke cautions, investors need to consider several important factors as they try to determine who to partner with for the long-term. Those who have a sustainable edge, coupled with subject matter expertise, local presence, and the right partnerships will stand out from the tourists in the space.

The Challenge

In the movie 28 Days Later, London has been savaged by a raging virus. What exists is just a deserted urban landscape.

I can’t help but think that at some point in the not-too-distant future, I could be flying over Northern Virgina or Silicon Valley and look down to see hectares and hectares of decommissioned data centres. It’s a haunting and dystopic vision, but not implausible. Amid all the hype on AI and infrastructure – and the possibility of disruption – it’s worth asking, could this boom go bust?

It is challenging to cut through the clutter and make sense of the fundamentals. Data centres make major headlines almost daily – from hyperscalers committing to levels of capital expenditure never seen before to DeepSeek’s disruptive emergence as a more cost-effective competitive threat. As some in the space note, “Market participants may be faced with making unprecedented infrastructure commitments while navigating rapidly evolving technology, uncertain financial models, and intensifying geopolitical competition.” Against this backdrop, what’s the long-term investment case and how should we think about investing in data centres and digital infrastructure? The right answer is often the simplest one: find the right partner with whom to navigate the uncertainty.

The Opportunity

“Crossing the Chasm” describes the critical point in tech adoption when a product moves from early adopters to the early majority. Have we made that crossing? Is AI as big a driver of demand as the market suggests? By all measures, the answer seems to be yes.

We are living through a wave upon wave moment in which both cloud computing – think video streaming, gaming, trading, medical devices, and autonomous driving vehicles – and AI are driving the demand for compute and therefore necessitate more data centres. Cloud is its own wave, growing by 20% to 30% annually and is for many a compelling rationale alone for investing in data centres. Our own digital infrastructure business was founded nearly a decade ago based solely on the demand for data centres from cloud adoption.

While cloud was enough, the even bigger wave came when OpenAI debuted ChatGPT in 2022, bringing with it an additional step-function of demand that is growing exponentially. From October 2022 to April 2025, ChatGPT went from zero to 800 million weekly active users, from zero to 20 million subscribers, and from zero in revenue to nearly $4 billion. Given the confluence of cloud and AI, McKinsey estimates that in the US alone, the demand for data centres will grow to 80 Gigawatts (GW) by 2030, which implies a buildout of an additional 50 GW to 60 GW over the next five years. Globally, “by 2030, data centres are projected to require $6.7 trillion to keep pace with the demand for compute power with $5.2 trillion for AI and $1.5 for cloud and traditional IT applications”.

As investors seek to capitalize on the AI boom through exposure to data centres, these trends explain the potential upside. But what are the risks? Could someone deliver compute more efficiently or could there be a breakthrough in quantum computing that renders today’s infrastructure obsolete? This is where Jevons Paradox offers a comforting lens: improvements in efficiency can amplify demand and consumption, not reduce them.

This is what crossing the chasm is all about – getting to the point of mass adoption. Thus, the risk of disruption becomes an argument in favour of investing in data centres. A good partner has the foresight from experience to anticipate the paradox.

Avoiding the Tourists

Given the imbalance of supply and demand of capital in data centres, investors need to be wary of the “tourists” raising capital in the space. These tourists – opportunists swooping in given the recent market hype– likely think all it takes is buying land. But those with experience know that the land is just the beginning. You must have a ground game to understand developing in these markets, which means knowing how to navigate the dynamics amongst local stakeholders — communities, regulators, utilities, grid operators, construction companies — to see a project through. Without expertise, it’s easy to blindly misstep.

What should you look for instead? Given that hyperscalers are the primary drivers of capital expenditure and are the players involved in the race for compute, look for the market participants who have a hyperscale focus and a proven track record with a reputation for their experience, expertise and are trusted and transparent partners.

Focus on managers who develop build-to-suit instead of build-to-spec. Having a long-term (10 to 15 year) signed triple net lease with an investment-grade corporate tenant provides stability, predictability of cash flows, and downside protection. There are only a select handful of managers that can achieve this: those with scale, global reach, local presence, and vertically integrated operating platforms. Managers who have done it before and are a partner of choice for the hyperscalers and who have seen opportunities where others did not.

Finding the Path Forward

There is no question that AI is a megatrend that has the potential to radically transform economies, triggering governments, organizations, and investors to spend billions of dollars on research and development, including the build out and innovative improvement of digital infrastructure. Investment in data centres is rightly seen as a generational opportunity; it’s real and it’s here to stay. Yet, the opportunity does not always guarantee results, profits, or success.

Many of us will remember the excitement of the internet in the early 2000s – and how many of the promising start ups at the time ended up in the investment graveyard. The only hope of banishing the fear of data centres decaying into rusting shells? Choosing the right partner. Because if the lights do go out – if the servers go cold and the racks fall silent – at least your partner knew to bring a flashlight.

While we don’t know what the future holds, it is very likely that those that succeed are the players with subject matter expertise and experience; those who built investment platforms optimized to work with the hyperscalers and structure investments with a focus on cash flows and downside protection. That is the way to invest: gauging the probabilities and searching for the attractive risk-adjusted returns.