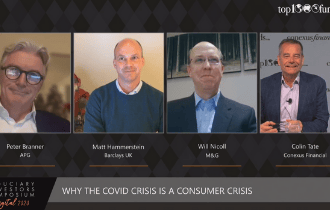

There are many differences between the 2008 financial crisis and the 2020 COVID-19 induced economic crisis, not the least of which is how the policy makers have responded. In 2008 the bailout of the banks was the focus, and in 2020 the bailout of the consumer was the focus. So why have governments been focusing on the consumer, and what does that mean for investment opportunities? Is this a long-term thematic that investors should be navigating in their investment allocations?

Peter Branner

Chief investment officer, APG

Peter Branner has been chief investment officer at APG since September 2018. In this role, he is responsible for the overall investment operations and further optimising sustainable and long term returns in line with the APG strategy. APG Asset Management is part of APG Group NV, the Netherlands’ largest pension delivery organization. APG Group manages €479 billion in pension assets and ensures that over 4.5 million people can be confident that their accrued pension rights are being invested, administered, and paid out correctly. Branner has more than 25 years of investment experience. Before joining APG, he served as CEO/CIO of Swedish SEB Investment Management in Stockholm. In this role he was responsible for the overall investment process at the firm and its broad range of funds and institutional mandates covering all major asset classes with in excess of €100 billion in assets under management. Previously, he was CIO at Fortis Investments’ multi management division in London. Before that role, he served as managing director of IKANO Fund Management in Luxembourg and held other investment positions within the IKANO Group. He graduated from Copenhagen Business School with a BSc in economics and a MSc in business administration.

Matt Hammerstein is the CEO for Barclays Bank UK, covering retail banking, investments and wealth UK, business banking and Barclaycard UK.

Prior to becoming CEO, he was head of retail lending covering both the secured and unsecured lending businesses. He joined Barclays in 2004 as director of group strategy, later progressing to become the group chief of staff; a key strategic role in which he provided vital support to the Group CEO during the financial crisis. He went on to manage Barclays Group corporate strategy and corporate relations, Barclays customer and client experience in retail and business banking and Barclays UK retail products and segments.

Before Joining Barclays, he was a senior management consultant at Marakon Associates where he worked for 12 years in the financial services, consumer products and energy sectors within the Americas and Europe.

Hammerstein graduated with a degree in Mechanical Engineering from Yale University, and an MBA from the University of Chicago.

He is a member of the BBUK board and sits on the money and pensions service adult advisory group. He is also a member of the FCA practitioner panel and trustee of the Charities Aid Foundation and active ambassador in Barclays for inclusion, wellbeing and anything that makes the workplace more fun.

William Nicoll

Chief investment officer, private and alternative assets, M&G Investments

William Nicoll was appointed CIO, private and alternative assets in February 2020 which covers private debt, real estate, private infrastructure equity and teams investing in third party funds. Prior to this he served as head of institutional fixed income and was previously co-head of alternative credit where he was responsible for the development of various products for institutional investors.

Nicoll joined M&G in 2004. Prior to this, he was head of European credit at Henderson Global Investors and before this had worked at Cazenove & Co in corporate bond research and fund management.

He graduated from Trinity College, Cambridge University with a degree in Natural Sciences. He is a CFA charterholder and a Chartered Fellow of the Chartered Institute for Securities and Investment.

Colin Tate has been an investment industry media publisher and conference producer since 1996. In his media career, Tate has launched and overseen dozens of print and electronic publications. He is the chief executive and major shareholder of Conexus Financial, which was formed in 2005, and is headquartered in Sydney, Australia. The company stages more than 20 conferences and events each year – in London, New York, San Francisco, Los Angeles, Amsterdam, Beijing, Sydney and Melbourne – and publishes five media brands, including the global website and strategy newsletter for global institutional investors conexust1f.flywheelstaging.com. One of the company’s signature events is the bi-annual Fiduciary Investors Symposium. Conexus Financial’s events aim to place the responsibilities of investors in wider societal, and political contexts, as well as promote the long-term stability of markets and sustainable retirement incomes. Tate served for seven years on the board of Australia’s most high profile homeless charity, The Wayside Chapel; and he has underwritten the welfare of 60,000 people in 28 villages throughout Uganda via The Hunger Project.

Key takeaways

Will

- This is a very weird crisis due to the level of government support being thrown at consumers.

- Consumer risk transfer from banks to asset managers will continue into the future.

- We believe there is still a demand for quality real estate offices in the future however retail will be challenged. Offices will not go away but it is an opportunity to upgrade and reconsider what type of space is needed.

- All private asset markets have their own cycles. The real challenge is to find a market that is not commoditised.

Peter

- The S of ESG is increasing in importance.

- China was strong before the pandemic and even stronger now.

- Physical due diligence is likely to return as soon as possible.

- The extent of de-urbanisation is possibly overstated.

Matt

- We are all in the same COVID storm but we are in two very different boats in terms of how people have been impacted. Young people, those with children and the self-employed are particularly vulnerable.

- There have been many habitual shifts during COVID – Cash usage in the UK has been down c. 60%, and non-cash payment methods are likely to continue in the future. The buy now pay later trend has been greatly accelerated during COVID. There has also been a big shift to supporting local businesses, to investing in one’s home and spending on hobbies.

- Retail has hardship but also pockets of huge opportunity.