The composition of an investment committee is the most meaningful criteria in assessing diversity, equity and inclusion in private market fund managers according to Mercer.

The consultant sets out criteria that it thinks will ensure success of a DEI program which includes: fund manager ownership, investment team composition, investment committee composition, thresholds and alignment. It believes that investment committee composition is the most meaningful criteria as this is typically where final investment decisions happen.

In the white paper, The Power of Change: The what, why and how of creating a diverse private market portfolio, Mercer says incorporating DEI into private market portfolios could result in an increased likelihood of outperforming benchmarks.

In the paper Mercer points to recent research suggesting diverse teams make better decisions and are less likely to be influenced by unconscious biases. A study conducted by the National Association of Investment Companies which looked at the diversity of private equity firms found that, from 1994 to 2018, diverse funds outperformed the top quartile benchmark on a net IRR basis, and outperformed the benchmark median quartile on a total value to paid in capital and a distributions to paid in capital basis.

“The pandemic and growing demand for social change, coupled with market volatility, have made investors realize that change is here. There are many benefits to embracing DEI, as well as risk mitigation considerations. By creating a private markets DEI investment program, institutional investors can send a strong signal to asset managers that diversity is a priority. We are working with managers and asset owners to help them transform investment management through their portfolio investment choices,” said Raelan Lambert, global alternatives leader at Mercer.

“By increasing the diversity of their managers, investors can create an environment where new ideas can thrive. This environment enables fresh perspectives and different networks through which to access potential new deal flow.”

But to develop and implement an effective DEI investment program in private markets, it is essential to have a clear, consistent and quantifiable definition of what the term means in investment practice, the paper says.

There are a couple of specific considerations that apply to due diligence around diversity within private market fund managers, the paper says. For example because some diverse managers may not have long track records, it’s essential to find ways to mitigate performance risk. In addition Mercer says it’s useful to assess the alignment of financial incentives across all professionals on an investment team and the organisation more broadly, and encourages investors to examine the decision- making influence of minority groups to ensure alignment, and make sure HR policies promote meritocratic DEI hiring, particularly within the investment team.

It is also important to have ongoing monitoring of the managers on diversity matters and investors need to create their own frameworks for monitoring and evaluating their DEI programs and ensuring they’re meeting relevant objectives and investment targets. Key performance indicators can be useful and should encourage data collection on diversity and a range of other important metrics.

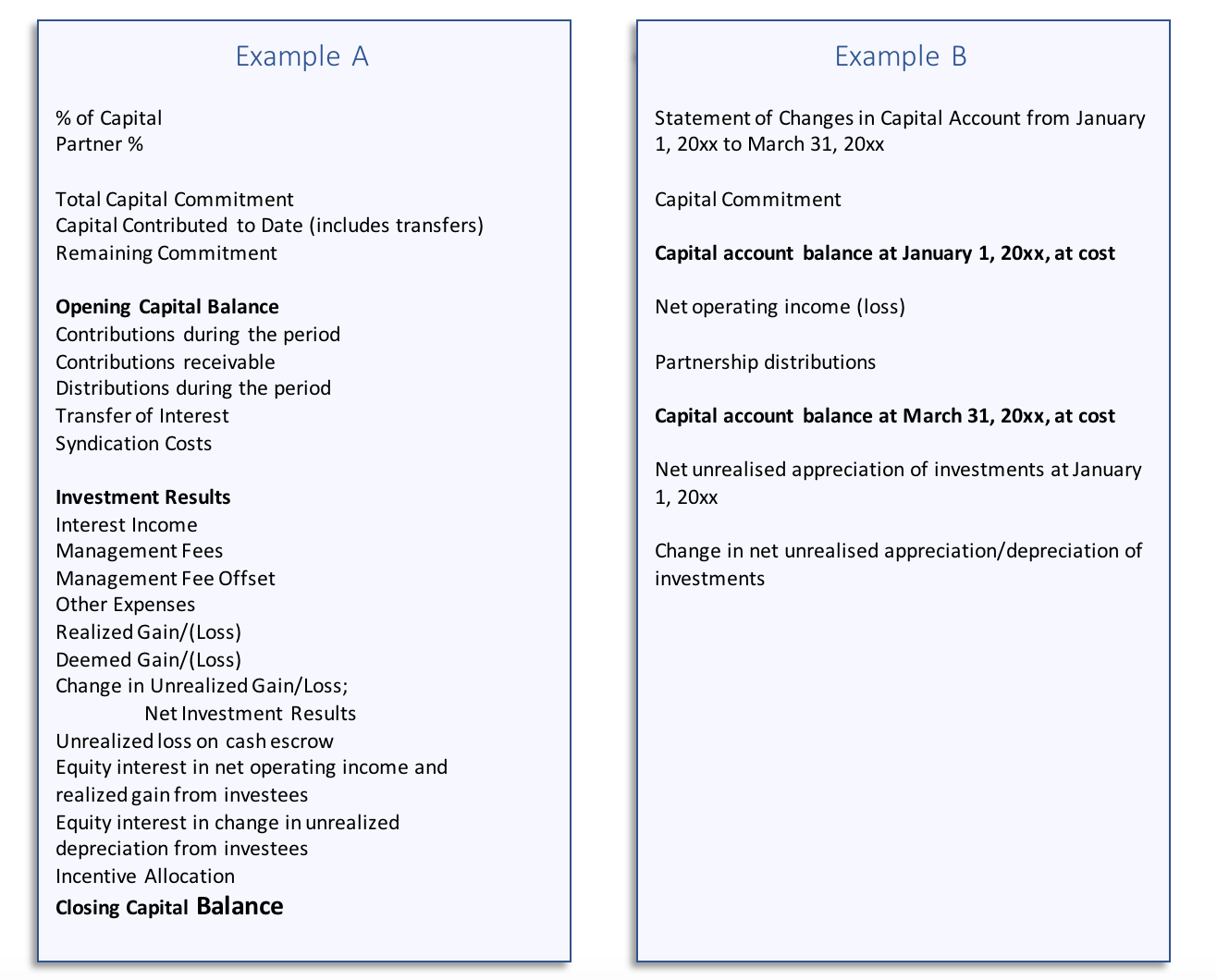

Examples A and B are taken, line by line, from two private equity general partners’ (GPs’) quarterly capital account statements or “NAV statements” to their investors. Example A is very granular, while Example B is more summarised. Both statements communicate the same high-level information to the limited partner (LP). However, for example are they both net of allocated incentive (aka carried interest)? It is not clear in this example, and combining data from hundreds of different statements can make the same differences add up if the data is “apples-to-oranges”.

Examples A and B are taken, line by line, from two private equity general partners’ (GPs’) quarterly capital account statements or “NAV statements” to their investors. Example A is very granular, while Example B is more summarised. Both statements communicate the same high-level information to the limited partner (LP). However, for example are they both net of allocated incentive (aka carried interest)? It is not clear in this example, and combining data from hundreds of different statements can make the same differences add up if the data is “apples-to-oranges”.