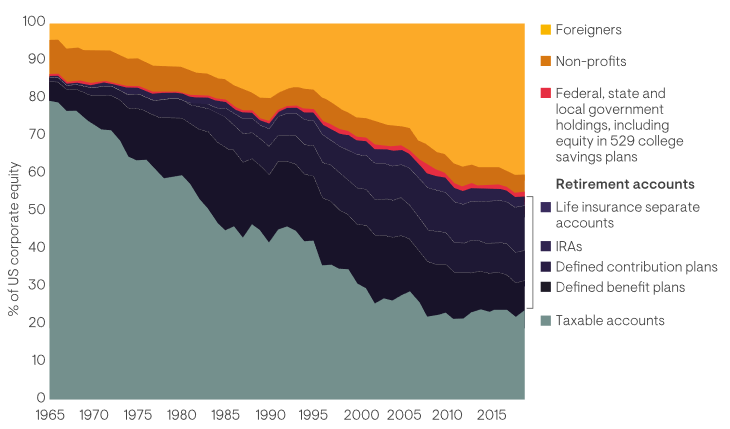

Financial markets play a central role in the capitalist economy, allocating new savings to productive investment, acting as a signalling device to corporate management, and providing liquidity to investors.

The efficient markets paradigm claims that competition among investors keeps asset prices close to fair value, but a new interpretation contends that stock markets have morphed into a contest between two sets of investors: those seeking short-term gain matched against those targeting long-term value. This unending battle corrupts prices, creates macroeconomic instability and costs vast sums in asset management fees.

The new paradigm highlights the role played by principal-agent relationships in leading investors and corporations to focus on short-term share price movements at the expense of long-run cashflows. A cascade of agency issues runs from savers to asset owners, on to asset managers and ultimately into corporate boardrooms. Agency problems at every level in this chain give rise to a pervasive short-termism that reduces long-run returns to savers while imposing substantial costs on wider society.

We focus on the key link in this chain: the actions of asset owners in delegating responsibility to asset managers. When setting the terms of the contract, asset owners often impose tracking error constraints that limit the scope for divergence from benchmark returns in the short term. Even in the absence of such constraints, managers have a strong commercial incentive to avoid a sustained period of underperformance. As a result, the management of career risk often prevails over long-term decision-making.

The focus on short-term performance constitutes the original sin of investing and leads to many of the problems in asset pricing and asset management. Managers respond to underperformance by reducing underweight positions in assets with rising prices which they had previously spurned. These purchases penalise long-term returns and amplify the price rise leading to overvaluation.

A related problem is the propensity for asset owners to hire recently successful managers and fire unsuccessful ones, thereby creating fund flows that further amplify price changes in the short term. These pro-cyclical flows incentivise performance-chasing by asset managers while also creating the opportunities which momentum and trend-following investors exploit.

Asset mis-pricing and bubbles damage the real economy, creating macroeconomic convulsions and giving false signals to the corporate sector. If share prices fail to reflect the fundamental value of a company, corporate managers have the dilemma of choosing whether to target the short-term share price or long-term cashflows. The actions relating to each objective are for the most part mutually exclusive.

To target the share price CEOs can reduce capital expenditure and R&D, focus on quick pay-off projects, engage in buybacks at high prices, increase leverage to benefit short-term earnings, and use accounting devices to flatter current profits. They may also pursue strategies designed to keep pace with their competitors without paying due regard to the risks – “dancing while the music is still playing” to paraphrase Chuck Prince – the corporate equivalent of a momentum strategy.

One of the great beneficiaries of the present state of financial markets has been the asset management industry whose annual fees amount to around $300 billion. The industry meets many of the criteria of a highly competitive industry: vast numbers of producers, low barriers to entry and low start-up costs. However, the dynamics we describe give rise to excessive turnover, an inflated asset base on which to charge fees and supernormal profits across the industry.

Fiduciary duty requires asset owners to act in the best interests of the ultimate beneficiaries. It can be viewed as mitigating some of the problems that arise in the process of delegation. However, many asset owners are either explicitly authorising or tacitly accepting the use of short-term tracking to market cap benchmarks. Since this activity is likely to reduce long-term returns, there is an a priori case that these asset owners are in breach of their fiduciary duty.

The body of theory developed over the last 14 years at LSE’s Paul Woolley Centre for the study of Capital Market Dysfunctionality and elsewhere suggests that the remedies depend predominantly on the way that large pools of capital are administered: how the assets are allocated, the terms under which trustees and other fiduciaries delegate to external asset managers, the strategies they endorse, and the way they monitor the results.

A more effective application of fiduciary duty to curb performance-chasing offers the potential for greater long-term returns with the added benefit of more stable and efficient markets. By verifying the implicit time horizon of the strategies adopted by the asset managers they employ, asset owners could incentivise a shift towards longer horizons within financial markets with both private and social benefits.

A more detailed report on which this article was based can be found here.

Philip Edwards and Paul Woolley are co-founders of Ricardo Research