Key Takeaways

- China’s economic policy has shifted to growth, COVID-19 restrictions have been lifted, regulatory rhetoric has relaxed and the tone toward the property and private sectors has become more supportive.

- While we expect China’s growth momentum to improve further in the coming months, a hard-hit property sector, aging demographics and geopolitics remain headwinds to China’s growth trajectory.

- Long-term themes remain intact and a vast potential opportunity set exists across public and private markets. Investors should be ready to revise their approach to successfully navigate China’s next chapter.

China has reopened. The recovery of the world’s second-largest economy is underway after three years of some of the strictest public health measures globally. An earlier and faster-than-expected departure from zero-COVID policy began at the end of 2022 as major cities abolished mandatory mass testing requirements. Rules around domestic quarantine requirements and inbound travelers eased in January as China welcomed the Year of the Rabbit with Lunar New Year holiday celebrations. The reopening has occurred in tandem with a strong policy shift towards supporting growth by facilitating a consumption recovery and rebuilding consumer confidence, including measures to stabilize China’s property sector. This policy pivot led to a cyclical recovery between November 2022 and February 2023 as sentiment toward Chinese assets improved and fueled one of the best performing three-month periods on record for the MSCI China Index—albeit from a depressed starting point. A nine-day long policy event, the National People’s Congress (NPC), concluded on March 15 with policymakers re-emphasizing stability of growth as a key goal of the government and reassuring the private sector and international business community of Beijing’s pro-business stance. As many aspects of China’s economy and society normalize over the coming quarters, we expect China’s growth momentum to improve. While a cyclical recovery may continue to drive markets in the near term, successfully navigating China’s next chapter will also require public and private investors to refocus on a wide set of new opportunities—and new risks. These include long-term secular tailwinds and structural headwinds with the potential to affect asset class performance and investment portfolios in the years ahead.

Reopening and Recovery

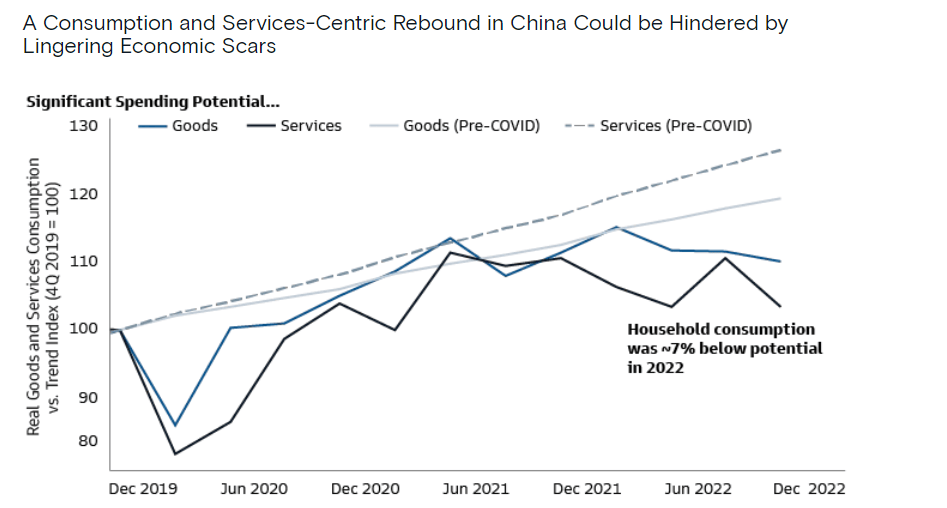

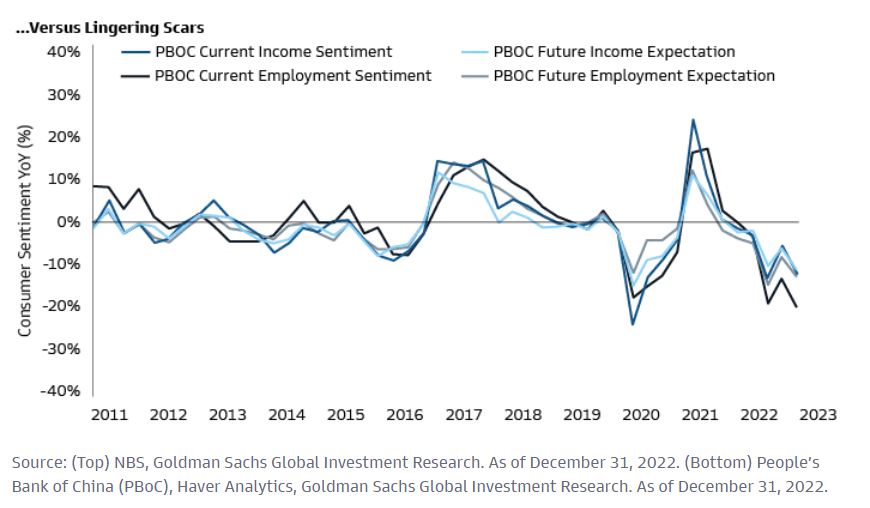

The potential pace and magnitude of a consumption rebound in China this year remains firmly in focus among market participants. Chinese household consumption was ~7% below potential in 2022, implying significant room for recovery.1 If the post-pandemic consumption pattern of other economies leaves any indication, China may see sharp rebounds in discretionary consumer goods and services spending, especially domestic tourism. During China’s Lunar New Year Golden Week (January 21-27), movie box office revenues, postal package delivery, and restaurant sales all exceeded 2019 levels. There was also a V-shaped recovery of domestic air traffic and booming hotel demand. Consistent with the mobility data, China has returned to work with a sense of urgency. Purchasing Managers’ Index (PMI) data came in above consensus expectations in February, with the Caixin Services PMI—the most sensitive part of the economy to a reopening—surging to 55.0 well above the historical mean of 53.7.2 We believe China’s reopening has the potential to trigger a consumption revival in 2023 led by a release of pent-up demand, improvement in the labor market and incomes, and a broader recovery in consumer confidence. However, it is still too early to tell how robust and durable China’s economy will be, and three years of zero-COVID policy and eighteen months of property sector stress have left scars that could hinder a broad-based consumption recovery. For example, elevated unemployment rates among China’s 16-24-year-olds could weigh on the consumption capability of this cohort, even as the recent relaxation in various regulated areas, such as tech and education as well as the more recent recognition of platform companies as national champions and employment generators, provides some support for job prospects and income security. Meanwhile, cumulatively, from 2020 to 2022, excess savings in China—which we define as the amount of savings above what a “normal” pre-COVID savings rate would imply—appear to be relatively small in contrast to other economies such as the US, estimated at less than 3% of GDP or 6% of household disposable income at the peak during the pandemic, though in absolute terms this number exceeds RMB 3tn (~$435bn).3

Along with signs of a consumption rebound, we believe it will be vital for investors to closely monitor global spillover effects from China’s reopening on goods trade, international travel, and commodities. Increased domestic demand in China could boost goods exports from other economies, for example. We expect Asian economies—which account for more than 50% of China’s import demand—to be the key beneficiaries of this growth impulse, though results will vary at a country level. China is the largest export market for most economies in the region, absorbing 50% of exports from Taiwan and Australia, 30-40% from New Zealand, Korea, Malaysia, and the Philippines, and around 20% from the rest (with a notably smaller 7% for India). The distribution of benefits will also depend on which sectors in China experience the strongest growth. Taiwan accounts for a quarter of tech imports into mainland China, for example. Demand recovery in foreign services, particularly for international travel, would additionally provide a modest boost to global activity. Again, Asian economies and some developed markets are likely to benefit if international travel returns to pre-pandemic levels. Higher commodity demand and prices are another channel through which China’s reopening will affect other economies. China is the world’s largest commodity consumer and biggest oil importer, and we expect its reopening to be moderately inflationary due to higher commodity prices. Within China, the unique nature of the post-reopening recovery may result in a mixed inflation picture. Prices of pork, a staple in China, surged in 2022 but may be less of an issue as supply disruptions begin to ease. Durable goods such as autos, smartphones, and computers tend to have long and sophisticated supply chains and are likely to be affected differently by reopening.

China’s reopening and recovery will be closely watched by many investors over the coming quarters. Data suggests hedge funds moved swiftly to rebuild China exposure from November to January. Active mutual funds globally re-risked to a lesser extent. However, by the end of February, Chinese equity funds had recorded steady year-to-date inflows of ~$3.6bn from global mutual fund investors.4 We see large pools of capital that do not have the level of holdings in China that they used to allocate. This implies that net foreign buying may continue in the months ahead, especially given the recent improvement in China’s fundamental outlook. Revenue normalization in areas that have been impacted the most by COVID restrictions may remain a tailwind and could drive further equity gains. The downside risk of maintaining underweight exposure to Chinese assets could therefore be high. We see public market strategies well placed to capture further upside in the near term. These strategies can take advantage of both improving fundamentals and tactical re-rating opportunities in areas where valuations are still suppressed relative to historical ranges, notwithstanding the recent rally. We expect China’s equity and fixed income complex to contain an abundance of alpha generating opportunities for bottom-up, active managers in 2023 and beyond. Many investors still include China as part of a broader allocation to Asia or emerging markets; however, China’s size and the breadth of its equity and fixed income markets could merit a standalone country or incremental regional allocation for investors considering Chinese equity and fixed income exposure. Both China’s A-share market and Chinese fixed income markets boast a strategic investment case for international investors underpinned by their size, liquidity, and diversification appeal.

Beyond Reopening

Despite optimism around China’s reopening and recovery in the near term, we expect headwinds to shape China’s growth trajectory and asset class performance in the years ahead. We examine three key issues in more detail: property sector stress, demographic shifts, and geopolitics.

First, China’s property market remains a key concern. The country’s real estate market stayed soft in 2022 amid continued liquidity and credit stress for developers, even as greater concerns over contagion risks stemming from Evergrande’s default began to abate. More recently, sentiment has further improved as policymakers’ tone towards the sector has turned decisively more dovish. Credit support to both high-quality developers and homeowners has been introduced and we expect more policy easing to come. We have since seen a recovery in both primary and secondary property transactions year-to-date. The long-term policy focus is likely to be on managing a multi-year property sector slowdown, rather than engineering an upcycle. Property developers’ debt-repayment problems have been among the biggest issues affecting Asia’s credit markets over the past two years. More recently, the asset class has experienced a forceful rebound. A recent rally of China property high yield bonds reflected a reduction of left tail risk for the stronger developers. We think stresses and defaults could continue to build and the near-term outlook remains challenging. Even so, we believe there is a potential opportunity for attractive total returns in the deleveraging of the Chinese property sector through active security selection, while recognizing that Asia’s credit markets represent a diverse opportunity set beyond China.

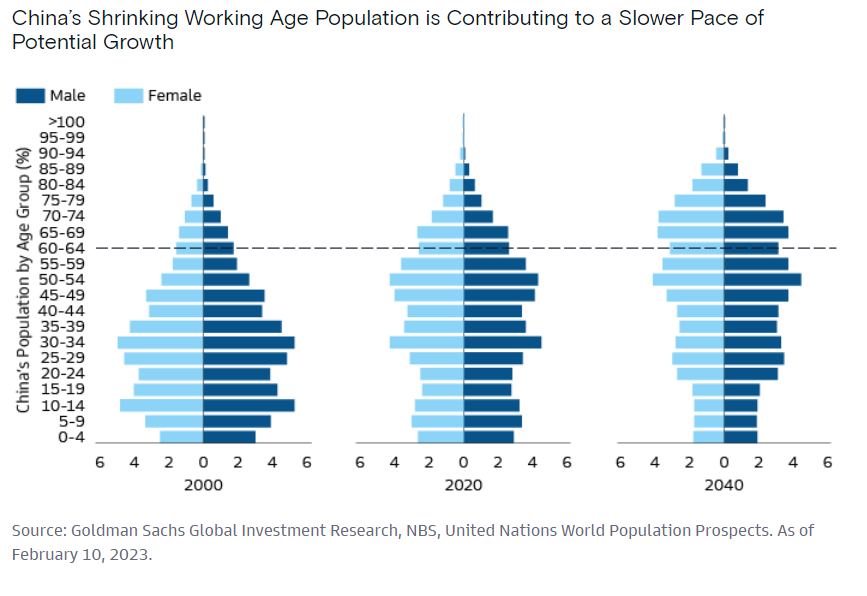

Second, China’s changing demographics will likely present long-term challenges to the country’s growth potential and alter the structure of its economy. China’s population started shrinking in 2022 for the first time in six decades.5 The demographic transformation has led to an increasingly top-heavy population pyramid. China’s old-age dependency ratio (the ratio of the population aged 65 and over to the population aged between 15 and 64) is expected to increase from 10% in 2000 to 41.5% by 2040, according to United Nations projections.6 Although China loosened its family planning restrictions in 2015 to address emerging demographic problems, birth rates have not improved following the implementation of the two-child policy. Even if China were to further relax its birth policies, fertility rates may not increase due to structural factors, including the fall in the number of women of childbearing age—a result of family planning that began in 1980; and improving living standards and education levels delaying marriages and childbirth, and the pressures and costs of parenting. Demographic headwinds are not unique to China. Many countries have increasingly aging populations, but China is already home to the largest population of older people in the world. Investors have opportunities to lean into areas of demographic change. Segments of China’s healthcare sector stand to benefit as aging consumers start to spend a higher proportion of their budget on medical services and less on tangible goods. At the same time, President Xi Jinping has put health and social care at the center of the government’s policy agenda. More broadly, lower labor force participation rates tend to raise labor costs and result in retirees drawing down savings. This may constrain the available supply of capital, potentially creating compelling opportunities for private investors seeking to put capital to work in China.

Third, geopolitical risk remains a significant overhang on Chinese assets. The Russia-Ukraine war raised investor concerns around geopolitical issues, including China-Taiwan tensions and US-China trade and technology frictions. Diplomatic tensions with the US increased at the start of 2023 as the US shot down a suspected surveillance balloon and Secretary of State Blinken postponed his planned trip to Beijing. Strained relations between the US and China appear to have encouraged both to strive for more self-sufficiency in key industries. This may lead to more centralized economic policies where state intervention plays an important role, either directly or indirectly, through incentives and disincentives to decision makers and businesses. The US move to ban the transfer of advanced semiconductor technology to China may prompt Chinese leaders to ramp up state-directed investment in domestic chip producers and bolster onshore manufacturing. This could intensify the race between the two countries for dominance in the tech sector. Elsewhere, Beijing and Washington have also been at odds over access to audit papers of Chinese companies. Since 2021, Chinese offshore initial public offerings (IPOs) in the US have almost ground to a halt. However, February saw the first Chinese company to raise more than $100 million in the US in 15 months as China’s securities regulator eased curbs on overseas IPOs, sparking hopes that Chinese companies will restart their ambitions to list in major markets such as New York.

Geopolitical headwinds and new alliances ultimately create a more uncertain environment that weighs on consumer and corporate confidence. Governments’ fiscal spending priorities may also change, with increased spending on defense and/or more support for domestic industries. Private capital may be advantaged by its ability to provide long-term, patient capital that can respond to long-term shifts, while reacting less to near-term geopolitical gyrations. Private capital can also provide investors with access to a broader selection of industries given the stops and starts in the IPO market. From an FX perspective, global instability is also leading to a desire for greater currency diversification and could give rise to more institutional investor allocations and central bank reserves potentially shifting to RMB and EUR, alongside the dollar. That said, there are still material barriers to a wholesale shift into RMB. For example, foreign ownership of Chinese Government Bonds (CGBs) remains low at around 12%, although we think CGBs continue to offer investors diversification benefits given their low correlation with other assets.7 We also expect structural inflows as a result of increasing weights of CGBs in major bond indices to be supportive for the asset class over the long term.

Secular Trends

Every new cycle has new winners, and in China, picking the right themes and sectors in the right cycle has demonstrated to be highly rewarding. As China enters a new chapter, we believe it will be critical for investors to align their portfolios with long-term secular trends. This may include opportunities that are essential building blocks to—or at least well-synced with—initiatives set to guide China’s economic growth orientation in the decades ahead. China’s Common Prosperity vision, for example, is a concept which we believe represents a growth reorientation where policy support could pivot towards industries that carry long-term strategic value to China, including areas of technology, healthcare, and decarbonization.

Prosperity heavily depends on the ability for China to grow its economy in a high-quality, efficient, and sustainable manner. We believe China will have to develop its internal production capabilities in foundational technologies, specialized equipment and essential materials along key supply chains, such as semiconductors and enterprise software, if it is to improve its global competitiveness and self-sufficiency—especially against a backdrop of elevated US-China tensions. Building out digital infrastructure will also be essential to enable China to reach its long-term growth targets. Digitization will touch most areas of China’s economy, but we believe it could have the greatest impact on the enterprise technology and financial sectors.

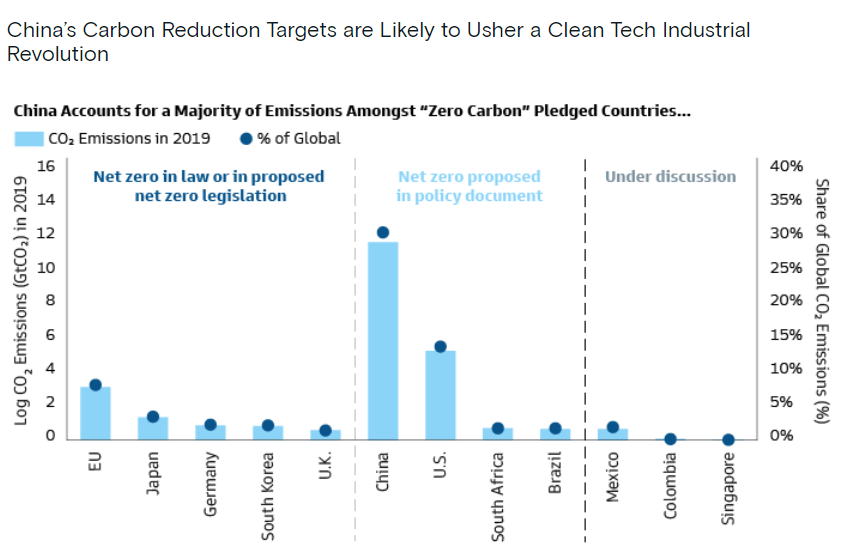

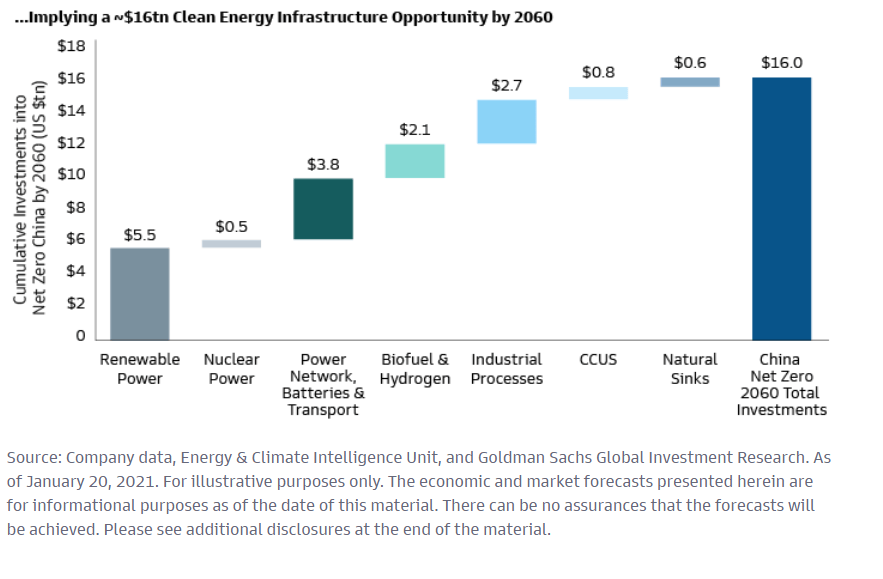

Core technology aside, energy security is another necessary condition for sustained growth. While China is the largest producer of rare earth elements critical for energy transition, it is also the largest energy consumer in the world, representing 14% of oil and 52% of coal demand globally. About 73% of its oil consumption and 8% of coal is sourced externally, underscoring China’s heavy dependence on energy imports in areas that could expose the country to national security concerns.8 The word “ecology” has also received significant mentions in many official Common Prosperity reports, and reducing energy pollution is a core component of sustainable development. We believe China’s pledge to reach peak CO2 emissions by 2030 and carbon neutrality by 2060 will continue to underpin its quest for less-polluting energy supplies and enhancing energy efficiency. This could usher in secular investment opportunities centering on renewables (e.g. solar, wind, hydrogen) and environmentally-friendly energy applications, notably electric vehicles and related supply-chain components (e.g. battery technology and charging piles). Policymakers are also increasingly focused on alleviating water scarcity and reducing water pollution.

We believe finding and executing public and private investments in areas that benefit from structural tailwinds will prove rewarding. The make-up of China’s newly born unicorns—privately held start-ups with valuations over $1 billion—is increasingly concentrated in industries that are more aligned with China’s national development goals. In 2022, 70% came from four fields: clean technology, renewable energy, healthcare and smart logistics.9 Economies of scale and industry consolidation have historically been winning formulas in China. Going forward, a focus from policymakers on regulating anti-monopoly behaviors, discouraging cross-sector capital expansion for platform operators, and offering targeted support to emerging companies may strengthen the competitive positioning of small and medium sized enterprises. ‘Little Giants’—emerging companies handpicked by China’s authorities for explicit policy support—are particularly aligned with strategic policy goals. These small/mid-caps are mostly found in capital goods, new materials, technology hardware and semiconductors. These sectors are critical to Chinese national security, growth sustainability, and the Common Prosperity initiative.

New China Playbooks

China remains a large, growing market with a vast opportunity set. But as China reopens and its economy recovers, the country’s next chapter is set to look a lot different than the last. This means investors cannot rely on their existing game plan. As the long-term trends in China shift, it is important to see the change, understand the change, and continue to look forward. We believe investors will need to take a more nuanced view of public market exposures and add thoughtful idiosyncratic exposure to private markets with managers able to identify and execute in thematic areas with structural tailwinds. This could make portfolios more resilient as China enters its next chapter.

Important information

1Goldman Sachs Global Investment Research. China post-reopening consumption recovery: Large potential, lingering scars. As of January 18, 2023.

2Goldman Sachs Global Investment Research. As of March 1, 2023.

3Goldman Sachs Global Investment Research. China Data Insights. As of February 7, 2023.

4EPFR, Morningstar, MSCI, FactSet, Goldman Sachs Global Investment Research. As of February 28, 2023. Morningstar data includes flows across China Equity and China A-Share Equity categories. Past performance does not guarantee future results, which may vary.

5National Bureau of Statistics of China. As of January 18, 2023.

6Goldman Sachs Global Investment Research. Population Aging, Pension System, and Individual Retirement Savings in China. As of February 10, 2023.

7Source: IMF, Goldman Sachs Global Investment Research, Goldman Sachs Investment Strategy Group, and Goldman Sachs Asset Management. As of January 29, 2023.

8Goldman Sachs Global Investment Research. Finding the “Common” paths to “Prosperity”. As of October 25, 2021.

9South China Morning Post (SCMP). China added 74 unicorns in 2022, maintaining steady pace of growth despite fundraising crunch. As of February 3, 2023.

Glossary

Alpha refers to returns in excess of the benchmark return.

Bps refers to basis points or 1/100th of 1%

Correlation is a measure of the amount to which two investments vary relative to each other.

Dovish refers to more accommodative monetary policy, the opposite of Hawkish

FX is foreign exchange market.

GDP is Gross Domestic Product

Left-tail risk refers to the risk of unlikely yet extremely negative portfolio outcomes.

PBOC is People’s Bank of China

Risk Considerations

All investing involves risk, including loss of principal.

International securities may be more volatile and less liquid and are subject to the risks of adverse economic or political developments. International securities are subject to greater risk of loss as a result of, but not limited to, the following: inadequate regulations, volatile securities markets, adverse exchange rates, and social, political, military, regulatory, economic or environmental developments, or natural disasters.

Private equity investments are speculative, highly illiquid, involve a high degree of risk, have high fees and expenses that could reduce returns, and subject to the possibility of partial or total loss of fund capital; they are, therefore, intended for experienced and sophisticated long-term investors who can accept such risks.

Alternative Investments often engage in leverage and other investment practices that are extremely speculative and involve a high degree of risk. Such practices may increase the volatility of performance and the risk of investment loss, including the loss of the entire amount that is invested. There may be conflicts of interest relating to the Alternative Investment and its service providers, including Goldman Sachs and its affiliates. Similarly, interests in an Alternative Investment are highly illiquid and generally are not transferable without the consent of the sponsor, and applicable securities and tax laws will limit transfers.

Emerging markets investments may be less liquid and are subject to greater risk than developed market investments as a result of, but not limited to, the following: inadequate regulations, volatile securities markets, adverse exchange rates, and social, political, military, regulatory, economic or environmental developments, or natural disasters.

Equity investments are subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. Different investment styles (e.g., “growth” and “value”) tend to shift in and out of favor, and, at times, the strategy may underperform other strategies that invest in similar asset classes. The market capitalization of a company may also involve greater risks (e.g. “small” or “mid” cap companies) than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements, in addition to lower liquidity.

Investors should also consider some of the potential risks of alternative investments:

Alternative Strategies. Alternative strategies often engage in leverage and other investment practices that are speculative and involve a high degree of risk. Such practices may increase the volatility of performance and the risk of investment loss, including the entire amount that is invested.

Manager experience. Manager risk includes those that exist within a manager’s organization, investment process or supporting systems and infrastructure. There is also a potential for fund-level risks that arise from the way in which a manager constructs and manages the fund.

Leverage. Leverage increases a fund’s sensitivity to market movements. Funds that use leverage can be expected to be more “volatile” than other funds that do not use leverage. This means if the investments a fund buys decrease in market value, the value of the fund’s shares will decrease by even more.

Counterparty risk. Alternative strategies often make significant use of over- the- counter (OTC) derivatives and therefore are subject to the risk that counterparties will not perform their obligations under such contracts.

Liquidity risk. Alternatives strategies may make investments that are illiquid or that may become less liquid in response to market developments. At times, a fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all.

Valuation risk. There is risk that the values used by alternative strategies to price investments may be different from those used by other investors to price the same investments.

Infrastructure investments are susceptible to various factors that may negatively impact their businesses or operations, including regulatory compliance, rising interest costs in connection with capital construction, governmental constraints that impact publicly funded projects, the effects of general economic conditions, increased competition, commodity costs, energy policies, unfavorable tax laws or accounting policies and high leverage.

Alternative Investments – Hedge funds and other private investment funds (collectively, “Alternative Investments”) are subject to less regulation than other types of pooled investment vehicles such as mutual funds. Alternative Investments may impose significant fees, including incentive fees that are based upon a percentage of the realized and unrealized gains and an individual’s net returns may differ significantly from actual returns. Such fees may offset all or a significant portion of such Alternative Investment’s trading profits. Alternative Investments are not required to provide periodic pricing or valuation information. Investors may have limited rights with respect to their investments, including limited voting rights and participation in the management of such Alternative Investments.

Investments in real estate companies, including REITs or similar structures are subject to volatility and additional risk, including loss in value due to poor management, lowered credit ratings and other factors.

Alternative investments are suitable only for sophisticated investors for whom such investments do not constitute a complete investment program and who fully understand and are willing to assume the risks involved in Alternative Investments. Alternative Investments by their nature, involve a substantial degree of risk, including the risk of total loss of an investor’s capital.

The above are not an exhaustive list of potential risks. There may be additional risks that are not currently foreseen or considered.

Conflicts of Interest

There may be conflicts of interest relating to the Alternative Investment and its service providers, including Goldman Sachs and its affiliates. These activities and interests include potential multiple advisory, transactional and other interests in securities and instruments that may be purchased or sold by the Alternative Investment. These are considerations of which investors should be aware and additional information relating to these conflicts is set forth in the offering materials for the Alternative Investment.

General Disclosures

Diversification does not protect an investor from market risk and does not ensure a profit.

The views expressed herein are as March 28, 2023 and subject to change in the future. Individual portfolio management teams for Goldman Sachs Asset Management may have views and opinions and/or make investment decisions that, in certain instances, may not always be consistent with the views and opinions expressed herein.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by Goldman Sachs Asset Management to buy, sell, or hold any security, they should not be construed as investment advice.

Past performance does not guarantee future results, which may vary. The value of investments and the income derived from investments will fluctuate and can go down as well as up. A loss of principal may occur.

THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION WHERE OR TO ANY PERSON TO WHOM IT WOULD BE UNAUTHORIZED OR UNLAWFUL TO DO SO.

Prospective investors should inform themselves as to any applicable legal requirements and taxation and exchange control regulations in the countries of their citizenship, residence or domicile which might be relevant.

Examples are for illustrative purposes only and are not actual results. If any assumptions used do not prove to be true, results may vary substantially.

There is no guarantee that objectives will be met.

Indices are unmanaged. The figures for the index reflect the reinvestment of all income or dividends, as applicable, but do not reflect the deduction of any fees or expenses which would reduce returns. Investors cannot invest directly in indices.

This information discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. This material has been prepared by Goldman Sachs Asset Management and is not financial research nor a product of Goldman Sachs Global Investment Research (GIR). It was not prepared in compliance with applicable provisions of law designed to promote the independence of financial analysis and is not subject to a prohibition on trading following the distribution of financial research. The views and opinions expressed may differ from those of Goldman Sachs Global Investment Research or other departments or divisions of Goldman Sachs and its affiliates. Investors are urged to consult with their financial advisors before buying or selling any securities. This information may not be current and Goldman Sachs Asset Management has no obligation to provide any updates or changes.

Economic and market forecasts presented herein reflect a series of assumptions and judgments as of the date of this presentation and are subject to change without notice. These forecasts do not take into account the specific investment objectives, restrictions, tax and financial situation or other needs of any specific client. Actual data will vary and may not be reflected here. These forecasts are subject to high levels of uncertainty that may affect actual performance. Accordingly, these forecasts should be viewed as merely representative of a broad range of possible outcomes. These forecasts are estimated, based on assumptions, and are subject to significant revision and may change materially as economic and market conditions change. Goldman Sachs has no obligation to provide updates or changes to these forecasts. Case studies and examples are for illustrative purposes only.

Although certain information has been obtained from sources believed to be reliable, we do not guarantee its accuracy, completeness or fairness. We have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public sources.

References to indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only and do not imply that the portfolio will achieve similar results. The index composition may not reflect the manner in which a portfolio is constructed. While an adviser seeks to design a portfolio which reflects appropriate risk and return features, portfolio characteristics may deviate from those of the benchmark.

The opinions expressed in this white paper are those of the authors, and not necessarily of Goldman Sachs. Any investments or returns discussed in this paper do not represent any Goldman Sachs product. This white paper makes no implied or express recommendations concerning how a client’s account should be managed. This white paper is not intended to be used as a general guide to investing or as a source of any specific investment recommendations.

United Kingdom: In the United Kingdom, this material is a financial promotion and has been approved by Goldman Sachs Asset Management International, which is authorized and regulated in the United Kingdom by the Financial Conduct Authority.

European Economic Area (EEA):This material is a financial promotion disseminated by Goldman Sachs Bank Europe SE, including through its authorised branches (“GSBE”). GSBE is a credit institution incorporated in Germany and, within the Single Supervisory Mechanism established between those Member States of the European Union whose official currency is the Euro, subject to direct prudential supervision by the European Central Bank and in other respects supervised by German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufischt, BaFin) and Deutsche Bundesbank.

Switzerland: For Qualified Investor use only – Not for distribution to general public. This is marketing material. This document is provided to you by Goldman Sachs Bank AG, Zürich. Any future contractual relationships will be entered into with affiliates of Goldman Sachs Bank AG, which are domiciled outside of Switzerland. We would like to remind you that foreign (Non-Swiss) legal and regulatory systems may not provide the same level of protection in relation to client confidentiality and data protection as offered to you by Swiss law.

Asia excluding Japan: Please note that neither Goldman Sachs Asset Management (Hong Kong) Limited (“GSAMHK”) or Goldman Sachs Asset Management (Singapore) Pte. Ltd. (Company Number: 201329851H ) (“GSAMS”) nor any other entities involved in the Goldman Sachs Asset Management business that provide this material and information maintain any licenses, authorizations or registrations in Asia (other than Japan), except that it conducts businesses (subject to applicable local regulations) in and from the following jurisdictions: Hong Kong, Singapore, Malaysia, India and China. This material has been issued for use in or from Hong Kong by Goldman Sachs Asset Management (Hong Kong) Limited, in or from Singapore by Goldman Sachs Asset Management (Singapore) Pte. Ltd. (Company Number: 201329851H) and in or from Malaysia by Goldman Sachs (Malaysia) Sdn Berhad (880767W).

New Zealand: This material is distributed in New Zealand by Goldman Sachs Asset Management Australia Pty Ltd ABN 41 006 099 681, AFSL 228948 (’GSAMA’) and is intended for viewing only by wholesale clients in Australia for the purposes of section 761G of the Corporations Act 2001 (Cth) and to clients who either fall within any or all of the categories of investors set out in section 3(2) or sub-section 5(2CC) of the Securities Act 1978, fall within the definition of a wholesale client for the purposes of the Financial Service Providers (Registration and Dispute Resolution) Act 2008 (FSPA) and the Financial Advisers Act 2008 (FAA),and fall within the definition of a wholesale investor under one of clause 37, clause 38, clause 39 or clause 40 of Schedule 1 of the Financial Markets Conduct Act 2013 (FMCA) of New Zealand (collectively, a “NZ Wholesale Investor”). GSAMA is not a registered financial service provider under the FSPA. GSAMA does not have a place of business in New Zealand. In New Zealand, this document, and any access to it, is intended only for a person who has first satisfied GSAMA that the person is a NZ Wholesale Investor. This document is intended for viewing only by the intended recipient. This document may not be reproduced or distributed to any person in whole or in part without the prior written consent of GSAMA.

Australia: This material is distributed by Goldman Sachs Asset Management Australia Pty Ltd ABN 41 006 099 681, AFSL 228948 (‘GSAMA’) and is intended for viewing only by wholesale clients for the purposes of section 761G of the Corporations Act 2001 (Cth). This document may not be distributed to retail clients in Australia (as that term is defined in the Corporations Act 2001 (Cth)) or to the general public. This document may not be reproduced or distributed to any person without the prior consent of GSAMA. To the extent that this document contains any statement which may be considered to be financial product advice in Australia under the Corporations Act 2001 (Cth), that advice is intended to be given to the intended recipient of this document only, being a wholesale client for the purposes of the Corporations Act 2001 (Cth). Any advice provided in this document is provided by either of the following entities. They are exempt from the requirement to hold an Australian financial services licence under the Corporations Act of Australia and therefore do not hold any Australian Financial Services Licences, and are regulated under their respective laws applicable to their jurisdictions, which differ from Australian laws. Any financial services given to any person by these entities by distributing this document in Australia are provided to such persons pursuant to the respective ASIC Class Orders and ASIC Instrument mentioned below.

- Goldman Sachs Asset Management, LP (GSAMLP), Goldman Sachs & Co. LLC (GSCo), pursuant ASIC Class Order 03/1100; regulated by the US Securities and Exchange Commission under US laws.

- Goldman Sachs Asset Management International (GSAMI), Goldman Sachs International (GSI), pursuant to ASIC Class Order 03/1099; regulated by the Financial Conduct Authority; GSI is also authorized by the Prudential Regulation Authority, and both entities are under UK laws.

- Goldman Sachs Asset Management (Singapore) Pte. Ltd. (GSAMS), pursuant to ASIC Class Order 03/1102; regulated by the Monetary Authority of Singapore under Singaporean laws

- Goldman Sachs Asset Management (Hong Kong) Limited (GSAMHK), pursuant to ASIC Class Order 03/1103 and Goldman Sachs (Asia) LLC (GSALLC), pursuant to ASIC Instrument 04/0250; regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws

No offer to acquire any interest in a fund or a financial product is being made to you in this document. If the interests or financial products do become available in the future, the offer may be arranged by GSAMA in accordance with section 911A(2)(b) of the Corporations Act. GSAMA holds Australian Financial Services Licence No. 228948. Any offer will only be made in circumstances where disclosure is not required under Part 6D.2 of the Corporations Act or a product disclosure statement is not required to be given under Part 7.9 of the Corporations Act (as relevant).

Canada: This presentation has been communicated in Canada by GSAM LP, which is registered as a portfolio manager under securities legislation in all provinces of Canada and as a commodity trading manager under the commodity futures legislation of Ontario and as a derivatives adviser under the derivatives legislation of Quebec. GSAM LP is not registered to provide investment advisory or portfolio management services in respect of exchange-traded futures or options contracts in Manitoba and is not offering to provide such investment advisory or portfolio management services in Manitoba by delivery of this material.

Japan: This material has been issued or approved in Japan for the use of professional investors defined in Article 2 paragraph (31) of the Financial Instruments and Exchange Law by Goldman Sachs Asset Management Co., Ltd.

South Africa: Goldman Sachs Asset Management International is authorised by the Financial Services Board of South Africa as a financial services provider.

Malaysia: This material is issued in or from Malaysia by Goldman Sachs (Malaysia) Sdn Bhd (880767W)

Hong Kong: This material has been issued or approved for use in or from Hong Kong by Goldman Sachs Asset Management (Hong Kong) Limited.

Singapore: This material has been issued or approved for use in or from Singapore by Goldman Sachs Asset Management (Singapore) Pte. Ltd. (Company Number: 201329851H).

Israel: This document has not been, and will not be, registered with or reviewed or approved by the Israel Securities Authority (ISA”). It is not for general circulation in Israel and may not be reproduced or used for any other purpose. Goldman Sachs Asset Management International is not licensed to provide investment advisory or management services in Israel.

Jordan: The document has not been presented to, or approved by, the Jordanian Securities Commission or the Board for Regulating Transactions in Foreign Exchanges.

Colombia: Esta presentación no tiene el propósito o el efecto de iniciar, directa o indirectamente, la adquisición de un producto a prestación de un servicio por parte de Goldman Sachs Asset Management a residentes colombianos. Los productos y/o servicios de Goldman Sachs Asset Management no podrán ser ofrecidos ni promocionados en Colombia o a residentes Colombianos a menos que dicha oferta y promoción se lleve a cabo en cumplimiento del Decreto 2555 de 2010 y las otras reglas y regulaciones aplicables en materia de promoción de productos y/o servicios financieros y /o del mercado de valores en Colombia o a residentes colombianos. Al recibir esta presentación, y en caso que se decida contactar a Goldman Sachs Asset Management, cada destinatario residente en Colombia reconoce y acepta que ha contactado a Goldman Sachs Asset Management por su propia iniciativa y no como resultado de cualquier promoción o publicidad por parte de Goldman Sachs Asset Management o cualquiera de sus agentes o representantes. Los residentes colombianos reconocen que (1) la recepción de esta presentación no constituye una solicitud de los productos y/o servicios de Goldman Sachs Asset Management, y (2) que no están recibiendo ninguna oferta o promoción directa o indirecta de productos y/o servicios financieros y/o del mercado de valores por parte de Goldman Sachs Asset Management.

Esta presentación es estrictamente privada y confidencial, y no podrá ser reproducida o utilizada para cualquier propósito diferente a la evaluación de una inversión potencial en los productos de Goldman Sachs Asset Management o la contratación de sus servicios por parte del destinatario de esta presentación, no podrá ser proporcionada a una persona diferente del destinatario de esta presentación.

Bahrain: This material has not been reviewed by the Central Bank of Bahrain (CBB) and the CBB takes no responsibility for the accuracy of the statements or the information contained herein, or for the performance of the securities or related investment, nor shall the CBB have any liability to any person for damage or loss resulting from reliance on any statement or information contained herein. This material will not be issued, passed to, or made available to the public generally.

Kuwait: This material has not been approved for distribution in the State of Kuwait by the Ministry of Commerce and Industry or the Central Bank of Kuwait or any other relevant Kuwaiti government agency. The distribution of this material is, therefore, restricted in accordance with law no. 31 of 1990 and law no. 7 of 2010, as amended. No private or public offering of securities is being made in the State of Kuwait, and no agreement relating to the sale of any securities will be concluded in the State of Kuwait. No marketing, solicitation or inducement activities are being used to offer or market securities in the State of Kuwait.

Oman: The Capital Market Authority of the Sultanate of Oman (the “CMA”) is not liable for the correctness or adequacy of information provided in this document or for identifying whether or not the services contemplated within this document are appropriate investment for a potential investor. The CMA shall also not be liable for any damage or loss resulting from reliance placed on the document.

Qatar This document has not been, and will not be, registered with or reviewed or approved by the Qatar Financial Markets Authority, the Qatar Financial Centre Regulatory Authority or Qatar Central Bank and may not be publicly distributed. It is not for general circulation in the State of Qatar and may not be reproduced or used for any other purpose.

Saudi Arabia: The Capital Market Authority does not make any representation as to the accuracy or completeness of this document, and expressly disclaims any liability whatsoever for any loss arising from, or incurred in reliance upon, any part of this document. If you do not understand the contents of this document you should consult an authorised financial adviser.

The CMA does not make any representation as to the accuracy or completeness of these materials, and expressly disclaims any liability whatsoever for any loss arising from, or incurred in reliance upon, any part of these materials. If you do not understand the contents of these materials, you should consult an authorised financial adviser.

United Arab Emirates: This document has not been approved by, or filed with the Central Bank of the United Arab Emirates or the Securities and Commodities Authority. If you do not understand the contents of this document, you should consult with a financial advisor.

European Economic Area (EEA): This marketing communication is disseminated by Goldman Sachs Asset Management B.V., including through its branches (“GSAM BV”). GSAM BV is authorised and regulated by the Dutch Authority for the Financial Markets (Autoriteit Financiële Markten, Vijzelgracht 50, 1017 HS Amsterdam, The Netherlands) as an alternative investment fund manager (“AIFM”) as well as a manager of undertakings for collective investment in transferable securities (“UCITS”). Under its licence as an AIFM, the Manager is authorized to provide the investment services of (i) reception and transmission of orders in financial instruments; (ii) portfolio management; and (iii) investment advice. Under its licence as a manager of UCITS, the Manager is authorized to provide the investment services of (i) portfolio management; and (ii) investment advice. Information about investor rights and collective redress mechanisms are available on www.gsam.com/responsible-investing (section Policies & Governance). Capital is at risk. Any claims arising out of or in connection with the terms and conditions of this disclaimer are governed by Dutch law. In Denmark and Sweden this material is a financial promotion disseminated by Goldman Sachs Bank Europe SE, including through its authorised branches (“GSBE”). GSBE is a credit institution incorporated in Germany and, within the Single Supervisory Mechanism established between those Member States of the European Union whose official currency is the Euro, subject to direct prudential supervision by the European Central Bank and in other respects supervised by German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufischt, BaFin) and Deutsche Bundesbank.

Japan: This material has been issued or approved in Japan for the use of professional investors defined in Article 2 paragraph (31) of the Financial Instruments and Exchange Law (“FIEL”). Also, Any description regarding investment strategies on collective investment scheme under Article 2 paragraph (2) item 5 or item 6 of FIEL has been approved only for Qualified Institutional Investors defined in Article 10 of Cabinet Office Ordinance of Definitions under Article 2 of FIEL.

Date of First Use: April 20, 2023. 310270-OTU-1771097

Key Takeaways

- Unpredictable markets and elevated economic uncertainty may call for a more deliberate approach to portfolio construction.

- A stronger tilt toward dynamic active strategies may help deliver alpha on a more consistent basis.

- Allocations that mix traditional public equities and fixed income with hedge funds and private alternatives such as infrastructure, real estate and private credit may boost portfolio performance while hedging some risk through diversification of returns.

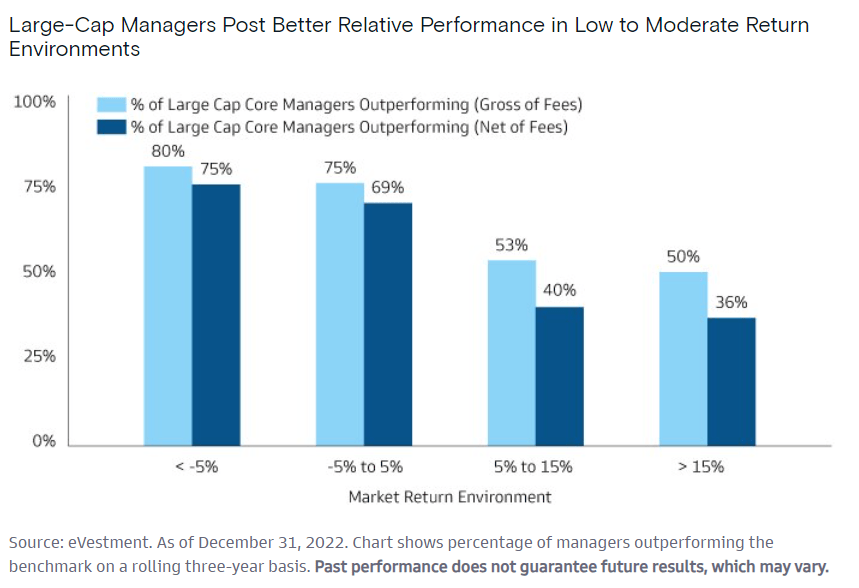

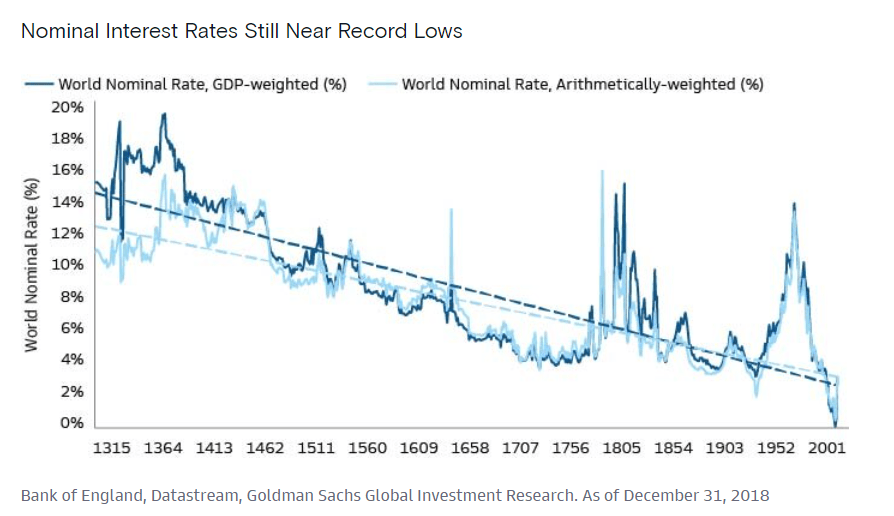

The last decade was generally one of plain sailing for investors. A mix of very low inflation and interest rates following the 2008 Global Financial Crisis (GFC) cut the cost of capital for companies and pushed equity and bond prices sharply and steadily higher. This set off an extended secular bull market during which nearly all financial assets appreciated from low starting valuations. As a whole, active fund managers investing in US large cap equities beat their benchmarks in just two calendar years between 2008 and 2022. In nautical terms, a rising tide of easy monetary conditions and low inflation, coupled with relative geopolitical stability, lifted all boats, no matter whether there was a captain at the helm or not.

In these conditions, passive benchmark-oriented strategies delivered robust returns—often outpacing those delivered by many actively managed strategies. But as Franklin D. Roosevelt once said, “a smooth sea never made a skilled sailor.” Last year’s stormy markets made it clear that what might have appeared to be investor acumen in the years after the GFC was, in many cases, probably just market beta. Indeed, by 2021 passively managed index funds had overtaken active funds’ ownership of the US stock market for the first time.1 This suggests the marginal buyer in most public asset classes was more likely to be an open-ended index fund than a portfolio manager making decisions rooted in research and corporate engagement.

In today’s markets, characterized by higher interest rates and elevated volatility, we believe investors will likely have to be more selective. Profitability and indebtedness will matter more, and tighter financial conditions, increased economic and geopolitical uncertainty and increased return dispersion may offer greater opportunities for managers to generate alpha. We began to see this outperformance in 2022, when 57% of active US large-cap core equity managers outpaced their benchmarks, the highest percentage in over a decade.2 Over a longer period, data suggests more challenging markets characterized by lower total returns tend to correlate with better relative returns for active managers.

We believe building durable investment portfolios in a world of higher volatility, changing correlations and what we consider a new macroeconomic reality requires a stronger tilt toward active strategies with the potential to deliver alpha through nimble portfolio management and original research. The most effective way to do this, in our view, involves an integrated approach that combines traditional public assets such as equities and fixed income with hedge funds and private alternatives. Private real assets, including real estate and infrastructure, have low correlation with public assets, which can provide attractive diversification opportunities. Private equity and credit correlations are largely driven by pricing lags, as these assets are less liquid than their public counterparts. But they have the potential to enhance overall returns, which can complement a portfolio’s beta component. First, though, a closer look at the shortcomings and risks of a passive-only strategy may help illustrate why we believe the time is right for investors to rethink their approach to asset allocation and portfolio construction.

A Closer Look at Benchmarks

Passive investment strategies, in our view, do not put capital to work in the most effective way possible. Most allocate according to size (market capitalization), with the largest amount of capital flowing to securities with the largest weight in an index. That has meant index investors were heavily exposed to a small group of securities in recent years. As of December 2021, the five largest US companies accounted for nearly 25% of the market capitalization of the S&P 500 and 37% of the Russell 2000 Growth—most of them long-duration growth stocks. This may have seemed like a good problem to have during the post-GFC bull market, when these companies were driving market appreciation and investor returns. The situation looked quite different, though, when the market turned in 2022.

Other benchmarks also overweight certain stocks or sectors. The MSCI World Index is heavily skewed toward US stocks in general and technology stocks in particular. Roughly 40% of the small-cap companies in the Russell 2000 Index were unprofitable by the end of 2022, as measured by negative 12-month trailing earnings per share (EPS), up from just 15% in 1995.3 Investors with passive benchmark exposure must own attractive and unattractive stocks. And in smaller, less efficient markets such as small cap and emerging market equities, tracking error can be high. That amounts to unintentional—and uncompensated—risk.

In passive bond benchmarks, issuer weights are often determined by market value of outstanding debt rather than fundamentals, and index inclusion does not include considerations such as bond liquidity or transaction costs. But this weighting schema also means that the benchmarks are tilted towards the sectors and companies with the most debt. In addition, they tend to be backward-looking: index composition is based on credit ratings that are revised after, rather than before, a change in fundamentals.

It’s also important to understand that passive investing isn’t as passive as one may think. Benchmarks are built by investment committees that make decisions based on a specific methodology. The S&P 500 is not the index of the biggest 500 companies in the United States. It comprises 500 companies that meet certain qualifications set by the committee. Consider that it took years for the S&P to add Tesla to the index because the company was unprofitable. During this time, it was among the top performing US stocks. Since being added in late 2020, Tesla stock has lost value.4

Dispersion

In an actively managed portfolio, a manager makes decisions about which securities to purchase and attempts to add value through fundamental analysis of those securities and, at times, buying those that she deems undervalued or short selling those that appear overvalued. This is important, because we believe that successful investing is heavily rooted in investor skill. Applying that skill requires opportunity, and opportunity grows when markets are volatile and returns varied. If we were writing a mathematical equation to express this interconnected relationship, it might be done like so: alpha = manager skill * dispersion.

In the last cycle, a wave of liquidity and a decline in borrowing costs boosted most asset prices, limiting performance dispersion. Over the last year, return dispersion across strategies and asset classes has increased sharply. The current pace of interest rate increases and broader financial tightening will eventually slow. But it is difficult to overstate how historically low interest rates and bond yields have been over past decades. We believe it is unlikely that they will retreat to those levels any time soon. Going forward, we expect conditions to become more micro-driven, focused on how companies adapt to the post-pandemic realities of higher inflation, higher rates and emerging secular trends, including deglobalization, decarbonization and demographics.

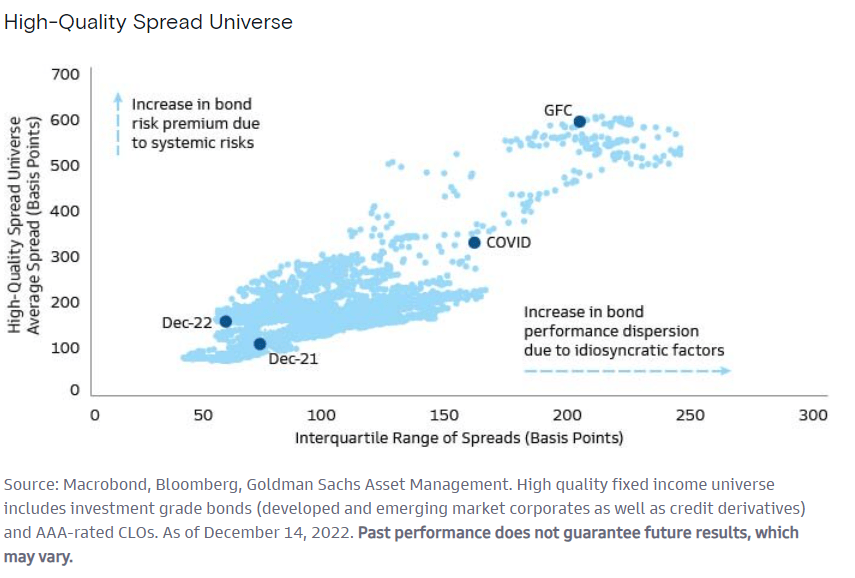

Instead, a market environment of increased idiosyncratic risk and a higher corresponding dispersion of returns seems likely to persist. The chart showing the High-Quality Spread Universe illustrates how this applies to high-quality fixed income spread sectors including investment grade corporate credit and AAA-rated securitized sectors. As illustrated by the bottom left corner of the chart, ample liquidity and record low interest rates in the last cycle lifted all assets with limited performance dispersion. For instance, corporate bonds in a given sector generally performed in line with each other despite differences in balance sheet positions. We expect that to change in a higher-for-longer rate and inflation environment, and that will provide opportunities to generate alpha through active security selection. An investor with detailed knowledge of a company’s ability to afford higher borrowing costs will be more valuable in today’s environment to add alpha—and avoid losses—than in the post-GFC era when low rates obscured the differences in corporate finances.

The possibility of greater intra-sector dispersion also suggests the potential for wider dispersion in specific company returns. This creates more opportunity for managers to generate alpha based on other key factors such as cost of capital and profitability. The end of the record low-rate, low-inflation era suggests that company-specific—or micro—factors may have greater influence on individual stock returns in the years ahead. The 2022 surge in interest rates may have delayed the onset of a more micro-driven market. But as investors adjusted to a higher-rate environment and resilient US economic data pointed to reduced recession risk, the share of S&P 500 stock returns explained by micro factors has increased, driven by high single-stock volatility and low stock correlation.5 We expect dispersion to increase in this environment, making security-specific factors more important.

21st Century Risks

Climate change and the transition to a low-carbon economy and other environmental, social and governance (ESG) factors are widely recognized as investment considerations. In our view, active managers are better equipped to analyze and verify corporate sustainability practices because they can directly engage with company management. Green bonds have made fixed income a particularly important source of financing for the technologies and policies that can help the shift to cleaner energy sources and other projects with the potential for positive environmental impact. An active manager who engages regularly with bond issuers to understand their sustainability strategies can more readily identify ESG leaders and laggards and develop a better sense of their commitment to ESG.

The Role of Private Assets

Private markets might best be characterized as the realm of “deep active.” Managers do not manage to a specific benchmark. Benchmarks reflect aggregate performance of managers, rather than something to track. But adding private market investments to an allocation that also includes public assets can provide greater diversification. Private ownership structures and deal terms typically give investors the ability to have more influence over company operations. These markets can also provide the opportunity to invest in assets that are best positioned to adapt to key long-term structural trends, including a partial pullback from globalization and a shift toward green energy. We see potential opportunities to capitalize on these and other trends in corporate and real assets and across the capital stack, from debt to equity.

Private investments require more patience than public ones, as well as the ability to sacrifice near-term liquidity for longer-term gains. But we believe they are also likely to offer higher excess return per unit of risk relative to beta-driven investment options.

Portfolio Construction: The Best of Both Worlds

A public-private mix may give investors—whether pension funds, insurance companies or individuals—a stronger chance of increasing alpha potential. The optimal mix of assets will vary from investor to investor. What may be appropriate for an endowment or insurance company may be different than what makes sense for an individual investor. The right place to land for some investors may be a combination of active and passive strategies. Such a hybrid asset allocation can allow investors to optimize their potential performance depending on variables such as risk tolerance, fear of underperforming and controlling costs. In an active-passive mix, investors may want to consider concentrating active exposure in the least efficient markets (e.g., emerging-market equities, which include a high concentration of state-owned enterprises, small-cap equities, emerging-market and high-yield credit, real assets) and taking a more passive approach in larger, more efficient markets such as large-cap equities.

Another option might be to concentrate the passive portion of an allocation in passive strategies rooted in a more rules-based methodology. For example, a rules-based fixed income strategy would seek to define a liquid investable universe, which is then refined by fundamentals and rebalanced periodically. We believe this can result in a smarter passive strategy with improved risk-adjusted return potential over a market cycle. On the active side, it’s important that investors consider where it makes the most sense to pay for alpha. For example, private market funds and hedge funds come with higher fees, but we believe they offer more potential to generate alpha.

However, in a world where economic conditions may change more rapidly than in decades gone by, investors should be ready to revise their approach to portfolio construction. Passive exposure, for example, might be concentrated in a “main” market portfolio that benefits during market upswings and helps to control costs, while active exposure might act as an adjustable hedge against risk. This could involve a public active portfolio that provides short-term, dynamic hedges and a private market portfolio that supplies a longer-term hedge against structural changes. Such a structure may make portfolios more resilient as conditions and risks change—something that we expect to happen more frequently in an era of elevated inflation, increased geopolitical risk and accelerated secular transitions.

For active managers, volatility and uncertainty can be an opportunity. We believe having the ability to take advantage of that in a diversified portfolio can make a significant difference to total return, particularly in a less predictable investing environment.

Important information

1Investment Company Institute data. As of December 31, 2021.

2Factset, Goldman Sachs Global Investment Research, as of February 17, 2023. Past performance does not guarantee future results, which may vary.

3Goldman Sachs Global Investment Research. As of March 14, 2023

4Refinitiv. As of March 30, 2023

5Goldman Sachs Investment Research. As of January 10, 2023.

Glossary

Alpha is excess returns versus a benchmark index.

Beta refers to the tendency of a security’s returns to respond to swings in the markets.

Collateralized loan obligation (CLO) is a single security backed by multiple loans.

Correlation is a measure of the amount to which two investments vary relative to each other. Past correlations are not indicative of future correlations, which may vary.

Duration is a measure of the sensitivity of the price of a fixed income investment to a change in interest rates. The longer the duration the greater the sensitivity to changes in interest rates.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. Earnings per share serves as an indicator of a company’s profitability.

Greenwashing is the practice of making overstated or misleading claims about the environmental ambition of a project, asset, or activity.

Gross Domestic Product (GDP) is the value of finished goods and services produced within a country’s borders over one year.

Volatility is a measure for variation of price of a financial instrument over time.

MSCI World Index is a free-float weighted equity index that includes developed world markets and does not include emerging markets.

Russell 2000 Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000 Index is a subset of the Russell 3000 Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

Risk Considerations

All investing involves risk, including loss of principal.

Alternative Investments often engage in leverage and other investment practices that are extremely speculative and involve a high degree of risk. Such practices may increase the volatility of performance and the risk of investment loss, including the loss of the entire amount that is invested. There may be conflicts of interest relating to the Alternative Investment and its service providers, including Goldman Sachs and its affiliates. Similarly, interests in an Alternative Investment are highly illiquid and generally are not transferable without the consent of the sponsor, and applicable securities and tax laws will limit transfers.

High-yield, lower-rated securities involve greater price volatility and present greater credit risks than higher-rated fixed income securities.

Emerging markets investments may be less liquid and are subject to greater risk than developed market investments as a result of, but not limited to, the following: inadequate regulations, volatile securities markets, adverse exchange rates, and social, political, military, regulatory, economic or environmental developments, or natural disasters.

Equity investments are subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. Different investment styles (e.g., “growth” and “value”) tend to shift in and out of favor, and, at times, the strategy may underperform other strategies that invest in similar asset classes. The market capitalization of a company may also involve greater risks (e.g. “small” or “mid” cap companies) than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements, in addition to lower liquidity.

Investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity, interest rate, prepayment and extension risk. Bond prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline in the bond’s price. The value of securities with variable and floating interest rates are generally less sensitive to interest rate changes than securities with fixed interest rates. Variable and floating rate securities may decline in value if interest rates do not move as expected. Conversely, variable and floating rate securities will not generally rise in value if market interest rates decline. Credit risk is the risk that an issuer will default on payments of interest and principal. Credit risk is higher when investing in high yield bonds, also known as junk bonds. Prepayment risk is the risk that the issuer of a security may pay off principal more quickly than originally anticipated. Extension risk is the risk that the issuer of a security may pay off principal more slowly than originally anticipated. All fixed income investments may be worth less than their original cost upon redemption or maturity.

Private investors should also consider some of the potential risks of alternative investments:

Alternative Strategies. Alternative strategies often engage in leverage and other investment practices that are speculative and involve a high degree of risk. Such practices may increase the volatility of performance and the risk of investment loss, including the entire amount that is invested.

Manager experience. Manager risk includes those that exist within a manager’s organization, investment process or supporting systems and infrastructure. There is also a potential for fund-level risks that arise from the way in which a manager constructs and manages the fund.

Leverage. Leverage increases a fund’s sensitivity to market movements. Funds that use leverage can be expected to be more “volatile” than other funds that do not use leverage. This means if the investments a fund buys decrease in market value, the value of the fund’s shares will decrease by even more.

Counterparty risk. Alternative strategies often make significant use of over- the- counter (OTC) derivatives and therefore are subject to the risk that counterparties will not perform their obligations under such contracts.

Liquidity risk. Alternatives strategies may make investments that are illiquid or that may become less liquid in response to market developments. At times, a fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all.

Valuation risk. There is risk that the values used by alternative strategies to price investments may be different from those used by other investors to price the same investments.

Alternative Investments – Hedge funds and other private investment funds (collectively, “Alternative Investments”) are subject to less regulation than other types of pooled investment vehicles such as mutual funds. Alternative Investments may impose significant fees, including incentive fees that are based upon a percentage of the realized and unrealized gains and an individual’s net returns may differ significantly from actual returns. Such fees may offset all or a significant portion of such Alternative Investment’s trading profits. Alternative Investments are not required to provide periodic pricing or valuation information. Investors may have limited rights with respect to their investments, including limited voting rights and participation in the management of such Alternative Investments.

Investments in real estate companies, including REITs or similar structures are subject to volatility and additional risk, including loss in value due to poor management, lowered credit ratings and other factors.

Collateralized loan obligations (“CLOs”) involve many of the risks associated with debt securities, including interest rate risk, credit risk, default risk, and liquidity risk. The risks of an investment in a CLO also depend largely on the quality and type of the collateral and the class or “tranche” of the CLO. There is the possibility that the strategy may invest in CLOs that are subordinate to other classes. CLOs also can be difficult to value and may be highly leveraged (which could make them highly volatile). The use of CLOs may result in losses.

Environmental, Social and Governance (“ESG”) strategies may take risks or eliminate exposures found in other strategies or broad market benchmarks that may cause performance to diverge from the performance of these other strategies or market benchmarks. ESG strategies will be subject to the risks associated with their underlying investments’ asset classes. Further, the demand within certain markets or sectors that an ESG strategy targets may not develop as forecasted or may develop more slowly than anticipated.

Infrastructure investments are susceptible to various factors that may negatively impact their businesses or operations, including regulatory compliance, rising interest costs in connection with capital construction, governmental constraints that impact publicly funded projects, the effects of general economic conditions, increased competition, commodity costs, energy policies, unfavorable tax laws or accounting policies and high leverage.

The above are not an exhaustive list of potential risks. There may be additional risks that are not currently foreseen or considered.

Index Benchmarks

Indices are unmanaged. The figures for the index reflect the reinvestment of all income or dividends, as applicable, but do not reflect the deduction of any fees or expenses which would reduce returns. Investors cannot invest directly in indices.

The indices referenced herein have been selected because they are well known, easily recognized by investors, and reflect those indices that the Investment Manager believes, in part based on industry practice, provide a suitable benchmark against which to evaluate the investment or broader market described herein. The exclusion of “failed” or closed hedge funds may mean that each index overstates the performance of hedge funds generally.

Conflicts of Interest

There may be conflicts of interest relating to the Alternative Investment and its service providers, including Goldman Sachs and its affiliates. These activities and interests include potential multiple advisory, transactional and other interests in securities and instruments that may be purchased or sold by the Alternative Investment. These are considerations of which investors should be aware and additional information relating to these conflicts is set forth in the offering materials for the Alternative Investment.

General Disclosures

Diversification does not protect an investor from market risk and does not ensure a profit.

The views expressed herein are as March 28, 2023 and subject to change in the future. Individual portfolio management teams for Goldman Sachs Asset Management may have views and opinions and/or make investment decisions that, in certain instances, may not always be consistent with the views and opinions expressed herein.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by Goldman Sachs Asset Management to buy, sell, or hold any security, they should not be construed as investment advice.

Past performance does not guarantee future results, which may vary. The value of investments and the income derived from investments will fluctuate and can go down as well as up. A loss of principal may occur.

THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION WHERE OR TO ANY PERSON TO WHOM IT WOULD BE UNAUTHORIZED OR UNLAWFUL TO DO SO.

Prospective investors should inform themselves as to any applicable legal requirements and taxation and exchange control regulations in the countries of their citizenship, residence or domicile which might be relevant.

There is no guarantee that objectives will be met.

Indices are unmanaged. The figures for the index reflect the reinvestment of all income or dividends, as applicable, but do not reflect the deduction of any fees or expenses which would reduce returns. Investors cannot invest directly in indices.

This information discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. This material has been prepared by Goldman Sachs Asset Management and is not financial research nor a product of Goldman Sachs Global Investment Research (GIR). It was not prepared in compliance with applicable provisions of law designed to promote the independence of financial analysis and is not subject to a prohibition on trading following the distribution of financial research. The views and opinions expressed may differ from those of Goldman Sachs Global Investment Research or other departments or divisions of Goldman Sachs and its affiliates. Investors are urged to consult with their financial advisors before buying or selling any securities. This information may not be current and Goldman Sachs Asset Management has no obligation to provide any updates or changes.

Economic and market forecasts presented herein reflect a series of assumptions and judgments as of the date of this presentation and are subject to change without notice. These forecasts do not take into account the specific investment objectives, restrictions, tax and financial situation or other needs of any specific client. Actual data will vary and may not be reflected here. These forecasts are subject to high levels of uncertainty that may affect actual performance. Accordingly, these forecasts should be viewed as merely representative of a broad range of possible outcomes. These forecasts are estimated, based on assumptions, and are subject to significant revision and may change materially as economic and market conditions change. Goldman Sachs has no obligation to provide updates or changes to these forecasts. Case studies and examples are for illustrative purposes only.

Although certain information has been obtained from sources believed to be reliable, we do not guarantee its accuracy, completeness or fairness. We have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public sources.

Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or its securities. Nothing in this document should be construed to constitute allocation advice or recommendations.

References to indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only and do not imply that the portfolio will achieve similar results. The index composition may not reflect the manner in which a portfolio is constructed. While an adviser seeks to design a portfolio which reflects appropriate risk and return features, portfolio characteristics may deviate from those of the benchmark.

The opinions expressed in this white paper are those of the authors, and not necessarily of Goldman Sachs. Any investments or returns discussed in this paper do not represent any Goldman Sachs product. This white paper makes no implied or express recommendations concerning how a client’s account should be managed. This white paper is not intended to be used as a general guide to investing or as a source of any specific investment recommendations.

United Kingdom: In the United Kingdom, this material is a financial promotion and has been approved by Goldman Sachs Asset Management International, which is authorized and regulated in the United Kingdom by the Financial Conduct Authority.

European Economic Area (EEA):This material is a financial promotion disseminated by Goldman Sachs Bank Europe SE, including through its authorised branches (“GSBE”). GSBE is a credit institution incorporated in Germany and, within the Single Supervisory Mechanism established between those Member States of the European Union whose official currency is the Euro, subject to direct prudential supervision by the European Central Bank and in other respects supervised by German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufischt, BaFin) and Deutsche Bundesbank.