APG is considering licensing its new bespoke ESG real estate index to the broader industry, with CRREM compliance a driving factor of broadening its availability.

APG launched a new cost-effective ESG-focused real estate index strategy for pension funds last month and APG head of global real estate investment strategy Rutger van der Lubbe says following the launch the organisation has received many inbound requests about licencing the index.

“This was not originally in our scope but we are contemplating it,” he says.

The index was developed in conjunction with STOXX and includes data from providers including RepRisk, Sustainalytics and CRREM (Carbon Risk Real Estate Monitor).

Van der Lubbe says one of the benefits of licencing would be to increase recognition across the broader industry that CRREM compliance is important, driving compliance and ultimately improving energy use in the property industry.

APG has been involved in other innovative ideas that have been made available to the broader industry, including the SDI initiative, which was an asset owner collaboration with PGGM, BCI and AustralianSuper.

The real estate index strategy built by APG combines data providers and the fund’s own unique proprietary views.

“We wanted to leverage various data providers for the best fit for what we want to achieve,” van der Lubbe says.

“We created our own index with those filters as we believe what clients are after is not available in the public domain at this point in time. We are not aware of an index solution that looks at the criteria like we do, to really embed responsible investment criteria for a passive strategy. We aim to deliver something standout from the market perspective and our own RI leadership.”

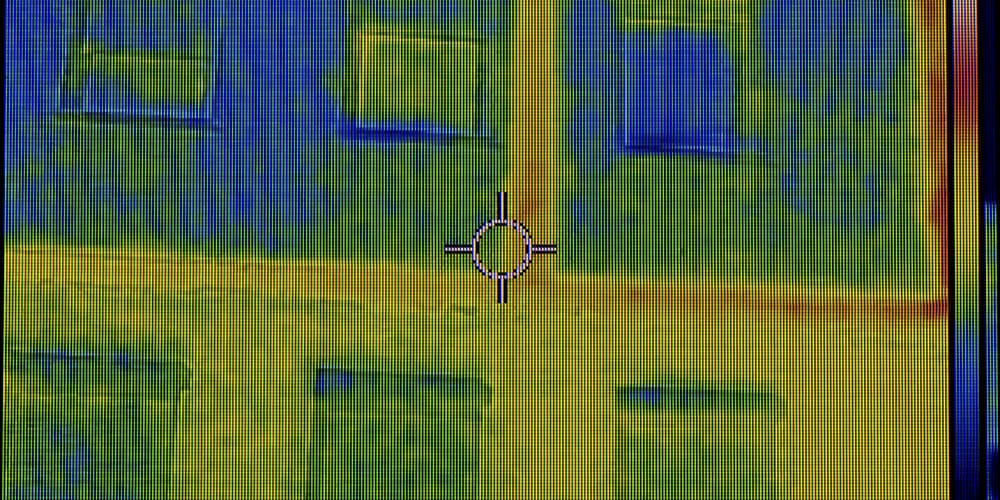

The strategy is built on a proprietary process that filters via APG’s exclusion policy, inclusion policy, solid reputation, good governance and CRREM, with van der Lubbe emphasising the CRREM compliance as a unique element.

“It prescribes carbon transition pathways and energy pathways,” van der Lubbe says, adding the guidelines for energy emission and consumption for buildings applies to the present and the years up to 2050.

In its strategy APG reweights securities so it is factor-neutral on a currency, regional and sector basis, to avoid individual tilts that could arise from the five criteria.

The index also uniquely includes APG’s bespoke inclusion policy and whether specific assets meet transition pathways.

APG has about €55 billion ($57 billion) in global real estate assets, the majority of that is actively managed for ABP.

The bulk of the real estate assets are in a globally integrated investment strategy that invests in both public and private assets.

“It is a function of what is out there,” van der Lubbe says.

“The US has a very well developed public real estate market so we have greater share of public there, in Europe it is orientated towards private exposures, in APAC more balanced.

“We are known for an active approach so look for a typical share of control to drive the strategy of the entities we invest and to drive ESG matters.”

This new index strategy will be aimed at smaller clients and is the equivalent to the equities index strategy launched in 2021.

There is consideration of further initiatives to be launched in other asset classes in the future.

“We hope it will drive the industry towards further carbon reduction,” van der Lubbe says.