Investors need to ensure they are accessing the new economy if they are to benefit from the growth story that drives emerging markets returns. Investors at the Fiduciary Investors Symposium talk about how they allocate to emerging markets.

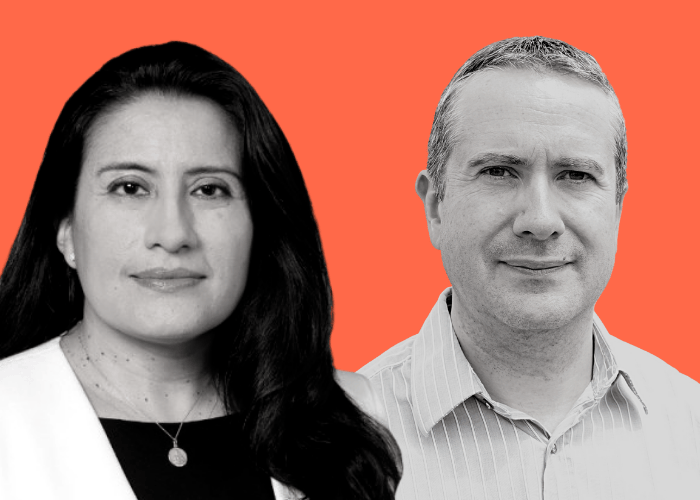

Just under half of the companies in emerging market indexes are low growth old companies that typically miss out on the key growth trends that have been unleashed by digitisation and the smart phone according to Sara Moreno, managing director at US investment manager Jennison.

Moreno explained that the digital transformation at ground level in emerging markets is driving opportunities. It is also behind financial inclusion across populations excluded by the traditional banking sector. She said China led the revolution, using e-commerce to increase inclusion and allowing companies to market directly to consumersMark Walker, chief investment officer at Coal Pension Trustees, a £21 billion pension fund for employees in the United Kingdom’s former coal sector, said his focus is on trying to avoid distinctions between emerging and developed markets.

Walker views allocations through a regional lens and has a growing allocation to Asia where he described China as the driver.

“We are less focused on market cap and more focused on our split between regions,” he explained. “If you only look at equity market cap as a signpost to future growth opportunities, you are likely to be disappointed.”

The pension fund’s investment in China began in the private equity and venture space with 10 per cent of the fund’s private equity allocation now allocated to China. The portfolio has also shifted away from accessing China via Hong Kong since establishing an A Shares portfolio in 2019. The challenge is ESG integration, explained Walker.

“If you look at the data, carbon emission intensity in emerging markets comes particularly from China; China is bigger than other markets.”

Regarding ESG, Jennison’s Moreno advised not painting China with one brush since underneath there are many companies integrating ESG.

Healthcare

One of the most important secular growth trends in China is in healthcare, where the aging population is also wealthier with money to spend. Moreno said that the pharmaceutical industry is being led by innovation and Chinese talent in the sector is increasingly returning from abroad. Lots of scientists are graduating out of China too, she said.

Areas of focus include developing drugs to fight cancer where China has particularly high levels of the disease, and telemedicine. She noted a cross pollination between Chinese healthcare companies and multinationals too.

Coal Pension Trustees, which counts its two biggest exposures in China to healthcare and technology sectors, said geopolitical tensions also pose a risk.

“The last thing we want is to put our money in and not be able to get it out, ” said Walker, noting a recent spike in risk from authorities questioning sending money outside China during a recent Chinese private equity fund distribution.

“You have to think what might change from a political policy perspective,” he said describing the biggest risk as permanent loss of capital.

“We can’t know the minds of politicians” he said, so his focus is on individual investments at a micro level.

Elsewhere in emerging markets investors see exciting opportunities in India despite the impact of COVID.

“The market is very forward looking; although emerging economies lag the recovery growth will accelerate,” predicted Moreno.

In India, strategy is also focused on bottom-up stock picking and she noted India’s high level of savings, good demographics plus a reform agenda and interesting infrastructure cycle all offering opportunities.

“India has taken a step back, but longer term the fundamentals haven’t altered,” she said.

Walker said investment opportunities in emerging markets depended on – and highlighted the importance of – a global vaccination program.

“There has to be a global solution; we need to work on getting everyone vaccinated,” he said.

In another observation, Moreno said that emerging economies are no longer export led.

“For sure, Chinese growth has fuelled commodity, export-led demand in many emerging economies but now emerging markets need to focus on local growth.”

Here she said, some economies are more successful than others.

“It involves leveraging their demographic and education systems to digitise at a faster pace.”