Will the COVID-19 crisis mean we will be trapped in the lower for longer regime or are we on the road to a rate change? This session examined the proposition that we are in a “lower for longer” environment, explored whether a reflationary environment will prevail, and debated if growth is around the corner. The session also highlighted what these potential scenarios might mean for investors and identify opportunities from an investment perspective.

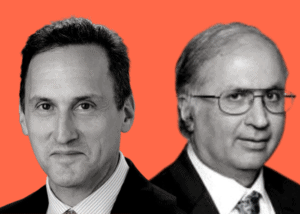

Robert Tipp, CFA, is a managing director, chief investment strategist, and head of global bonds for PGIM Fixed Income. In addition to co-managing the global multi-sector strategies, Tipp is responsible for global rates positioning for core plus, absolute return, and other portfolios. He has worked at the firm since 1991, where he has held a variety of senior investment manager and strategist roles. Prior to joining the firm, he was a director in the portfolio strategies group at the First Boston Corporation, where he developed, marketed, and implemented strategic portfolio products for money managers. Before that, he was a senior staff analyst at the Allstate Research & Planning Center, and managed fixed income and equity derivative strategies at Wells Fargo Investment Advisors. He received a BS in Business Administration and an MBA from the University of California, Berkeley and holds the Chartered Financial Analyst (CFA) designation.

Dr. Sushil Wadhwani, CBE, is the chief investment officer for QMAW, originally founded as Wadhwani Asset Management in October 2002. Prior to joining QMA, he served as the founder and chief executive of Wadhwani Asset Management. Previously, he was a member of the monetary policy committee at the Bank of England. He also served as the director of quantitative systems at Tudor Investment Corporation, director of equity strategy at Goldman Sachs, and as an academic economist at the London School of Economics. He is an emeritus governor at the London School of Economics and a Commander of the Order of the British Empire. He earned a BSc, MSc and PhD from the London School of Economics and Political Science.

White is responsible for the content across all Conexus Financial’s institutional media and events. She is responsible for directing the bi-annual Fiduciary Investors Symposium which challenges global investors on investment best practice and aims to place the responsibilities of investors in wider societal, and political contexts, as well as promote the long-term stability of markets and sustainable retirement incomes. She is the editor of conexust1f.flywheelstaging.com, the online news and analysis site for the world’s largest institutional investors. White has been an investment journalist for more than 20 years and has edited industry journals including Investment & Technology, Investor Weekly and MasterFunds Quarterly. She was previously editorial director of InvestorInfo and has worked as a freelance journalist for the Australian Financial Review, CFO, Asset and Asia Asset Management. She has a Bachelor of Economics from Sydney University and a Master of Arts in Journalism from the University of Technology, Sydney. She was previously a columnist for the Canadian publication, Corporate Knights, which is distributed by the Globe and Mail and The Washington Post. White is currently a fellow in the Finance Leaders Fellowship at the Aspen Institute. The two-year program consists of 22 fellows and seeks to develop the next generation of responsible, community-spirited leaders in the global finance industry.

Key takeaways

- Inflation has become the number one investor worry according to a poll of delegates at FIS Digital 2021 with 51 per cent of respondents naming rising prices above any other risk.

- But it might not be long-term. Country by country and demographic drivers are disinflationary, and today’s robust economic activity will tail off and economies will turn as sluggish as 2019.

- Other panellists argued inflation could remain uncomfortably high. Even transient factors can take a while to unwind – particularly a labour shortage.

- The longer inflation stays high, and the less pre-emptive central banks are in trying to curb it, the greater the risk.

- Investors face challenges keeping to strategic asset allocations and navigating the impact of lost diversification between stocks and bonds.

- One popular strategy comes via increased allocations to commodities where low inventories has left many commodity markets in backwardation. But looking ahead factors like China prioritising financial stability over growth could quickly change the picture. Moreover, if central banks turn hawkish, it bodes badly for industrial metals.

- Elsewhere commentators said taxes will rise and this means deflationary forces could hold back the demand side. Systemic forces will also drive down inflation – taming inflation won’t just be the responsibility of central banks.

- Many pension funds’ portfolios are not designed for unanchored inflation. Insurance assets like inflation-linked bonds or commodities are good in the short-term but don’t fit easily in a long-term portfolio.

- Central bank credibility has provided an extraordinary backdrop to investment decisions – and any sense that discipline might be eroding could end badly for the portfolio.

Poll results

What do you consider to be the biggest risk facing your portfolio right now?