A fireside chat with the founder of one of the most successful investment management firms in the world on how capitalism is broken, and importantly how it can be fixed.

Ray Dalio is founder, co-chair and co-chief investment officer of Bridgewater Associates. He started Bridgewater out of his two-bedroom apartment in New York in 1975 and under his leadership, the firm has grown into the fifth most important private company in the US according to Fortune Magazine.

For his and Bridgewater's industry-changing innovations as well as his work advising policymakers around the world, Dalio has been called the “Steve Jobs of Investing” by aiCIO Magazine and Wired Magazine, and named one of the 100 Most Influential People by TIME Magazine.

He is also the author of The New York Times #1 Bestseller Principles, which outlines his work and life principles, the foundation of Bridgewater’s distinctive culture and the cornerstone of his and Bridgewater’s success. Dalio and Bridgewater also recently published Principles for Navigating Big Debt Crises, the first public dissemination of their research on these economic events, which enabled them to anticipate the 2008 Financial Crisis. He is currently working on his third book, which will outline his investment principles.

Dalio holds a Bachelor of Science degree in Finance from C.W. Post College and an MBA degree from Harvard Business School. He has been married to his wife, Barbara, for over 40 years and has four grown sons. He is an avid philanthropist with a special interest in ocean exploration and conservation.

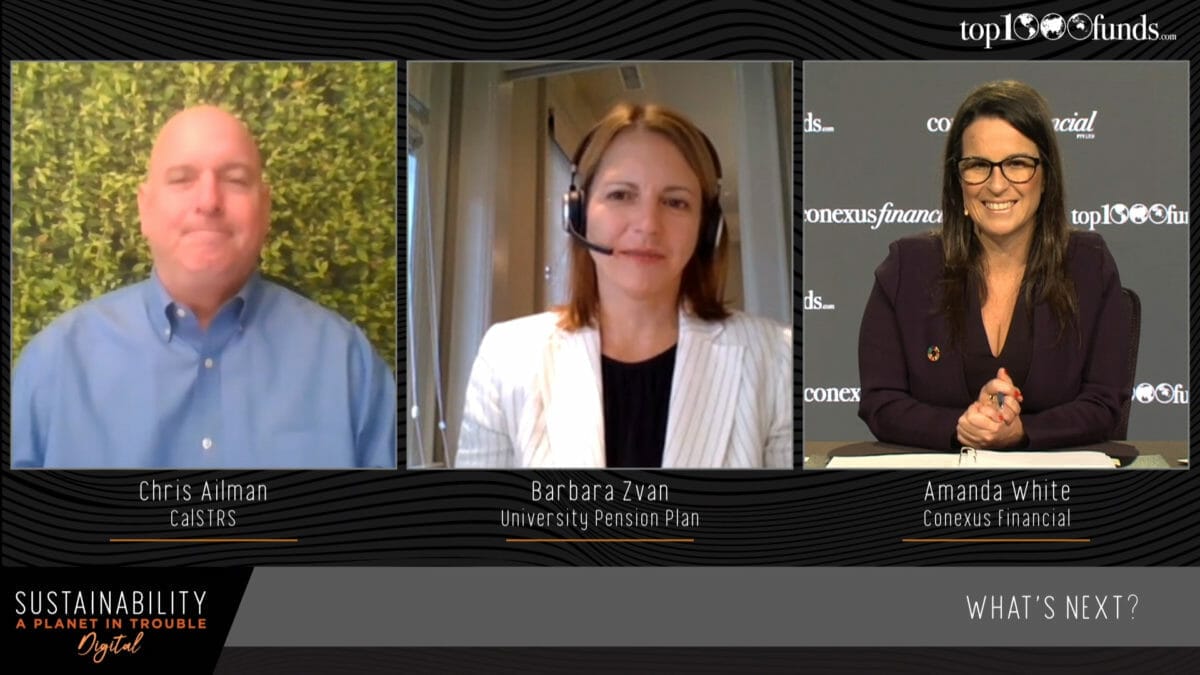

Tate has been an investment industry media publisher and conference producer since 1996. In his media career, Tate has launched and overseen dozens of print and

electronic publications. He is the chief executive and major shareholder of Conexus Financial, which was formed in 2005, and is headquartered in Sydney, Australia.

The company stages more than 20 conferences and events each year –

in cities which have included London, New York, San Francisco, Los Angeles, Amsterdam, Beijing, Sydney and Melbourne – and publishes three media brands,

including the global website and strategy newsletter for global

institutional investors conexust1f.flywheelstaging.com. One of the company’s signature events is the bi-annual Fiduciary Investors Symposium. Conexus Financial’s

events aim to place the responsibilities of investors in wider societal, and political contexts, as well as promote the long-term stability of markets and sustainable

retirement incomes. Tate served for seven years on the board of Australia’s most high profile homeless charity, The Wayside Chapel; and he has underwritten the

welfare of 60,000 people in 28 villages throughout Uganda via The Hunger Project.

Key takeaways

- ‘I think sustainability is the most important word of the 21st It’s the most important force.’

- For a society to be great, you need to increase productivity and then divide it well. COVID has made productivity difficult but it has also highlighted inequalities. For example, the top 40 per cent of the US population spends 5 times more on the education of their children than the bottom 60 per cent. This mismatch creates a fundamental inequality and unfairness. The US economic mechanism is not meeting its goals of fairness or equality. Inequality is not just unfair its damaging. Populism, for example, has arisen because of unfairness.

- The problems of civility, poverty and guns are American problems. I’m a mechanic. I don’t approach this moralistically. I want us to consider what we want to be as a nation and how we engineer for it.

- The system that we need is a bipartisan system, otherwise we will constantly be at one another’s throats battling over contradictory positions. We need to produce win-win outcomes, not lose-lose outcomes, to avoid social and political conflict. We need leaders to create harmony so we can work together to generate efficiencies.

- I am a realist. The curse of every generation is to not acknowledge the lessons from prior generations.

- The children of today will need skills to navigate the risks, uncertainties and opportunities of the future world.

- Regardless of who wins the US election, there will be significant stimulus.

- Impact investment is easier to measure than philanthropy, but it is still difficult.

- Oceans are the greatest asset in the world.

- Three issues currently exist that last occurred in the turbulent 1930s period:

- Extreme debt levels

- The values and political gap

- A rising power (China) challenging a historical power (USA)