Investors are increasingly seeking to design portfolios that achieve financial goals (return & risk) and have environmental and social impact. This session will look at how to assess the effect of ESG issues on macro economies and markets and how to engineer a scalable strategic asset allocation that delivers consistent financial performance and is aligned to the UN Sustainable Development Goals.

Karen Karniol-Tambour is the Head of Investment Research at Bridgewater Associates, the world’s largest hedge fund with $160 billion in institutional investments. In this capacity, she oversees a team of over 150 investment professionals researching and building systematic strategies to trade global financial markets. Karen oversees Bridgewater’s systemized investment logic for trading fixed income, with a secondary responsibility for equities, and is a regular author of Bridgewater’s Daily Observations. She meets regularly with investors and policymakers, and represented Bridgewater at the World Economic Forum in Davos in 2017 and 2018.

Karen graduated from Princeton University’s Woodrow Wilson School, where she studied under Nobel Laureate Daniel Kahneman and was awarded the Gale F. Johnson Prize in Public Affairs. Born and raised in Israel, Karen has worked with nonprofit Seeds of Peace since she was a teenager and serves as member of its Global Leadership Council. Committed to enhancing women’s leadership in finance, Karen is an active angel investor focusing on technology startups led by women. She is a Council on Foreign Relations Corporate Leader and was included in Business Insider’s Rising Stars Under 35 in Asset Management

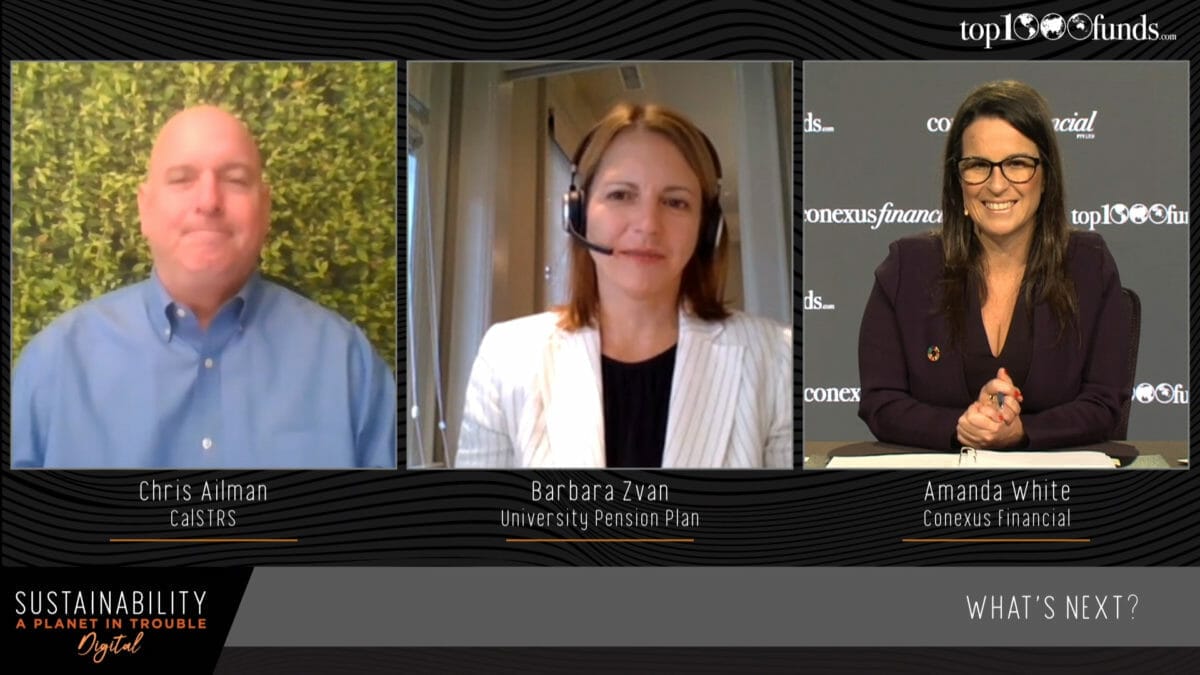

White is responsible for the content across all Conexus Financial’s institutional media and events. She is responsible for directing the bi-annual Fiduciary Investors Symposium which challenges global investors on investment best practice and aims to place the responsibilities of investors in wider societal, and political contexts, as well as promote the long-term stability of markets and sustainable retirement incomes. She is the editor of conexust1f.flywheelstaging.com, the online news and analysis site for the world’s largest institutional investors. White has been an investment journalist for more than 20 years and has edited industry journals including Investment & Technology, Investor Weekly and MasterFunds Quarterly. She was previously editorial director of InvestorInfo and has worked as a freelance journalist for the Australian Financial Review, CFO, Asset and Asia Asset Management. She has a Bachelor of Economics from Sydney University and a Master of Arts in Journalism from the University of Technology, Sydney. She was previously a columnist for the Canadian publication, Corporate Knights, which is distributed by the Globe and Mail and The Washington Post. White is currently a fellow in the Finance Leaders Fellowship at the Aspen Institute. The two-year program consists of 22 fellows and seeks to develop the next generation of responsible, community-spirited leaders in the global finance industry.

Key takeaways

- It is increasingly obvious that it is not feasible to be an investor without thinking hard about issues of sustainability. It is impossible to map the expected future path of the world without considering the SDGs.

- The biggest change in perspective required is the evolution from risk/return to risk/return/impact. We believe it is very practical and achievable for institutional investors to consider all three dimensions. There is no need to sacrifice return in order to meet impact targets.

- Investors should build a diversified portfolio of sustainable assets, scalable to your whole portfolio. Assets should be chosen that further your goals.

- The sustainability investment data ecosystem is growing rapidly. What we are doing today may be ten times better in a few years.

- Net zero by 2050 could be a secondary goal to the SDGs, or it could be your only goal. You can then buy assets to build a portfolio to meet that goal.

- ‘In our minds a lot of investors are overly skewed to equities. In our view this is a huge mistake. It leaves you very naked if something unexpected happens.’

- ESG factors are critical to generating alpha simply because ESG factors are critical to the world’s present and future.

- We believe it is our duty as investors to raise awareness of where we can find investible opportunities aligned to specific SDGs and where we cannot. This will help maximise opportunities and help address gaps.