Before lockdown, some 100 staff worked from home every day at giant Dutch asset manager PGGM. Come COVID-19, that changed overnight to all 1400 employees needing to work from home. It called for a rapid system upgrade, strengthened firewalls and mass adoption of technology like Microsoft Teams in a sweeping IT operation, said Arjen Pasma, chief risk officer, investments at PGGM.

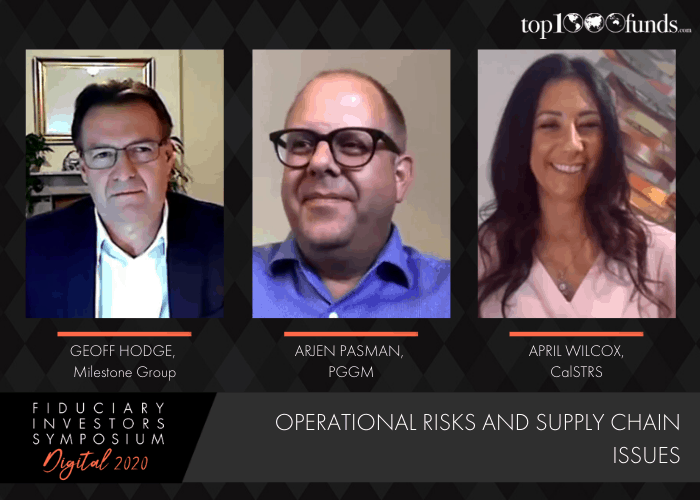

Speaking at FIS2020, Pasma told delegates how a skeleton treasury staff remained in the office (PGGM had to prepare special passes for these staff to leave their homes) to ensure that trades were cleared and settled and that margin calls were met.

“Those in our treasury function had a really busy time,” he said. Elsewhere, the asset manager went to lengths to furnish staff with laptops, stationary – and office chairs, he said.

April Wilcox, director of investment operations at US pension fund CalSTRS described moving an entire organisation to work from home as a “whirl wind.” In the beginning staff remoted into the pension fund’s network in coordinated shifts, she said. She described investment staff having to use their personal cell phones to call brokers to close and settle trades against the backdrop of extreme market volatility, huge trading volumes and liquidity worries, and a rush to set up Zoom and Webex accounts.

Meanwhile staff juggled poor home WiFi connections, home schooling and often cramped working conditions. In two weeks the whirl wind calmed, turning efficient and smooth-running, thanks particularly to strong governance structures, she said.

Fellow FIS panellist Geoff Hodge, president at Milestone Group, told delegates that the combination of factors caused by the pandemic made for unprecedented risk. He also noted how the pandemic has triggered re-shoring of some accounting activities: some back-up plans didn’t hold up, he said adding that state-of-the art operation centres in third countries are not necessarily the right thing “if you can’t go there.”

All panellists flagged how the pandemic has increased cyber risk.

“It’s going up the charts in terms of attention,” said Hodge. The risk comes from using personal devices and not operating within the usual “corporate perimeters.”

He also noted that challenges caused by the pandemic and the need to work from home have come at the same time as a regulatory focus on resilience, particularly regarding outsourced relationships and external supply chains. He said there is a need to have a “Plan B” if supply chains are interrupted.

Meanwhile, PGGM’s appetite to onboard new managers and service providers has slowed. The pandemic has made carrying out due diligence on new managers challenging, said Pasma.

PGGM is always on the lookout to “provide liquidity” and invest in opportune times, but challenges around measuring risk like excessive leverage and the correct valuation, particularly in private real estate, make due diligence all the more crucial. The fund won’t allocate where it does not feel comfortable, he said. CalSTRS is also working on creative ways to expand its due diligence. One area of real concern is cyber risk among its managers where the pension fund is asking its vendors to come up with solutions.

As returning to offices becomes an increasing focus, CalSTRS is also drawing insight from its external managers, said Wilcox. She said CalSTRS has continued with external manager searches through the crisis but said the pension fund has not allocated any funds yet.

PGGM has conducted face-to-face final interviews with new hires and is planning outside events to bring staff together.

“People miss each other; work is a social thing.” Pasma also predicted that offices will be more “a place where employees meet” rather than the default location to work.

CalSTRS has also kept hiring through the pandemic via video interviews, and the pension fund’s HR department has created a remote onboarding process. Wilcox concluded that maintaining culture, trust, team building and emotional wellbeing amongst staff is a key challenge.