Given the disruption and chaos currently facing the world, society and economies, this session looks at what an imagined future would look like and what the role of finance could be in a more informed and sustainable world.

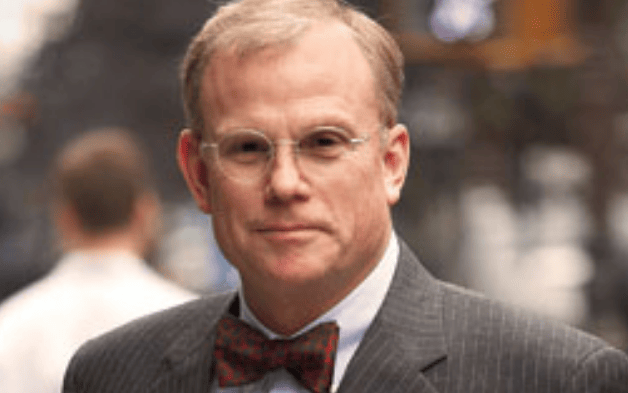

Stewart Brentnall joined TCorp as its first Chief Investment Officer in March 2017. The position was created following a merger between TCorp and two other NSW funds (State Super and iCare, formerly NSW WorkCover). He oversees TCorp’s end to end investment process. In this position, Mr Brentnall is responsible for running an aggregate portfolio of $110bn, representing defined benefit pension assets, insurance reserves, an infrastructure recycling fund and an intergenerational sovereign wealth fund. Mr Brentnall has led the evolution of TCorp’s investment model to a risk based Total Portfolio Approach.

From 2010-2017, Mr. Brentnall was Chief Investment Officer for ANZ, one of the large Australian banks. In 2009, ANZ bought out its joint venture with ING to strengthen its position in wealth management. He was brought in to oversee the transition, and to design and implement its asset management strategy.

Mr. Brentnall was previously Head of Investment Solutions at BT Financial Group, a newly created business unit to manage external funds. He also held various leadership roles in asset management at Queensland Investment Corporation (QIC), Goldman Sachs and Schroders. He began his career as an auditor with Deloitte.

Angela M. Rodell serves as the chief executive / executive director of the Alaska Permanent Fund Corporation, having been selected in October of 2015 by the board of trustees. The APFC is a state-owned corporation, based in Juneau, Alaska, that manages and invests the assets of the $55 billion Alaska Permanent Fund and other funds designated by law. As the chief executive Rodell is leading the APFC at a pivotal time in history as it continues to emerge as a revenue generating center for the State of Alaska.

Rodell also served on the APFC’s board of trustees as a cabinet member, having been appointed commissioner of the department of revenue in August, 2013 by Governor Sean Parnell. In addition to serving as a trustee, Rodell enjoyed the oversight role in working with the divisions and 900 employees within revenue, and participated as a member of several boards, including the Alaska Retirement Management Board, the Alaska Housing Finance Corporation Board, the Alaska State Bond Committee and the Alaska Industrial Development and Export Authority, among others.

Rodell first joined the State of Alaska in September, 2011, as State Treasurer and deputy commissioner over Revenue's Treasury Division, Permanent Fund Dividend Division and the Child Support Services Division. Formerly, Rodell served as financial advisor to more than $30 billion of transactions for state and state authorities in more than nine states, including Alaska. Transactions included general obligation, pension obligation, public power, tobacco securitisation, affordable housing, and toll road and transportation financing. Prior to becoming a financial advisor, Rodell served as the finance officer to Kentucky Housing Corporation.

Rodell has a Bachelor of Arts degree from Marquette University in Milwaukee, Wisconsin and a Masters in Public Administration from the University of Kentucky in Lexington, Kentucky.

Geoff Rubin is responsible for overall fund-level investment strategy and heads the total portfolio management (TPM) department – the operational arm of CPP Investments’ investment planning committee, with overall management accountability for the oversight and management of the fund’s investment portfolio.

He joined CPP Investments in 2011, with the inception of TPM, and has helped shape its growth and evolution, and to define and execute CPP Investments’ total portfolio approach.

Previously, he held finance roles with Fannie Mae and Capital One Financial where he managed the global balance sheet. Rubin also ran a consulting practice and was Adjunct Professor at American University’s Kogod School of Business in Washington, DC.

He holds a BA in Economics from the University of Virginia and a PhD in Economics from Princeton University.

Amanda White is responsible for the content across all Conexus Financial’s institutional media and events. In addition to being the editor of Top1000funds.com, she is responsible for directing the global bi-annual Fiduciary Investors Symposium which challenges global investors on investment best practice and aims to place the responsibilities of investors in wider societal, and political contexts. She holds a Bachelor of Economics and a Masters of Art in Journalism and has been an investment journalist for more than 25 years. She is currently a fellow in the Finance Leaders Fellowship at the Aspen Institute. The two-year program seeks to develop the next generation of responsible, community-spirited leaders in the global finance industry.

Key takeaways

Stewart

- The future is about risk allocation, not asset allocation. COVID-19 makes the distinction clearer between mature and less mature economies.

- In the future we should approach benchmarks with caution as they will look very different.

- Supply chains will be more spread across countries to reduce geographic concentration risk.

- The future will see an acceleration of sustainability investing and a rising heat around the demand for social justice. Questions around mission and governance will arise with a greater resolve to implement greater horizon strategies.

- A true long horizon portfolio may move away from 60/40 or 70/30 and move much closer to 100/0.

Angela

- The future looks brighter if we invest in technological infrastructure such as broadband.

- The future will see greater investment in the smaller cities.

- Perhaps moving forward we will think very differently about investing in commodities or cryptocurrencies, or risk being left behind.

Geoff

- Reassuringly, in the long-term the future growth trajectory will look a lot like the past; the combination of labour, capital and technology has been an incredibly resilient and consistent engine of growth and has survived World Wars and pandemics.