How have different governments around the world responded to the health and economic crisis and what are some of the innovative responses that will stimulate the economy and ensure a sustainable recovery?

Randall S Kroszner

Deputy Dean for Executive Programs and Norman R. Bobins Professor of Economics, University of Chicago Booth School of Business (United States)

Randall S. Kroszner is Deputy Dean for Executive Programs and Norman R. Bobins Professor of Economics. Kroszner served as a Governor of the Federal Reserve System from 2006 until 2009. He chaired the committee on supervision and regulation of banking institutions and the committee on consumer and community affairs. In these capacities, he took a leading role in developing responses to the financial crisis and in undertaking new initiatives to improve consumer protection and disclosure, including rules related to home mortgages and credit cards. He represented the Federal Reserve Board on the Financial Stability Forum (now called the Financial Stability Board), the Basel Committee on Banking Supervision, and the Central Bank Governors of the American Continent and was a director of NeighborWorks America. He chaired the working party of the OECD, composed of deputy central bank governors and finance ministers, on policies for the promotion of better international payments equilibrium. As a member of the Fed Board, he was also a voting member of the Federal Open Market Committee.

Since 1990, Kroszner has taught at the University of Chicago Booth School of Business. He was director of the George J. Stigler Center for the Study of the Economy and the State. He served as editor of the Journal of Law & Economics and has been associate editor of a number of other academic and policy journals. He was a member of the board of directors at the National Association for Business Economics and the Financial Management Association.

Dr. Kroszner serves as the Chair of the Financial Research Advisory Committee of the Office of Financial Research of the US Treasury. He is a member of the Federal Reserve Bank of Chicago’s Academic Advisory Council and of the board of advisors of the Paulson Institute. In addition, he is a research associate of the National Bureau of Economic Research.. Kroszner received a Sc.B. (magna cum laude) in applied mathematics-economics (honors) from Brown University in 1984 and an M.A. (1987) and Ph.D. (1990), both in economics, from Harvard University.

Lucrezia Reichlin is Professor of Economics at the London Business School, non-executive director of AGEAS Insurance Group and Eurobank Ergasias SA, as well as chair and co-founder of Now-Casting Economics ltd and a trustee of the International Financial Reporting Standards Foundation. She is a columnist for the Italian national daily Il Corriere della Sera and a regular contributor of Project Syndicate. Reichlin received a Ph.D. in Economics from New York University. She has held a number of different academic positions. From 2005 to 2008 she was the director general of research at the European Central Bank. From 2009 – April 2018 she was non-executive director of UniCredit Banking Group and from 2013-2016 she was chair of the Scientific Council at the Brussels based think-tank Bruegel. Reichlin has been an active contributor to the life of the Centre for Economic Policy Research (CEPR) over the years. She has been research director in 2011-2013, first chair of the CEPR Euro Area Business Cycle Dating Committee, co-founder and scientist in charge of the Euro Area Business Cycle Network and she is now a trustee.

She is a Fellow of the Econometric Society, the British Academy, the European Economic Association, and Academia Europaea. In 2016 she received the Birgit Grodal Award, European Economic Association, and the Isaac Kerstenetzky Scholarly Achievement Award.

Reichlin has published numerous papers on econometrics and macroeconomics. She is an expert on forecasting, business cycle analysis and monetary policy. She is currently working on a book about the European Central bank during the crisis. She pioneered now-casting in economics by developing econometrics methods capable of reading the real time data flow through the lenses of a formal econometric model. These methods are now widely used by central banks and private investors around the world. Her papers have appeared in top scientific journals, including the American Economic Review, Review of Economic Studies, Review of Economics and Statistics, Journal of Econometrics, Journal of Monetary Economics and Journal of the American Statistical Association.

Amanda White is responsible for the content across all Conexus Financial’s institutional media and events. In addition to being the editor of Top1000funds.com, she is responsible for directing the global bi-annual Fiduciary Investors Symposium which challenges global investors on investment best practice and aims to place the responsibilities of investors in wider societal, and political contexts. She holds a Bachelor of Economics and a Masters of Art in Journalism and has been an investment journalist for more than 25 years. She is currently a fellow in the Finance Leaders Fellowship at the Aspen Institute. The two-year program seeks to develop the next generation of responsible, community-spirited leaders in the global finance industry.

Key takeaways

Randy Kroszner

- Everyone wants to know whether we are setting ourselves up for a crash.

- Companies who are raising equity or debt and holding the cash can build a stronger “fortress balance sheet” to make them more resilient.

- The question is whether and when the Federal Reserve can pull back their additional support to avoid inflation. However, in the short run the major risk is deflation, not inflation, and the Fed will do everything possible to avoid a deflationary scenario.

Lucrezia Reichlin

- Monetary and fiscal policies in response to COVID-19 have been very different to the GFC period. We are likely to see increased innovation in coordination between monetary and fiscal policy.

- One key question is whether Europe will be able to cope with individual country national debt by transferring risk between countries.

- We should not be complacent of the possibility of inflation, however central banks have several instruments to counteract the potential risk, assuming they act in a timely manner.

- A reduction of stimulus too early could result in a deflationary spiral.

- Central banks will eventually think about how broad their investment mandate should be including sustainable investing, but we are not there yet.

Poll results

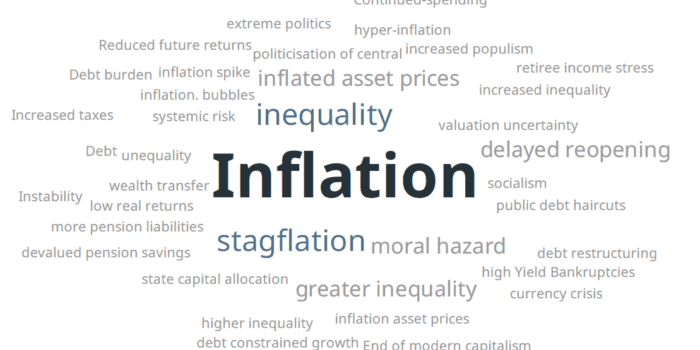

What do you think is the number one potential unintended long-term consequence from the policy responses to the crisis? (for example inflation, or inflated asset prices)