President of Robert F Kennedy Human Rights, Kerry Kennedy, welcomed delegates to its 2019 investor conference by outlining some of the milestones achieved by the organization in the past year. These include criminal legal system reform; suing Colombia on behalf of a journalist’s family; and major advancements in farm workers’ rights. This is an excerpt from her speech.

At RFK Human Rights we carry forward my father’s unfinished work on social justice.

On June 6th 1966, Daddy spoke to a crowd in Cape Town, South Africa and said: “Few will have the greatness to bend history itself. But each of us can work to change a small portion of events and in the total of all those acts will be written the history of this generation.”

Today we are sharing that message with students across the globe through our Speak Truth to Power education program. We teach students kindergarten through law school about their rights, about social emotional learning, and we show them how they can make a difference.

This year, thanks to our partnership with the Discovery Channel and board member Henry Schleiff, Speak Truth will be accessible to 30 million students. And thanks to board member Donato Tramuto, we are now expanding to corporate offices, beyond diversity and inclusion with our workplace Dignity program.

Earlier today, you heard the session on mass incarceration. At RFK Human Rights, we believe those closest to the problem are closest to the solution. So we joined with our partners — many who are formerly incarcerated — and asked them what their priorities were. We worked shoulder to shoulder for the next two years. And in March, the New York legislature passed, and the governor signed Bail Reform, Discovery reform and Speedy Trial Reform, the largest package of criminal legal system reform in over fifty years-rendering New York state the safest, most humane and most fair in the union.

Across the globe, journalists are under attack. Washington Post columnist Jamal Khashoggi was killed with total impunity by the government of Saudi Arabia. Last week the president of the United States accused the New York Times of treason. 94 journalists and media workers died in targeted killings in 2018. 1340 journalists have been killed on the job since 1992. Journalism is one of the most dangerous professions on earth.

Five months ago, we won the first case in the history of Latin America holding a government responsible for the killing of a journalist. Nelson Carvajal was a local journalist and community organizer who wrote a series of stories about corruption and collusion. The police never investigated his murder, his family started to investigate and one by one they were threatened with death and forced into exile. Over the years, 20 members of the Carvajal family were forced by those threats to go overseas. RFK Human Rights sued Colombia on behalf of the Carvajal family and against all odds we won.

The inter-American court for human rights held that the government of Colombia had to take protective measures for journalists, make a public apology and make reparations. Last February, we went to the convention of the inter-American press association in Cartagena Colombia.

Journalists arrived from across the continent. The president of Colombia lauded Nelson Carvajal. The ministry of justice officially apologized, and the twenty members of the Carvajal family reunited for the first time in two decades.

At RFK Human Rights, we hold governments accountable for abuses through advocacy and litigation, at any given time we have 35 open cases. And we have never lost a case.

In 1966, Daddy traveled to Delano California to hold hearings on conditions facing farm workers for the Senate Hunger Committee.

Half a century later, the conditions faced by the women and men who give us our daily bread—have changed very little.

In New York, the legacy of Jim Crow lives on, resulting in near-slave conditions for children, women, and men across our state. People are stuffed into overcrowded shacks, they cannot afford adequate food despite laboring to feed our people, and many have little access to running water, blackened by pesticides and filth in the fields, after 14-hour days of back-breaking labor. Drudgery, subjugation, and humiliation characterize life for people who plant vegetables, pick fruit, and milk cows.

I went to a small community, ironically, just outside the town of Liberty, New York, to visit workers at Hudson Valley Foie Gras. Next time you see Foie Gras on the menu, ask where it is from. If they say Hudson Valley, that’s this farm.

Each day gruesomely exploited farm workers must force feed approximately 350 ducks in a row by holding each duck between the worker’s knees, elongating its neck, yanking open its beak, and shoving a long electric funnel down its throat. This process is sustained torture for worker and duck alike. I asked one farm worker what his hours are. He said, “I work three, four hour shifts — from midnight till 4am, from 8am till 12 noon, from 4pm until 8pm.” The workday starts again at midnight.

During that entire period the worker never sees more than four hours off in a row. He is paid minimum wage. And though he earns it, he is denied the overtime pay due him — overtime paid to every deli worker in New York City. If he dares to attempt to form a union, he can be fired.

I asked one farm worker when he gets a day off. The answer? “We don’t get a day off.” Not after a week, not after the 22 days it takes to cram a duck’s liver so full that it is ready for slaughter, not even on Christmas.

He said, “I worked at Hudson Valley Foie Gras for 10 years and never got a day off.”

I asked if he received any benefits. “None”, came the response, except, for “housing”. And what is housing? He lived in a 10 x 14 foot room with two married couples and three single men — for 10 years.

I asked about worker’s compensation. He said his wife worked at Hudson Valley Foie Gras for 10 years. One day she was permanently injured on the job. That’s the day she was fired. She received not a cent in worker’s comp.

Terrifying conditions such as these are the reality for thousands of workers on chicken farms, dairy farms, vegetable fields and fruit orchards. Workers who complain can be fired.

All this is legal in the State of New York because of left over Jim Crow Laws.

In the 1930s, when Congress passed the New Deal labor laws, it provided protection for practically every member of America’s work force, except farm laborers.

The farm owners and Dixiecrats in Congress simply didn’t want to kill the golden goose by giving their African American workers benefits that would cost the growers money, cause them inconvenience, or put the sons of slaves on par with white factory workers.

Consequently, farm laborers never received the rights most workers take for granted. Farm laborers were regarded almost as chattel-barely human. They were excluded from federal labor protections, so all that progress Cesar Chavez made in California had no impact on New York State.

For the past decade our lawyers at RFK Human Rights have been joining our partners in the farmworker community shuttling back and forth to Albany, demanding the legislature take action. Last Wednesday, the legislature passed comprehensive reforms, and the Governor has promised to sign the package. Farmworkers in New York will now have the right to a day off per week, the right to collective bargaining , the right to overtime pay and the right to workers comp.

The proceeds from this Compass Conference make our work , both at home and around the world, possible. And I want to thank all of you here tonight for your help and participation.

I love the work we do at home and abroad holding governments accountable and training the next generation of defenders.

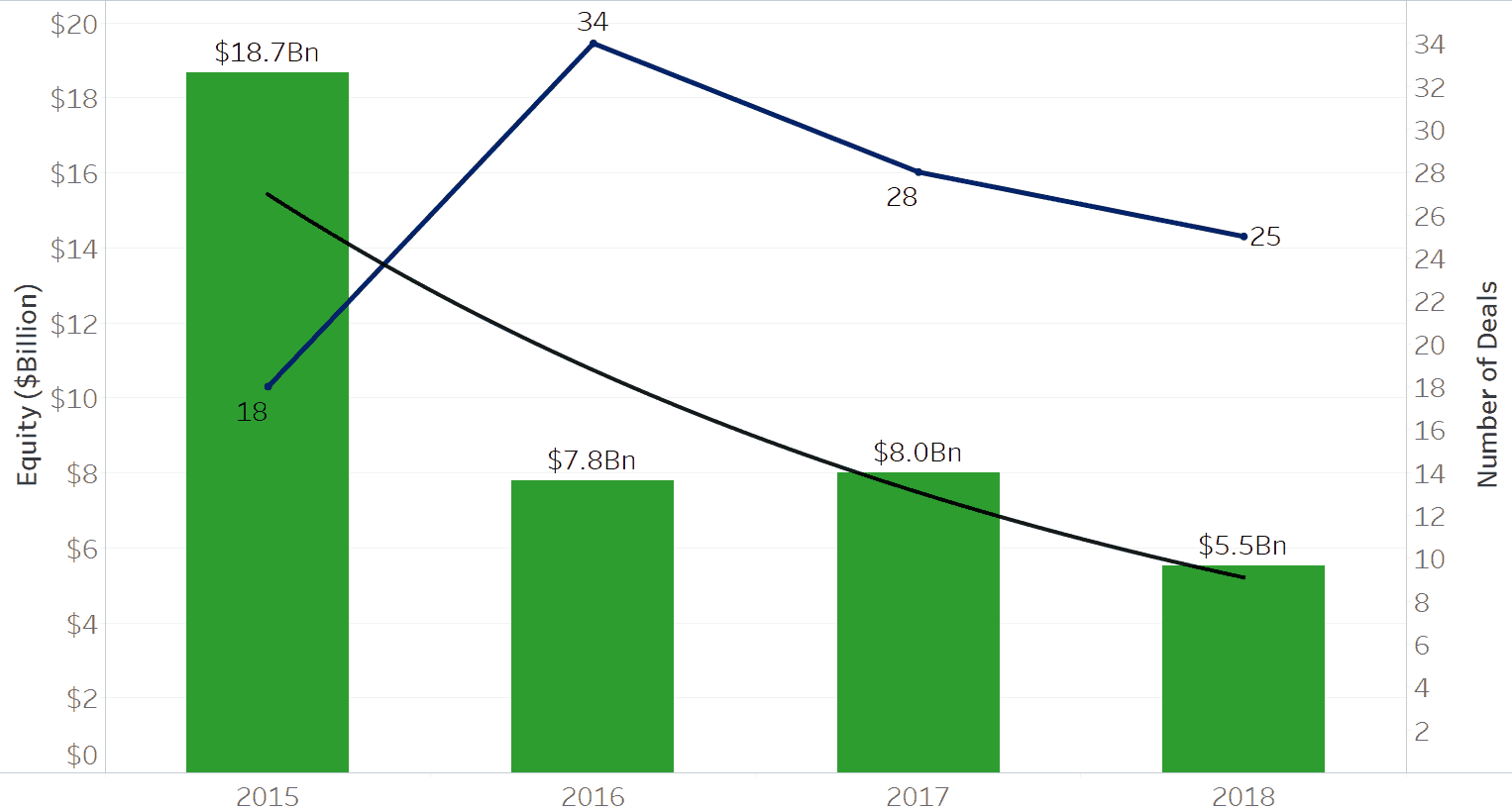

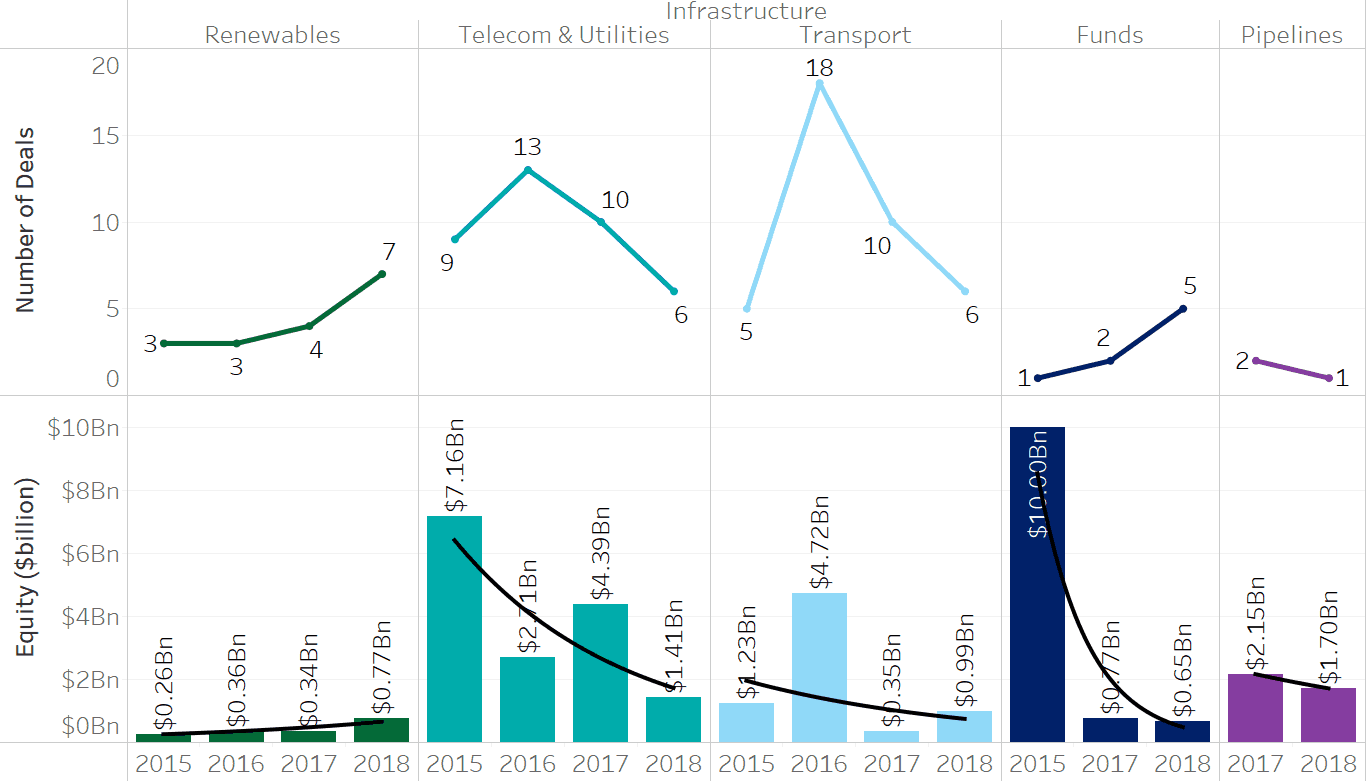

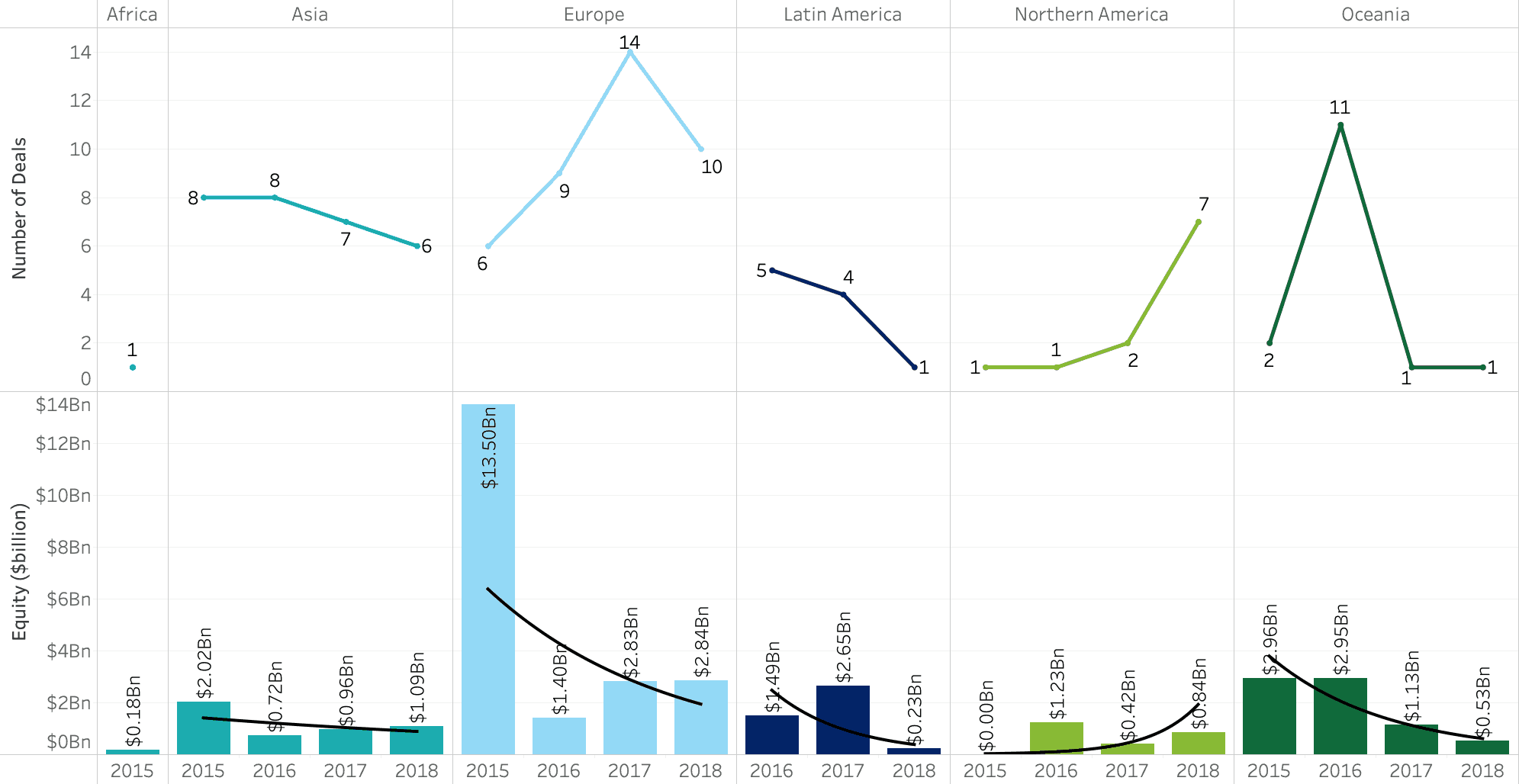

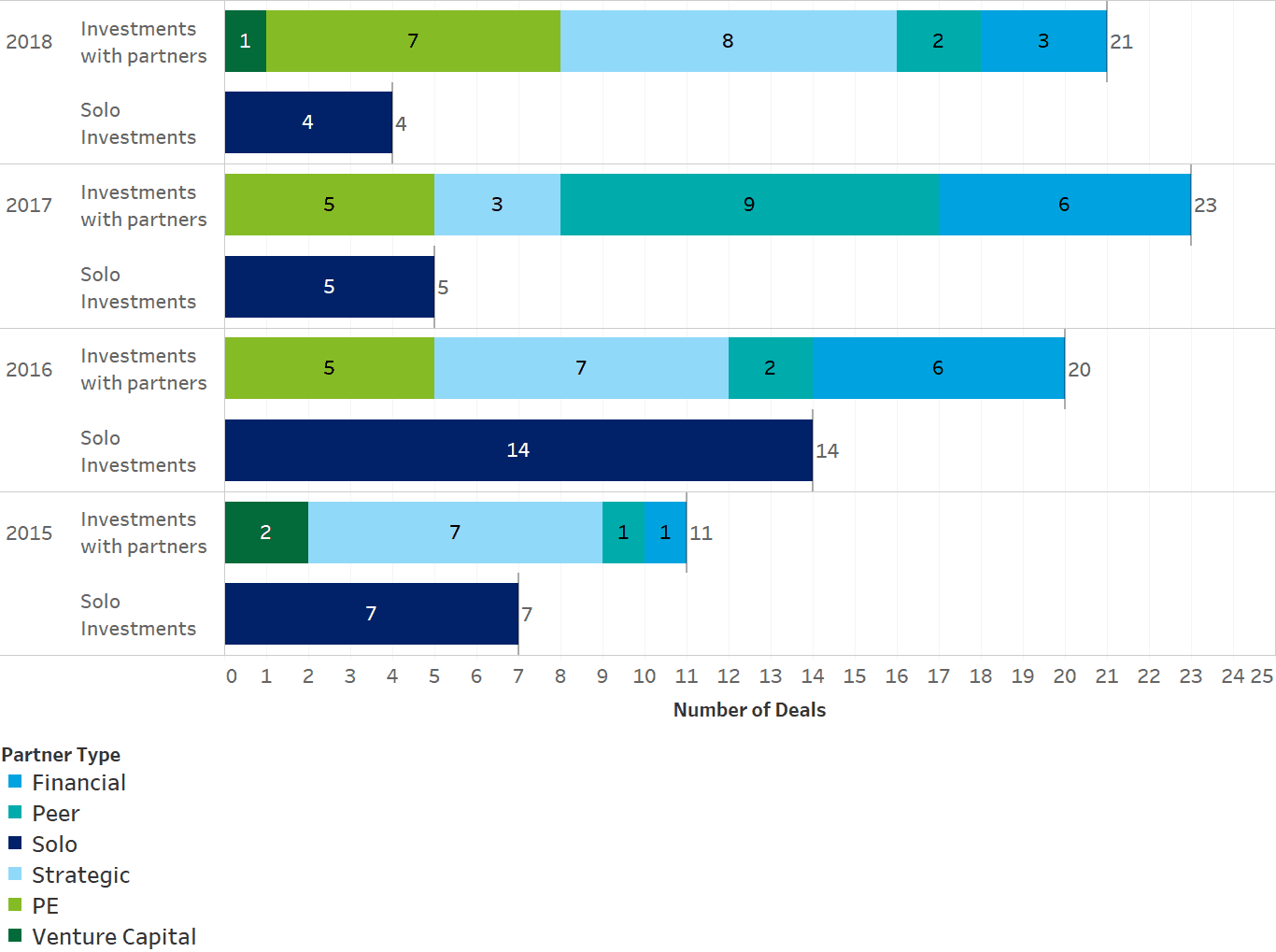

But for me, some of our most important work happens at this conference. Look around this room. Tonight we have gathered a couple of hundred people who collectively control about 7 trillion dollars in assets managed. That is about ten percent of the worlds economy. In this room, we have enormous power to make gentle the life of the world, and we will spend much of the next few days talking about how to harness that power for good while maximizing returns.

When people talk about sustainable investing, they almost immediately refer to ESG. At the Compass conference, we focus on the S in esg— the S is NOT about corporate philanthropy.

The S is about assuring that the company is respecting human rights throughout its business- up and down the supply chain. It’s about women and minority owned firms, not only in the C suites and on the boards of corporations, but also about hiring these firms to invest assets.

Today, women and minority-owned firms invest less than 2 per cent of assets under management world wide.

As my father used to say, we can do better than that.

The S in ESG is about the tech industry protecting free expression, access to information, privacy, and protecting from false information parading as truth. And it’s about climate justice — not for the polar bears and the ice caps, but for the people most effected by climate change who are too often least able to stop the polluters.

As my cousin Ted will discuss, it’s about disability inclusion, and, as my sister Kathleen will remind you, its about retirement safety. And it’s about social, racial and economic justice.

I grew up in a political family, and I’ve been surrounded by politicians my entire life. The easiest way to win a race is by appealing to people’s fear, anger and hatred. That’s an easy way to get elected, but it’s an impossible way to govern.

Daddy ran for president at a time when our country was more divided then at any time since the present. And he spent his campaign trying to heal divisions in our country.

He was able to do that, because he appealed to the best in us, the better angels of our nature, that part of us that says, we can be better as a nation, by harnessing the most enduring American values, of liberty, justice and self- sacrifice for the common good.

His message is perhaps more important now than any time in the last 50 years.

When Daddy announced for president, he said “peace and justice and compassion towards those who suffer, that’s what the United States should stand for.”

Fifty years later, that’s the message Americans are yearning to hear. That’s what we want. Black, and white, young and old, rich and poor, red and blue, we want a leader who will not be about division, But will be about understanding the suffering in our society and appealing to the better angels of our nature, and calling on us to say “work together, we can do this, we can go forward with peace and justice and compassion.”

I think that is a message for the United States and I think it’s a message for the world.

That’s why your work with us at RFK Human Rights is so important.

Thank you.