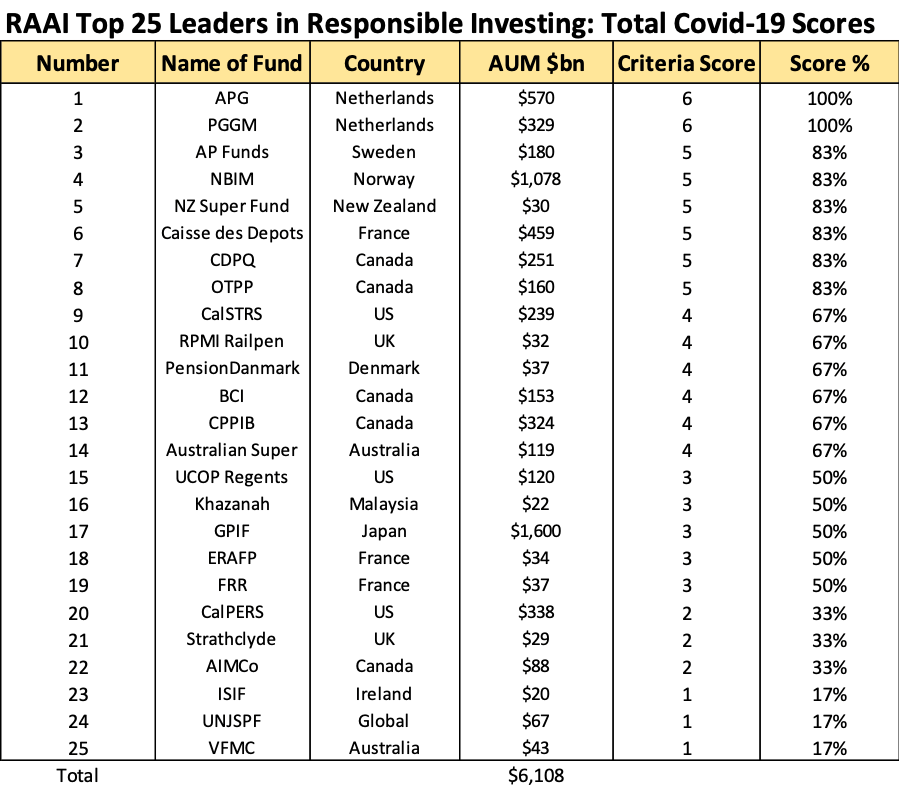

The Responsible Asset Allocator Initiative (RAAI) at New America finds that 25 leading public pension and sovereign wealth funds, with assets of $6 trillion, are investing tens of billions of dollars in COVID-19 solutions and in funds to support stricken companies.

One thing the global COVID-19 pandemic has made abundantly clear is that healthcare policy and economic policy are inextricably intertwined. We have seen tremendous damage inflicted on the global economy, not to mention terrible loss of life, as many elected officials have been unable and sometimes unwilling, to respond to the crisis with steadfast leadership and effective policies.

Asset owners charged with safeguarding national wealth and growing long-term savings cannot afford to sit on the sidelines during this pandemic. They must adapt their environmental, social and governance (ESG) frameworks to respond effectively to the crisis or suffer potentially far-reaching consequences in their portfolios. The pandemic is forcing asset owners to recalibrate their thinking about the financial system and its fragility in the face of shocks that threaten the collective well-being of society. Such risks include not only disease, but also social injustice, racial inequality, and climate change.

COVID-19 TRACKER

The Responsible Asset Allocator Initiative (RAAI) at New America analysed how the top 25 RAAI Leaders in responsible investing are responding to the COVID-19 crisis. The RAAI found that the leaders, composed of public pension and sovereign wealth funds controlling $6 trillion in AUM, are adapting their ESG frameworks to meet challenges created by the pandemic. The RAAI created a “COVID-19 Tracker” looking for actions taken in response to the crisis under six ESG criteria:

- Disclosure: Is the asset allocator providing critical disclosures to stakeholders and beneficiaries on business continuity during the crisis?

- Commitment: Is the asset allocator sticking with its responsible investing principles and maintaining a long-term investment horizon?

- Intention: Is the asset allocator adapting its portfolio to respond effectively to the Covid-19 crisis?

- Accountability: Is the asset allocator supporting portfolio companies that prioritize employee safety, job security, and relief for supply chains, even at the expense of short-term profits? Is it holding companies accountable?

- Partnership: Is the asset allocator working with others to fight against the pandemic?

- Impact: Is the asset allocator investing in Covid-19 solutions, for example tests, equipment, and medications? Is it supporting local businesses or global firms impacted adversely by the crisis?

Only four to six months have passed since COVID-19 became a global pandemic, but already most of the asset allocators tracked in the RAAI study are moving quickly to adapt their ESG frameworks and take concrete actions in the fight against COVID-19.

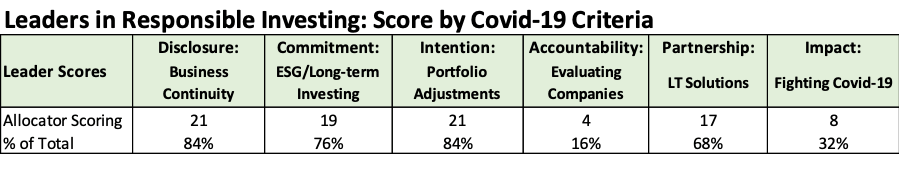

Over two thirds of the asset allocators tracked in the study reiterated their commitment to ESG principles and long-term investing, provided critical disclosures to stakeholders on COVID-19, adjusted their portfolios in response to the crisis, and joined partnerships in the fight against the pandemic. Most impressively, one third of the asset allocators examined had already invested tens of billions of dollars into COVID-19 solutions and into funds to support companies stricken by the pandemic. The pandemic is leading asset allocators to take a hard look at investing more heavily into the “S” factor in their ESG frameworks, in addition to environmental considerations.

TRACKER RESULTS

Topping the list of RAAI leading asset allocators responding to the pandemic were two Dutch pension funds APG ($570 billion) and PGGM ($329 billion), who both scored a perfect 100 per cent across the six criteria in our COVID-19 tracker. Other top scoring asset allocators in the fight against COVID-19, included the AP Funds ($180 billion) of Sweden, CDPQ ($251 billion) and OTPP ($160 billion) of Canada, Caisse des Depots ($459 billion) of France, NBIM ($1.1 trillion) of Norway and New Zealand Super Fund ($30 billion).

Disclosures on business continuity: 21 of the 25 Leaders tracked, or 84 per cent, provided information on office closures, pension payment schedules, withdrawal or contribution options during the crisis, and links to helpful websites on COVID-19. CDPQ gets special mention for imposing a salary freeze and postponing bonus payments for senior executives, to show solidarity with beneficiaries during the crisis. AP3 ($45 billion) of Sweden took a contrarian view, publishing a statement urging an early reopening of the economy, in March 2020, despite the coronavirus.

Commitment to ESG and long-term investing: 75 per cent of the asset allocators analyzed stressed maintaining a long-term approach to investing, sticking with ESG principles and investing in a sustainable recovery during and after the crisis. For example, NBIM published a guide for voting on sustainability issues and GPIF ($1.6 trillion) of Japan published a stewardship report. Other asset allocators doubled down on climate change action, including PensionDanmark ($30 billion) of Denmark which committed to a renewable energy fund, and RPMI Railpen ($32 billion) of the UK which invested in wind farms.

Intentionality and portfolio adjustments: 84 per cent of funds took actions such as adding or reducing risk in response to the crisis, searching for unique investment opportunities and shifting exposure to asset classes. For example, Australian Super ($119 billion) of Australia shifted to credit and private equity in response to the crisis while Caisse des Depots adjusted its housing portfolio. NBIM continued its exclusion program, eliminating more coal and energy companies from the portfolio while PGGM expanded its investment into healthcare.

Making portfolio companies accountable: only four, or 16 per cent of the 25 asset allocators examined, showed support for companies taking socially responsible actions that could have negative impacts on short-term performance. For example, APG demanded that Amazon account for worker safety measures during the pandemic while AP4 ($46.4 billion) of Sweden expressed willingness to forego dividends from companies hurt by COVID-19.

Partnerships against COVID-19: two thirds of the Leaders joined collaborative efforts in the fight against COVID-19. For example, over 100 Canadian CEOs, including BCI ($153 billion), CDPQ, CPPIB ($324 billion) and OTPP, signed a letter urging Canadian firms to care for employees during the crisis even though “this could have significant economic impact on businesses in the short term.”

Another example, four asset allocators, AustralianSuper, BCI, APG and PGGM formed a coalition to launch a green ESG investing tool during the period.

Impact investing in COVID-19 solutions: a third of the asset allocators tracked are investing into COVID-19 solutions and into funds to support companies impacted by the crisis. For example, CDPQ established a C$4 billion fund to support Quebec businesses temporarily affected by the COVID-19 pandemic; ISIF ($20 billion) from Ireland created a €2 billion fund to support medium and large Irish firms; APG invested over €550 million in COVID-19 bonds; Khazanah is considering investing up to $1.2 billion into hard-hit Malaysia Airlines; and Caisse des Depots of France not only issued a COVID-19 bond but also is investing up to €42 billion in listed French companies impacted by COVID-19.

Scott Kalb, is director and Marina Guledani is senior fellow at the Responsible Asset Allocator Initiative.