Road to 2030 is a thematic project designed to highlight undiscounted change. We believe that understanding the key long-term structural thematic drivers is the basis of good investment thinking. The project provides our clients with a useful framework for making investment decisions.

January 2020: the world was on the precipice of a global medical emergency that would empower the state, increase the might of technology firms, the pace of technological adoption, upend our cities, and dramatically accelerate the rise of China.

We did not know this, but that is not unusual. Not being able to prepare adequately for the future is the norm, not the exception.

“Forecasting is difficult, especially about the future… but one can prepare for the future that has already happened”

Peter Drucker

Think back to 1970. Oil was at $3.20 a barrel, the US had just begun détente with the Soviet Union, and the shah of Iran was the US protégé in the gulf.

- By 1980, Iran was in revolution, oil was 7 times more expensive, the US was the world’s largest creditor, and Deng Xiaoping started opening up China to the world

- By 1990, the USSR was within a year of dissolution, and the US was the world’s greatest debtor

- By 2000, China was joining the WTO, and the internet had begun to transform our lives

- By 2010, the US financial system had collapsed, and China was the world’s second largest economy.

Managing risk—that is to say, building strategies that are resilient to events like these—is not easy. So what can investor’s do?

In Road to 2030, we take a practitioner’s perspective aided by both internal and external experts to ask the ‘what if’ questions and consider major changes to the status quo. Road to 2030 explores the investment consequences of different scenarios – even those you wouldn’t imagine.

Road to 2030 explained

The Road to 2030 project is an investment led project designed to articulate possible visions of the future, the key drivers behind those outcomes, and to highlight areas of undiscounted change.

The project engaged investment teams at Ninety One around a series of roundtables held in 2019 and 2020. The primary purpose of these exercises was to ask “what if” questions in a structured way, encouraging us as investment managers to stretch our thinking and consider possibilities that seemed remote today. A pandemic, for instance, was one of the potential game changers highlighted early on in our research process, precisely the sort of extraordinary risk such a project should be able to concentrate minds on.

At the very least, the Road to 2030 is a horizon scanning and risk management exercise; at its best, it provides a foundational understanding of the main drivers that will transform markets over the next decade.

仰观宇宙之大, 俯察品类之盛 – 既懂得宏观世界 又懂得微观世界

“Raising one’s head to view the vastness of the universe; lowering one’s eyes to inspect the intricacies of things.”

– Calligraphy by the fourth century writer Wang Xizhi

Undiscounted change

The role of undiscounted change for investors

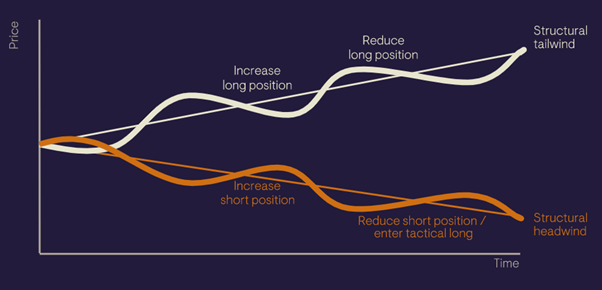

When a structural theme begins to form, the market typically lacks the ability to look that far forward, so the trend is progressively discounted through time.

For the investor, this is a point to get behind future tailwinds – a point at which future change is undiscounted.

When a theme has been in place for some time, on the other hand, it can result in an imbalance or a false equilibrium. At this point, the market has overly discounted change. Because a structural theme plays out over time, investors can determine when to invest in these themes, when not to, and when they should be tactically take a view opposite to their structural view.

In Road to 2030, the themes and scenarios are designed to help challenge our thinking and highlight areas of undiscounted change.

Why a thematic approach?

A thematic approach is useful for three main reasons

- A thematic approach identifies structural themes and imbalances that influence the global economy and asset markets on a multi year horizon. We believe that a clear understanding of those key tailwinds and headwinds can provide a valuable analytical advantage and inform longer run strategic preferences and aversions.

- Thematic research is an effective interdisciplinary means to address the problem of overspecialisation by cutting through traditional indices and narrow specialisations by country, region, sector or market capitalisation constructs that have been undermined by globalisation and increased correlations.

- An understanding of structural themes enhances individual security selection decisions in a general sense, through better contextualisation (“thinking as companies think”) or, more specifically, by incorporation into the investment thesis as growth drivers or inhibitors.

Explore themes

Explore the themes on Ninety One’s website

Explore scenarios

For decision makers, our scenarios are designed to help stir the imagination and highlight areas of undiscounted change.

We have sketched out a number of scenarios related to our themes and subthemes. Their role is to avoid the extremes of “interesting but useless” on the one hand and “useable but not very interesting” on the other. They are presented as stories because stories are memorable in a way dry facts cannot be—and thereby aid in imagining and planning for the future.

Explore the Road to 2030 project

Important Information & Disclosures

Important Information

This communication is provided for general information only should not be construed as advice. All the information in is believed to be reliable but may be inaccurate or incomplete. The views are those of the contributor at the time of publication and do not necessary reflect those of Ninety One. Any opinions stated are honestly held but are not guaranteed and should not be relied upon. All rights reserved. Issued by Ninety One.