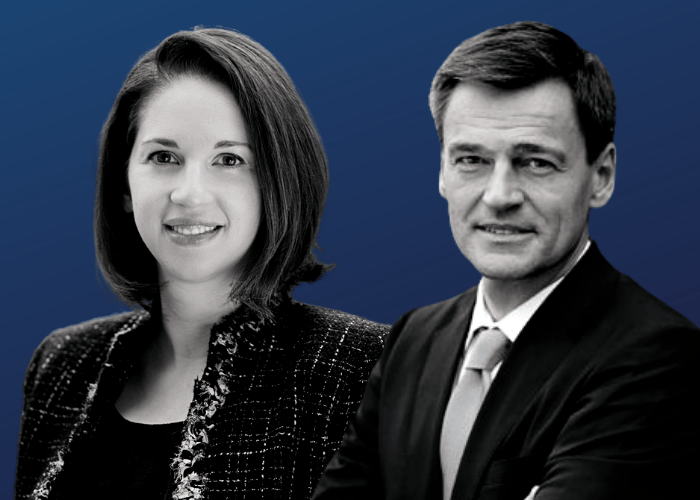

The appointment of Karen Karniol-Tambour and Carsten Stendevad as co-CIOs of Bridgewater’s new sustainability business marks a major milestone in the hedge fund’s business, applying its deep research-driven systematic approach to a new set of problems. Amanda White speaks exclusively to the two CIOs.

The co-CIOs of Bridgewater’s sustainability business, Karen Karniol-Tambour and Carsten Stendevad, call for investors to be as explicit and upfront as possible with their investment goals – whether they are financial or non-financial. They say the clarity of purpose allows portfolio construction engineers, such as Bridgewater, a greater chance of achieving those goals.

As a portfolio construction challenge Stendevad says that being explicit about financial and non-financial objectives is an important step in meeting sustainability goals.

“If you look at the entire ESG industry of the past 10 years and the number of challenges, investors had non-financial objectives but they didn’t say it. The truth is if you look more and more at climate or modern slavery in reality investors actually have non-financial goals. If you don’t say you have them and make the case for non-financial goals in a financial way then people make all kinds of academic exercises.”

He says it is important that investors have clarity around how they express their goals, as without clear logic the portfolio construction approach could become circular.

“For example diversity on boards, you can make the case in a risk and return way or you can say it’s just an objective,” he says. “If you make the intellectual leap then it becomes easier, you can approach it as engineers and in a portfolio construction way. Being intellectually clear on why you do certain things makes it easier to build portfolios.”

While it is not resolved one way or the other if ESG considerations affect return objectives Karniol-Tambour says there may be times when there is friction between impact and return.

“There could be a time when those are in tension and investors will have to make that choice. Investors have had to justify it, which is really just saying you care about other things,” she says. “But we think with clever engineering you can do both.”

Being intellectually clear on why you do certain things makes it easier to build portfolios.

Both CIOs say there is increasing comfort with investors to express other goals outside of simple return objectives. For example pensioners want a world they leave behind to be aligned with goals such as addressing climate change.

“That is as important to them as returns,” Karniol-Tambour says. “Then you look at those dual goals as cleverly as you can, and that’s where our expertise lies.”

Bridgewater approaches sustainability the same as it approaches all investment conundrums; building a rigorous research-oriented process based on the best data and systems it can build.

“We are trying to do it in a research-oriented manner. Before we answer the questions we build out a rigorous investment process, build out our understanding of what it means to be sustainable and tackle the challenges including tradeoffs. We don’t stop at the conceptual argument, we are trying as engineers to build the car to these specifications and see how well it drives,” Stendevad says.

Systematic processes to overcome murky data

Bridgewater’s sustainability efforts are twofold with ESG considerations integrated into the overall investment research process, and available as standalone offerings.

“We look at how you think about ESG or sustainability in terms of reaching risk and return objectives. Are there environmental or social issues pertinent for return-seeking portfolios? We will look at that in all of our portfolios and do that in pursuit of risk and return,” Stendevad explains. One example is examining all aspects of inequality as an increasing driver of fiscal policy.

“That work is done as part of our overall macro research, to advance our understanding of markets and economies and improve the risk-adjusted return of our existing portfolios. This is very important and we’ve done it for a long time. Then we have this additional, different thing. In addition to thinking about how these things effect risk and return, clients are saying we want to consider it irrespective of risk and return.”

An example of how the sustainability research is contributing to the broader research efforts and tools used in portfolio construction, Karniol-Tambour points to climate.

“Not many investors at Bridgewater had thought about climate,” he says.

As climate was examined a number of things emerged, for example in the pure alpha fund there is a climate specific risk control.

“We need that,” she says. “Issues like the long-term supply and demand for commodities was not weighing properly with climate change and what might happen. We now have a better understanding of what that means in climate transition across all portfolios.”

Karniol-Tambour says there are a lot of possibilities of where the manager’s offerings might go.

“For example yesterday I had a conversation with a client that has committed to net zero but is not sure what it means or how to do it,” she says. “Some things we are not sure about but will keep exploring. This is an area that will keep growing and expanding and we have made a commitment to that.”

Karniol-Tambour believes one edge that Bridgewater has is the 40 years of tools and research knowledge and that plays out when it comes to data.

“People talk about the mess of ESG data all the time. There is also a lot of mess in other data we deal with. The China data for example is chaos and we have built processes to deal with that data and triangulate it. Now our outlook is as reliable as it can be. A background in doing that in a systematic way is very helpful.”

For more than a decade data has been touted as a key problem of integrating ESG considerations into the investment process, Karniol-Tambour says part of the problem is that what is actually opinion is called data in ESG. Having the background to look at the process and data in a more systematic way is hugely helpful, she says.

Stendevad describes the aspiration as deploying the Bridgewater tool kit to a new problem.

“Especially in sustainability but investment in general, the only thing you can control is the depth of thinking, processes and how systematic you are. The inputs into logic can be clear or murky, the more systematic you are the more you can get through the grey zones. That is particularly relevant in sustainability.”

Sustainability in the broader business

At Bridgewater an investment committee has been set up specifically for the sustainability business which is made up of Karniol-Tambour, Carsten Stendevad and Daniel Hochman and could potentially expand to include further internal or external members in the future.

In addition to the structure of the new sustainability offering there is also a more conventional investment committee structure for the business at large, with Karniol-Tambour’s previous position of head of investment research across the business becoming obsolete.

“In the past I was on every project from creation to completion and bringing that all together from the research side. Now we have the better structure of an investment committee which is made up of six of us as permanent members,” she says.

As co-CIO of the sustainability business Karniol-Tambour also has oversight in integrating the sustainability considerations across the business, as well as the separate function and offering.

Stendevad, who was previously chief executive of ATP, the largest pension fund in Denmark, has been thinking about sustainability issues for a decade or more across an entire portfolio of assets. He says when investors are actively allocating capital over a long time horizon then the natural space to invest is sustainability.

Now he is co-leading Bridgewater’s sustainability efforts which includes a broad approach to thinking about sustainability solutions including private assets.

“We are thinking about everything, we are nowhere near doing anything [in private assets], but want to be open and think about how we make impact,” Karniol Tambour says.

Stendevad was hired by Bridgewater in 2017 as a kind-of executive intern and has been working on the sustainability solution for the past three years, alongside other big thematics like China.

“We are not getting started on the work now, we have been working for three years on the question of how to deeply embed sustainability into the existing research process and how to think about building portfolios with financial and non-financial dimensions. This marks the formalisation externally of that effort,” he says. “When it comes to building portfolios that deliver strongly on both financial and non-financial aspects that is a great challenge, it is not trivial. To do it well you have to invest in talent and analytical resources. This is an expression of how important it is for Bridgewater and what it takes as well.”

Stendevad says it is the first time that Bridgewater has taken an investment effort and turbo charged it, taking one of the firm’s most senior investors in Karniol-Tambour and building a whole capability around it, demonstrating the firm’s commitment in an ongoing major way.

“We ask what are all the ways to think about sustainability and we consider impact to be a third dimension as important as risk and return, if clients want to use it that’s great, but if they don’t that’s fine. Our main priority is this is a difficult problem and we want to be world class about it.”

See Karen Karniol-Tambour discuss the impact, risk and return framework in a video interview here.