As recent events in the EU spark anxiety in financial markets, researchers at EDHEC Risk Institute examine various performance attribution models and the relation to currency decisions and overlay management.

Performance – July 07, 2010

The Currency Dimension

By Elske van de Burgt CFA, Ortec Finance, Research Associate, EDHEC-Risk Institute, Jeroen Geenen and Lucas Vermeulen, Ortec Finance (1)

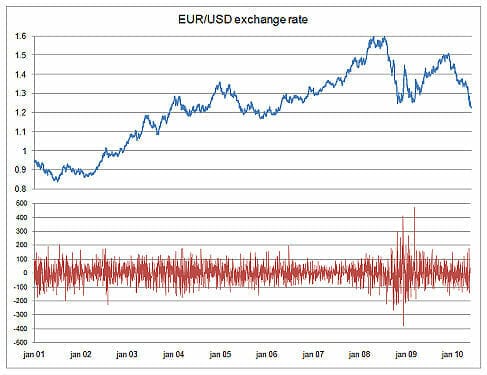

Recent events in the European monetary union have sparked new anxiety in financial markets across the globe. The Euro fell to its lowest level in more than 3 years against the dollar, as investors dropped the currency on their flight to safety. Investors fear a collapse of the economies of EMU countries because of the burden of government debt. The figure below clearly shows the jump in volatility of the Euro against the US Dollar from the start of the Greece debt crisis. Over the last couple of months, the currency dimension has become the dominating risk factor for foreign investors in the Eurozone. As a result, the management of currency risk is high on the agenda, and a proper analysis of the impact on performance of currency decisions is instrumental to that.

Figure 1: Historical rates and returns of the Euro against the US Dollar

Currency plays an important, yet often complicating, role in performance attribution. The currency dimension has many faces. We have to differentiate between local, base, and reporting currency. Currency can be viewed as an asset class or as a risk factor that is managed in an overlay. This variety might cause difficulties in dealing with currency in the analysis of investment decisions. Some investors consider currency a useless source of risk. It bears no risk premium; hence, it dilutes international returns and therefore needs to be hedged. Others consider currency an asset class in its own right due to the structure in the currency movements. The consensus now seems to be that both are true; it is a tactical asset class that should be strategically hedged.

The topic of performance attribution of currency decisions really came into vogue in the early nineties when investors started to operate globally. The CFA Institute sponsored research by Denis Karnosky and Brian Singer2. Their aim was to provide a comprehensive analytical framework for measuring currency decisions. Although the researchers emphasise in their monograph of 1994 their aim to be practical rather than theoretical, it has proved to be difficult to apply the model in practice. The link with the actual investment process turns out to be too weak, especially when it comes to the analysis of currency overlay management.

In 2003, Geenen et al. introduced an extension of the Karnosky and Singer framework3. It aimed to resolve the difficulties encountered when applying the framework in practice. An important innovation is the addition to the currency attribution model of the derivation of a proper benchmark for currency overlay management. In this article we explain the concept of currency overlay attribution.

Figure 2

Currency as an asset class

For most prevalent currencies, there are liquid markets for derivative instruments that enable foreign investors to hedge the exchange rate risk. As a result, investors can choose to put money in a certain market without being exposed to the currency of that market. More than that, they can translate a cash position into virtually any currency exposure with the help of cross currency hedges.

There is a variety of instruments which can be used to manage the currency risk, including forwards, futures, swaps, and options. Conceptually, one could even use cash management to create a hedged position. The basic principle of the hedge is to borrow the foreign currency for making the investment, and at the same time hold an equivalent amount of cash in the base currency to offset the loan. Exchange rate movements will affect both the investment as well as the loan, and consequently the currency effect is cancelled out. One cannot effectively hedge the currency impact on the return; therefore, this cross effect can be considered part of the investment return. The difference in interest rates of the local currency (receivable) and the foreign currency (payable) is the “cost of hedging”, which will be positive in case the foreign cash yield is smaller than the cash yield of the base currency. With the help of currency derivatives and cash management, it is possible to create a currency mix that is independent from the asset mix in the investment portfolio. As a result the return on a global portfolio can be viewed as a sub portfolio of local returns plus the cost of hedging, and a sub-portfolio of currency surprises. A currency surprise is actual currency return minus the expected return, i.e. the interest differential. An investor will try to select markets with relatively large risk premiums (or hedged returns), and select currencies with a positive return compared to what could be expected based on the interest differential.

The Karnosky and Singer framework

As investors became increasingly globally oriented in the last quarter of the previous century, it turned out that the performance attribution model of Brinson & al. could give quite misleading signals in the presence of currency management decisions. In 1994, Denis Karnosky and Brian Singer proposed an extension of the Brinson model to deal correctly with the currency dimension in global investment portfolios. The decomposition of global return into a local market component and a currency surprise component is at the heart of the approach that Karnosky & Singer (KS) developed. They argued that the existence of very efficient currency markets would allow for a simultaneous and opportunistic approach of managing investments and currency exposures. Hence, the two should be analysed as completely separated investment decision processes. Within each process, active decisions are measured in terms of allocation and selection effects within the familiar Brinson framework.

Figure 3: Brinson framework

The Brinson framework decomposes the difference in portfolio (actual) and benchmark (plan) return in an allocation, a selection, and an interaction effect. The attribution effects are calculated with the help of two reference portfolios: an allocation portfolio that is based on actual weights and plan returns, and a selection portfolio based on plan weights and actual returns.

The KS model consists of a pair of Brinson models, one for capital markets risk premium investing, and one for cash market decisions. The model assumes that the investment processes are entirely separated and operate simultaneously without feedback loops. Of course, in reality a currency overlay programme typically follows the market investments. We will speak about that later in this paper. First, we will use an example to highlight and explain the further the particularities of the various methods. Tables 1 to 3 summarise the hypothetical data that we use in the example. We assume a European investor with a global equity portfolio invested in the home region “Eurozone” and the foreign countries Japan, United Kingdom, and United States. Hence, the currency mix comprises of Euro (EUR), Japanese Yen (JPY), Pound Sterling (GBP), and US Dollars (USD). Table 1 lists the exchange and forward rates for these currencies. There are numerous reasons why actual forward rates can deviate from the benchmark forward rates. One of the most obvious explanations is the fact that synthetic contracts form the basis for the benchmark rates. This is in spite of the fact that currency markets are liquid; hence, the actual rates come very close to the theoretical rates. The difference can be the result of the difference between the assumed maturity of the benchmark forwards and the maturity of the actual contracts. Another explanation is the use of different types of instruments in the currency overlay programme. Therefore, the selection effect is important, although this does not fit well with the KS model. We will get back to this later. Table 2 lists the returns of markets and currencies. Because we focus in this article on currency decisions, we assume for the sake of simplicity that he actual returns are equal to the benchmark returns. The set of market returns consist of equity market and cash market returns. Table 3 summarises the passive and active policies on equity and currency markets. We express currency policy in terms of hedge ratios, i.e. the portion of the foreign currency exposure that is translated into base currency (Euro) exposure.

Table 1: FX data

Table 2: Returns of markets and currencies

Table 3: Investment policy and implementation

We can use this data to calculate Euro returns for the benchmark and the portfolio4. If we apply the standard Brinson model on these returns, we obtain the attribution effects presented in table 4.

Table 4: Standard attribution based on returns in EUR

Based on the Euro returns, the portfolio underperforms the benchmark by twenty basis points. The greatest contributor to this negative performance is Japan. This should not come as a surprise as it has the lowest Euro return of the four regions.

We can also calculate an attribution for the currency overly. The results are in table 5.

Table 5: Standard overlay attribution (weights add up to zero)

The attribution model of the overlay differs in two ways from the standard attribution. First, the currency weights add up to zero instead of one hundred per cent. This means that a smaller or larger hedge position in one foreign currency does not affect the position in one of the other foreign currencies. The only thing that changes is the resulting base currency (EUR) exposure, but this is irrelevant since its hedge return is zero by definition. Therefore, we do not subtract the total benchmark return in the allocation effect5. This means that the allocation effect for each currency is equal to the over- / underweight times the benchmark return. Second, we apply a negative sign in the calculation of the attribution effects because we look at hedged returns; a bet on a currency that has a positive currency surprise is a bad decision from a hedged perspective.

According to the results in table 5, the currency overlay programme recovers the losses sustained with the market investments. The overall performance of the benchmark is 9.40% and of the portfolio 9.51%, yielding an excess return of eleven basis points. Again the biggest contribution comes from Japan because of the hedge of the Yen exposure. From these attribution results, one could conclude that it is best to abandon Japanese investments entirely. However, the currency is distorting the results. Indeed, if we follow the Karnosky & Singer approach, we come to a quite different understanding. First, let us derive the risk premiums and Euro cash returns:

It is instantly clear that Japan offers the highest risk premium and lowest cash return. Hence, we expect high contributions from the bet on Japanese equities and the full hedge of the currency exposure. This is indeed what the KS model arrives at in tables 6 and 7 below.

Table 6: Karnosky & Singer attribution based on risk premiums

Table 7: Currency attribution

As opposed to the previous analysis, the currency weights are not based on hedged amounts, but on the exposures that remain after combining the currency weights resulting from the market decisions and the hedge decisions. This is a problem of the KS currency attribution, especially in case of fully hedged positions. It is not possible to calculate the selection effect directly, for the currency weight is zero. Instead, we have to revert to the results of the currency hedge.

Let us assume that we have one billion Euro assets under management of which we have invested 200 million in Japan. This is equal to 22.98 billion Yen. Hedging the full Yen exposure results in a gain of almost 600 thousand Yen, which is 2.6% of the hedged amount. Similarly, we calculate the synthetic benchmark return of 2.5%. Therefore, the selection (plus interaction) effect is (2.6% – 2.5%) × 200 / 1,000 = 2 basis points. The results of the KS model are completely reversed compared to previous analysis. The market decisions are all positive (yielding a positive excess performance of 20 basis points), but the overall result of the currency policy is negative (-9 basis points).

These outcomes seem to be more in line with what we would expect when looking at the data. Does this also mean that the KS approach is appropriate for a currency overlay manager assessing the quality of his decisions? We believe it is not.

Managing currency risk

The KS model assumes a simultaneous and opportunistic approach to both cash and currency markets. In this approach, the treatment of currency is not different from that of market investments. These days however, most investors do not consider currency to be an asset class, at least not strategically. Nevertheless, many perceive it as a source of alpha. Therefore, many institutional investors with significant foreign exposure run a currency overlay programme to hedge currency risk strategically, but they allow tactical deviations to take advantage of currency movements on the short-term.

The concept of currency overlay dates back to the 1980s. It started with a number of financial service providers offering currency hedging as a specialised service. At the same time, asset managers started a meaningful benchmark for the currency overlay programme.

A framework for performance attribution for currency overlay

In order to provide an appropriate analytical toolkit for global portfolios that include currency overlay management, Geenen & Al. proposed to extend the KS framework. The essence of the method is the derivation of a proper currency overlay benchmark. As opposed to the KS model, the method looks at currency exposures to hedge, rather than currency exposures to maintain. This is a subtle, yet significant difference. The strategic benchmark consists of synthetically hedging certain amounts of foreign currency exposures. The return of the benchmark is derived from virtually hedging. Thus, the benchmark result for the currency overlay programme is the strategic “amount of currency exposure to hedge” multiplied by the return of the virtual hedges. The question is how the strategic hedge amounts are determined. We have to distinguish between actual currency exposure and the strategic currency exposure. The strategic hedge amounts are derived from these two components; the difference between the actual and the plan exposure is the amount that the currency overlay manager should hedge. We can express the desired currency exposure in terms of the amounts as implied by the strategic benchmark, or alternatively in terms of total fund value. The former method is most common and is based on strategic hedge ratios. The latter is expressed as percentages of total assets. The table below derives the strategic hedge amounts for our example on the basis of strategic hedge ratios.

Table 8: Currency overlay benchmark

The Euro is the base currency and therefore its exposure results from the amounts of foreign currency that is hedged. The calculation of the strategic benchmark for the currency overlay starts by hedging all actual foreign currency exposures. For instance, we have invested 25 per cent in US equity and therefore we short the dollar by 25 per cent, which is added to the Euro exposure. Strategically we want to have a 20 per cent dollar exposure, which is half the strategic weight of US equities. Hence, the task of the overlay manager is to hedge 25 per cent and go long 20 per cent, which in net terms means hedge 5 per cent points of the USD exposure in the fund. To determine the value add of the active decisions we compare the value of the strategic decision layer with the actual portfolio, including the currency overlay. The strategic layer consists of a fully hedged benchmark for the market decisions and the strategic currency exposures. The actual fund consists of the unhedged market portfolio and the actual instrument in the currency overlay portfolio. We can easily split the total value add in contributions from the market and from the currency overlay:

Total

plan Fully Hedged Benchmark Return + Strategic Currency Mix Return

actual Actual Market Portfolio Return + Actual Currency Overlay Return

Market

plan Fully Hedged Benchmark Return

actual Actual Market Portfolio Return + Return of Virtual Hedge Actual Currency Exposure

Currency

plan Strategic Currency Mix Return + Return of Virtual Hedge Actual Currency Exposure

actual Actual Currency Overlay Return

If we apply this to the example in this paper, we get:

Figure 4: IDP analysis

The return of the virtual hedging of actual exposures (25 basis points) plays a special role in the analysis, as neither belongs to active market nor active currency overlay decisions. It is added to market to calculate actual fully hedged returns, and it is added to the currency overlay benchmark because it is one of the two components that make up the hedge plan for the currency overlay manager. Therefore, the overall performance is calculated as the market performance in terms of fully hedged returns minus the return of the virtual hedge return plus the currency overlay performance. The numbers are in table 9.

Table 9: Performance summary

We can also apply the Brinson models to arrive at the abovementioned results. Tables 10 and 11 contain the numbers of the analysis.

Table 10: Attribution of market decisions based on fully hedged returns Table

11: Attribution of currency decisions based on currency overlay benchmark

We can conclude from these numbers that the proposed extension of the Karnosky and Singer approach does not produce different results on the aggregate level, but attributes differently to the currencies. Additionally, the attribution effects are directly obtainable from the hedge weights and returns.

Conclusion

In this paper we have explained the framework for attribution of global portfolios with currency overlay management that was introduced by Geenen & Al. in 2006. The method is a refinement of the Karnosky and Singer model and aims at resolving the issues that one encounters when applying the model in practice.

The most important pitfall of the KS approach is that the currency attribution is based on remaining currency weights, and not on hedged weights. Therefore, it fails to provide an appropriate benchmark for currency overlay programmes, and, more technically, the calculation of the selection effects is not straightforward. However, on aggregate level the results of both methods are identical.

Footnotes:

1 Elske van de Burgt CFA is Managing Director Investment Performance, Ortec Finance, and Research Associate, EDHEC-Risk Institute.

Lucas Vermeulen is Managing Director UK, Ortec Finance.

Jeroen Geenen is Product Manager Investment Performance, Ortec Finance.

2 Denis S. Karnosky and Brian D. Singer, “Global Asset Management and Performance Attribution”, The Research Foundation of the Institute of Chartered Financial Analysts, 1994.

3 Jeroen Geenen, Marten Klok, Elske van de Burgt, “Currency Overlay Attribution: a Practical Guide”, Journal of Performance Measurement, Summer 2006.

4 For simplicity, we either ignore cross effects, or assume continuously compounded returns. In both cases, the Euro return is equal to local return plus the exchange rate return.

5 This is according to the original attribution model by Brinson, Hood, and Beebower. Later Brinson and Fachler proposed to calculate the allocation effects is excess of the overall benchmark return, in order to create negative allocation contributions if a underperforming segment would have been overweighted, or similarly if a positive effect if an underperforming segment would have been underweighted. This only makes sense, if overweighting one segment comes at the expense of the weights of the other segments. This does not hold true for overlays.