Investor Profile

South Africa’s GEPF prepares the ground for a two pot system

Featured Story

CalPERS mulls tying climate KPIs to incentive pay

Investor Profile

Dutch fund tackles the cost and time of shifting to DC

Investor Profile

CalSTRS’ sustainability strategy: Net zero and investing in opportunities

The Asset Owner Directory is an interactive tool to give readers an insight into the world of global asset owners. It includes key information for the largest asset owners around the world such as key personnel, asset allocation and performance.

| Fund Name | Country | AUM ($B) | Articles | More Info |

|---|---|---|---|---|

Government Employees Pension Fund (GEPF) | South Africa | $122 | 13 | View Info |

California State Teachers Retirement System (CalSTRS) | United States | $305 | 123 | View Info |

California Public Employees Retirement System (CalPERS) | United States | $467 | 295 | View Info |

Los Angeles County Employees Retirement Association | United States | $74 | 3 | View Info |

“Top1000funds.com is one of the best on-line sources for learning what my peers around the world are thinking and doing to allocate capital. It’s essential reading!”

Mark Walker

CIO, Coal Pension Trustees (United Kingdom)

“I find Top1000funds.com to be a useful, must-read source of information regarding developments within the institutional investment industry. Its global reach provides a variety of perspectives which aids the practitioner to navigate the challenges faced when managing a portfolio.”

Mansco Perry

Executive director and chief investment officer, Minnesota State Board of Investment (United States)

“The Top1000funds.com newsletter is an excellent read for CIOs. From my perspective, the newsletter provides important insights on how our global peers are innovating and changing the way they go about investing in order to drive better outcomes for stakeholders.”

Kristian Fok

Chief investment officer, Cbus (Australia)

“Top1000funds is the pre-eminent source for news and analysis on global issues of consequence to long-term investors. The focus is spot on. It is my go-to reference for what’s happening in our industry and what’s to come.”

Barbara Zvan

Former chief risk and strategy officer, Ontario Teachers Pension Plan

“Top1000funds.com always provides a thorough analysis of the best practices in the investment industry around the planet. This is a unique way to have such a perspective and there is always some insights we can all benefit from. The publication deserves a lot of credit for such work.”

Frederic Samama

Head of responsible investment, Amundi (France)

“Top1000funds.com consistently provides thorough, reliable and insightful information about how global assets owners are navigating an increasingly complex investment landscape.”

Janine Guillot

Chief executive, SASB (United States)

Investor Profile

Germany’s MetallRente ups risk, gains beneficiary enthusiasm

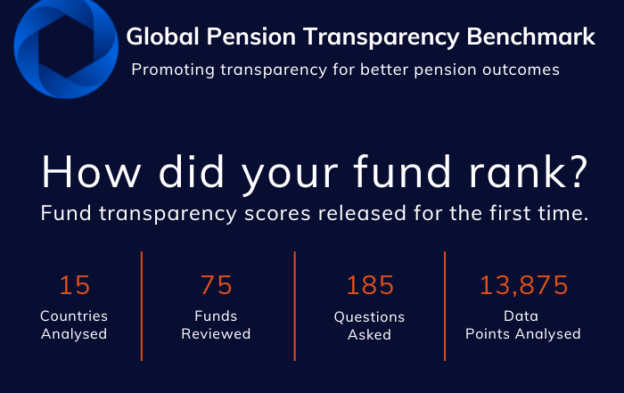

Promoting transparency for

better pension outcomes

FIS Singapore 2024

Why the future of humanity lies in Asia

Fiduciary Investors Symposium

The Fiduciary Investors Symposium brings global investors together to examine best-practice strategy and implementation.

The event enables institutional investors to engage with industry thought leaders in academia and practice, in a collegiate environment that promotes shared discussion.

Email to register now.

May 29-31, 2024 | Rotman School of Management, Toronto Canada

Fiduciary Investors Symposium

The Fiduciary Investors Symposium at Stanford University celebrates the fast-moving change taking place in economies and communities and will examine the impact of innovation on our lives, workplaces and investments.

September 17-19, 2024 | Stanford University, USA

Featured Story

Ford’s Roy Swan on how the Church of England is tackling its slavery legacy

Fiduciary Investors Series

Why Asia is the future

Global Pension Transparency Benchmark

Global Pension Transparency Benchmark makes process improvements

Featured Story

Risk management in an age of geopolitical uncertainty: Davos 2024 insights

“Top1000funds.com is a breath of fresh air in terms circulating stories that encompass new ideas and original thinking to keep us all abreast of the ideas that matters to us in the asset management industry in general and asset allocation spheres. I thank you for that.”

Hareb Masood Al-Darmaki

Deputy chair of investment committee; advisor to the managing director, Abu Dhabi Investment Authority

“Top1000funds.com provides a great mix of stories that are of interest to asset owners and those who work with them, covering both investment topics and organisational ones. While aimed at “the world’s largest institutional investors,” the articles are relevant to all kinds of asset owners, as well as professionals at other investment organisations.”

Tom Brakke

TJB Research (United States)

“The Top1000funds.com newsletter has become a very powerful source of information for the community of asset owners around the world. It is relevant and deep. I’ve known Amanda White for more than a decade now, she probably has the deepest understanding of the topics that are of interest to asset owners in the field globally.”

Jaap van Dam

Principal director investment strategy, PGGM; and author of Achieving Investment Excellence (The Netherlands)

“I really enjoy reading Top1000funds.com articles for my reference in investment. I would describe it as a kind of lighthouse when I was lost in turbulent market situation.”

Dong Hun Jang

CIO, POBA (Korea)

“Congratulations to Amanda and the team on this milestone. Your timely and relevant articles consistently offer thoughtful insights about the industry, and I look forward to seeing what the next era of investing will bring.”

Rebecca Fender

Head of the Future of Finance Initiative, CFA Institute

“Top1000funds.com produces high quality and thoughtful journalism that frequently aids my thinking.”

Tim Hodgson

Co-head, Thinking Ahead Group

“Accurate, authoritative, informative and readable. Top1000funds.com is everything a specialised industry publication should be. Congratulations on your 1000th issue.”

Fiona Reynolds

Chief executive, PRI

“I have been a big fan of Top1000funds.com for years and eagerly await the next issue. There are three reasons for this. First, it is very prescient. I will always remember how it was writing about income inequality as a system-level risk like climate change long before this was generally recognised. Second, it is always on top of the most relevant current events in sustainable investing. Third, it brings in guest writers who are luminaries in this domain.”

Robert G. Eccles

Visiting Professor of Management Practice, Said Business School, Oxford University