Published in partnership with IFM Investors

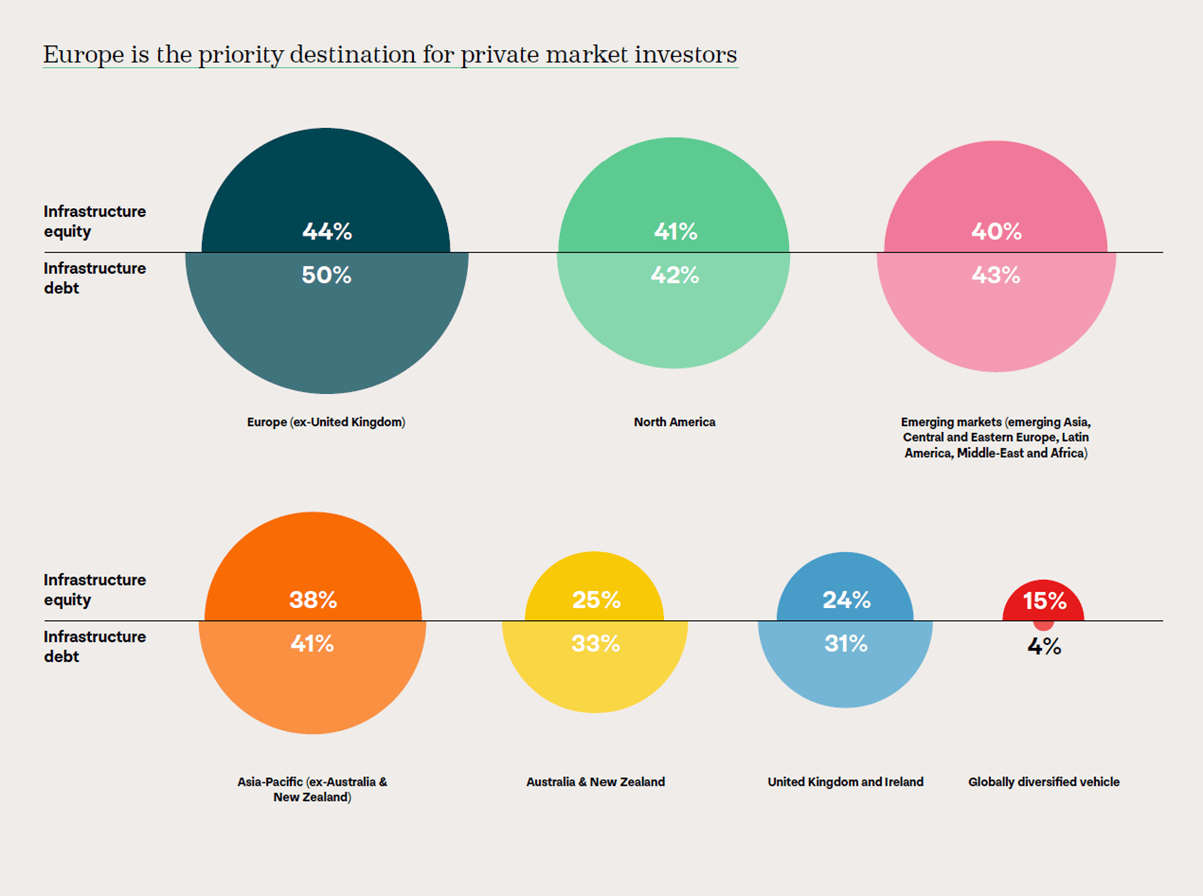

Asset owners hunting for new private market opportunities amid rising geopolitical volatility increasingly include Europe as a priority destination.

The shift in sentiment is clear: Half of global institutional investors now identify the region as a key target for infrastructure debt, and 44 percent for infrastructure equity.

“Infrastructure is increasingly seen as a way to generate alpha and boost portfolio performance,” said Mercer’s global head of real assets, Alan Synnott.

“In Europe, clients are typically drawn to infrastructure for its consistent returns and stabilising effect on portfolios. In Asia, approaches vary widely, reflecting the different levels of market development and sophistication across countries.”

The sustainability edge

One factor driving the appeal is Europe’s sustainable edge, with investors in North America, APAC, Europe and the Middle East listing sustainability as a financial driver for value creation and a top priority in their private market decisions.

North America is a long-term leader in energy infrastructure and data centres. But Europe also offers a well-established market with private sector participation across a range of sectors, giving investors broader exposure to themes, said Andrea Mody, head of North America, clients and strategy at IFM.

“Private infrastructure in North America is still evolving as an asset class compared to Europe, where the market is more mature, with its strong regulatory systems, history of public sector and private sector cooperation, and long track record of private sector capital in infrastructure,” Mody tells Top1000funds.com.

“Investors see Europe as an attractive destination, particularly those focused on sustainability and clean energy. When it comes to energy, North America is still viewed as an enormous market but it’s more an ‘everything, everywhere, all at once strategy’ rather than just about renewables.”

Europe’s leading position in renewable energy infrastructure represents a meaningful shift from just a couple of years ago when, according to Mody, North America was probably the leading place to invest.

“Some of the geopolitical changes, and question marks around energy security and defence, have caused hope for higher growth in Europe and investors are seeing Europe as an attractive and relatively safe destination where many investors believe they’ll have more policy certainty in the near term,” she said.

Growth, digitisation and decarbonisation

Asia Pacific (ex-Australia and New Zealand) ranks as the fourth most attractive region for private market investors, according to the IFM report, with 41 per cent looking at the region for infrastructure debt and 38 per cent for infrastructure equity.

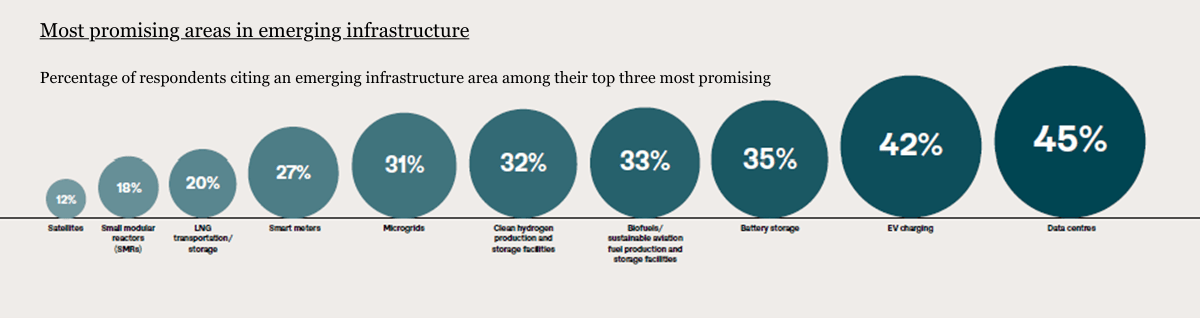

When it comes to digitisation, IFM sees a lot of opportunities across the region, but especially in developing Asia where digital penetration rates are still very low compared to more developed markets.

Australia’s largest superannuation fund, AustralianSuper, has also identified digitisation and sustainability as strong themes and attractive drivers for the asset class. The A$387 billion fund has increased its allocation to digital infrastructure, particularly data centres in North America, over the last several years, according to Roger Knott, acting head of real assets.

Market appeal

The IFM Investors’ second annual Private Markets 700 report also found that different investors like private infrastructure for different reasons.

Investors agree that infrastructure can add diversification, stable income, and long-term growth to a portfolio, but certain characteristics stand out depending on regional priorities.

“As infrastructure strategies become more sophisticated, investors across regions appear to be aligning their capital with distinct priorities, whether focused on performance, stability or sustainability,” the report states.

Among European investors, there are three key nuances, said Armit Bhambra, head of client solutions EMEA at IFM. They are a sharp focus on risk management, regulatory stability and sustainability.

“There is a significant focus on risk management, specifically diversification and inflation-hedging to build portfolio resilience,” Bhambra said.

“Investors in the region are concerned about inflation, with one cause being the evolving tariffs position in the US. Many are looking to private markets to help them insulate their portfolios from this risk. Asset classes like infrastructure, where revenues can be quite directly linked to changes in inflation, are increasingly seen as helpful portfolio construction building blocks.”

Regulatory stability

Bhambra said investors in Europe are also looking for regulatory stability because it enables them to make long-term high conviction investments.

“ ‘Our survey indicates that investors view Europe’s regulatory environment as an important factor when making allocations to private markets in the region, due in part to their long-term nature of those investments,” he said.

“Sustainability is really important to European and EMEA investors too, underpinned by a belief that the energy transition is unstoppable, irrespective of momentary political changes and momentary thematic changes.”

At AustralianSuper, sustainability is deeply embedded into the group’s governance and stewardship practices.

“ESG (Sustainable Investing) is something that we’re very attuned to,” Knott said in the IFM Report.

“Environmental impacts, governance and other social issues are front of mind across our investments. In infrastructure we pay strong attention to supply chain and labour condition standards.”

According to the research, infrastructure’s defensive, sustainable characteristics have special appeal to EMEA and Asia Pacific investors, while in North America, investors appear to be drawn to the asset class’s growth potential, especially in private infrastructure.

In North America, 48 per cent of infrastructure equity investors cite higher returns as their primary motivation, based on IFM’s research.

The IFM report found that North American investors expect net returns in the vicinity of 13.5 per cent from infrastructure equity and 9.7 per cent for infrastructure debt. This compares to 11.8 per cent and 7.7 per cent year‑on‑year in 2024, respectively.

Awash with opportunity

McKinsey estimates that US$106 trillion in global investment will be necessary through 2040 to meet demand for new and updated infrastructure.

While deal activity has remained robust in recent years, current levels of private infrastructure investment continue to fall materially short of what is needed, underlining the scale of the challenge and opportunity ahead.

There is no shortage of investment opportunities, Mody said.

“There is positive deal flow right around the globe,” she said.

“Australia is a smaller, more mature market but that doesn’t mean there aren’t opportunities there, and Europe is interesting, particularly around energy security and defence.”

When it comes to building infrastructure assets, different regions are moving at different paces, but every country and region recognises that they need to go on this journey, said Bhambra.

“China, Europe, North America and the Middle East are all running their own race, and some [regions] are long energy or long technology and it’s really interesting to observe,” he said.

“It is important to focus on quality and choose high-quality assets because in every category there is a spectrum. An experienced manager knows how to spot the difference.”