Asset owners collaborating to influence labour rights in investee companies have another string to their bow with the release of the Committee on Workers’ Capital report examining large fund manager voting performance.

The report, designed in part to help investors hold fund managers to account, looked at 13 resolutions in the 2023 proxy voting season examining the number of supported resolutions, as well as the consistency and transparency of behaviour in manager proxy voting. For example only three of the asset managers examined, Blackrock, LGIM and UBS Asset Management, actually disclosed their proxy voting rationale.

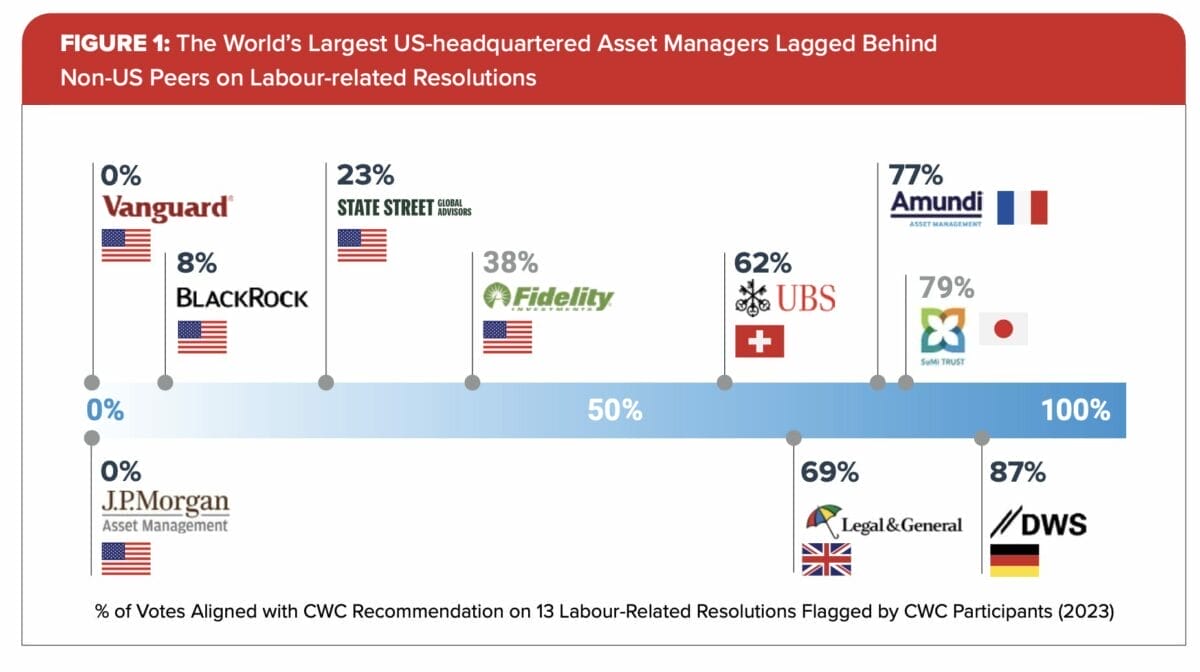

One clear result was the disparity in the behaviours of the US versus non-US fund managers, with the report acknowledging the drivers of that behaviour including the regulatory differences.

The largest five asset managers, all headquartered in the US – Blackrock, Vanguard, Fidelity, SSgA, JP Morgan – demonstrated low support for proxy votes related to fundamental labour rights in 2023. But the non-US cohort that was examined – Amundi, LGIM, UBS, DWS Group, SUMI Trust – voted in support of the proxy votes most of the time.

Hugues Letourneau, associate director of the CWC said the large shareholdings these firms have in the S&P500 meant it was essential for asset owners to engage their managers on labour rights. And he said the influence of managers is increasing, demonstrated by the AUM of the largest fund managers growing by 150 per cent in the 10 years since 2013, compared with pension assets in OECD markets which has grown by 46 per cent in that time.

“We do think when a large shareholder votes against a resolution it makes it easier for a company to turn around and say ‘our top 10 shareholders don’t care about this’,” he said. “It makes it easier to sweep it away. We want asset owners to share this report with managers and ask them what they are doing on the key issues we raise in the report.”

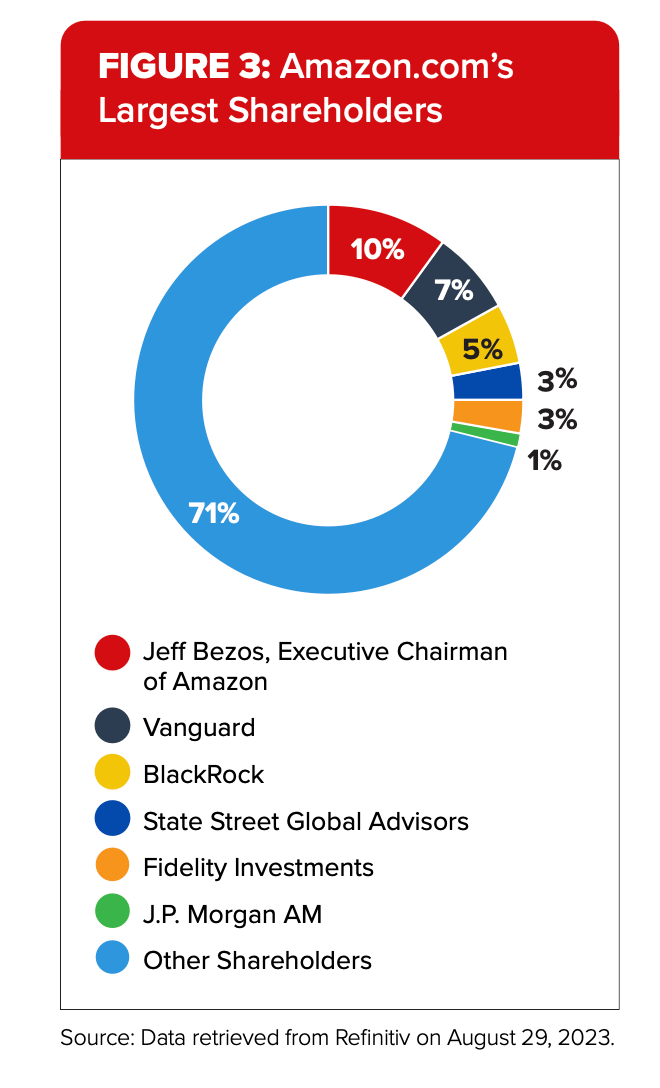

One of the resolutions examined was the freedom of association resolution at Amazon.com, co-filed by Canadian pension fund BCI, marking the first time a Canadian pension fund has filed a labour rights resolution according to Letourneau. About 20 per cent of Amazon is owned by Vanguard, BlackRock, SSgA, Fidelity Investments, and JP Morgan Asset Management.

In this case two asset managers, Blackrock and JP Morgan AM, demonstrated uneven and confusing shareholder engagement escalation pathways. They disclosed that they had been engaging with Amazon on social issues since January 2022 and yet they didn’t vote on that resolution.

The Amazon case also demonstrated an example of split voting with JP Morgan AM voting differently depending on its funds. In the case of both Amazon.com and Netflix shareholder resolutions the JP Morgan Large Cap Growth Fund voted against both resolutions, and the JP Morgan Sustainable Leaders Fund voted for both resolutions. Letourneau said this demonstrates the important role of ESG teams within fund managers to coordinate messaging and voting positions.

Letourneau is also the founder of the CWC Asset Manager Accountability Initiative, convening asset owners from around the world to engage with global asset managers on investment stewardship practices.

In the past two years it has brought groups of 15 asset owners from around the world to directly engage together with fund managers, including Macquarie, UBS, SSgA and Blackrock, in structured clients meetings. It has a scheduled meeting to discuss labour rights with Blackrock this February.