Executives at the South Carolina Retirement System pulled off a previously unimaginable task in 2020, conducting a complete review of the fund’s asset allocation, simplifying its portfolio, negotiating with suppliers, and gaining approval from the commission, all while working entirely remotely. Amanda White speaks to executive director Michael Hitchcock about the new portfolio and the process of getting there.

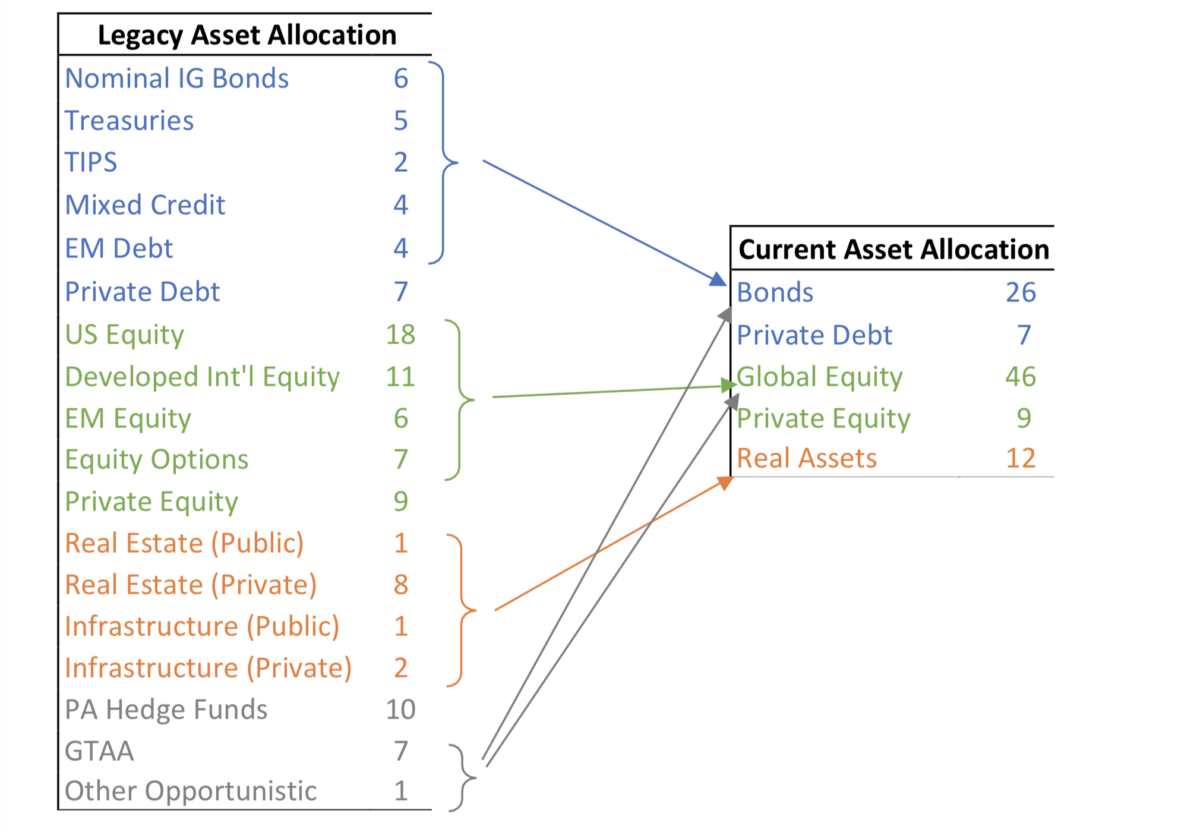

The South Carolina Retirement System has simplified its investment portfolio, moving from 18 different asset classes with 21 different benchmarks, to just five asset classes.

“We did a major redo of the asset allocation we called portfolio simplification, and we got the commission to approve it and implement it during the height of the pandemic,” says Hitchcock.

The exercise also changed the process acknowledging that the commission sets the policy portfolio and the actual portfolio, where the investor implements investments, is where complexity can show up. This now means the fund has a reference portfolio made up of stocks and bonds in a 70:30 split, which as the name suggests is a reference for the policy portfolio.

The policy portfolio was where all the action was in 2020. It is a multi-asset portfolio with similar expected volatility as the reference portfolio, consolidating the 18 exisiting asset classes into a more simplified allocation without impacting expected return.

The fund was complex and there was a concern it was over-diversified. With 18 different asset classes, many of the asset classes had small target weights, some with less than 3 per cent.

“We had a bunch of small allocations, like 4 per cent to EMD and 2 per cent to TIPS, which were always on. In the new allocation we didn’t prohibit these things but if we are adding complexity we have to have confidence to adding value,” Hitchcock says. “Simplicity is the basic premise, and complexity has to prove itself. We changed the way we thought about it.”

The fund’s portable alpha program – which is about 10 per cent of the fund in low beta hedge funds was reworked as well.

“The reworking of the hedge fund portfolio has taken a significant amount of time. We are aiming holistically for more persistence than magnitude, more diversification from a manager perspective. We don’t want a lot of snuck in beta in that portfolio,” he says. “That is benchmarked to cash plus 250, we are not looking for home runs, we just want a nice consistent 30-60bps a year at the plan level. Anyting more than that is gravy.”

In the second quarter of last year the $36 billion fund participated in $13 billion of transactions to implement this new asset allocation, all while working remotely.

“We had a look at some portfolios that weren’t as drastic, but where we got to felt right. We maintained flexibility to do more complicated things when the environment was right but were not forced into it by virtue of a target,” he says.

The new asset allocation

Consistent sources of alpha

As part of the change, the fund has moved all of its public equities to passive indexed to the MSCI ACWI IMI Net. It consolidated from 12 managers down to three, working primarily with Blackrock and State Street. Similarly most of the bond allocation is indexed to the Bloomberg Barclays Aggregate with a small portion off benchmark in emerging market debt and high yield.

Instead the focus is on part of the portfolio where it sees a possibility to get consistent outperformance over the public market equivalent, so asset classes like private equity, private debt and real estate.

“There is no room for complexity in public equities,” says Hitchcock. “We have a time horizon of 40-50 years, we are a decades long investor. We are not going to find an active manager that can outperform over that stretch of time, why pay for the opportunity to earn less.”

Similarly in bonds the fund wants the opportunity to add value through complexity but not to have a constant allocation.

“We want to look at when is the opportunity right to get paid for that complexity, it frees us up to think about timing. We are not trying to be cute and market time but look at when the environment is right.”

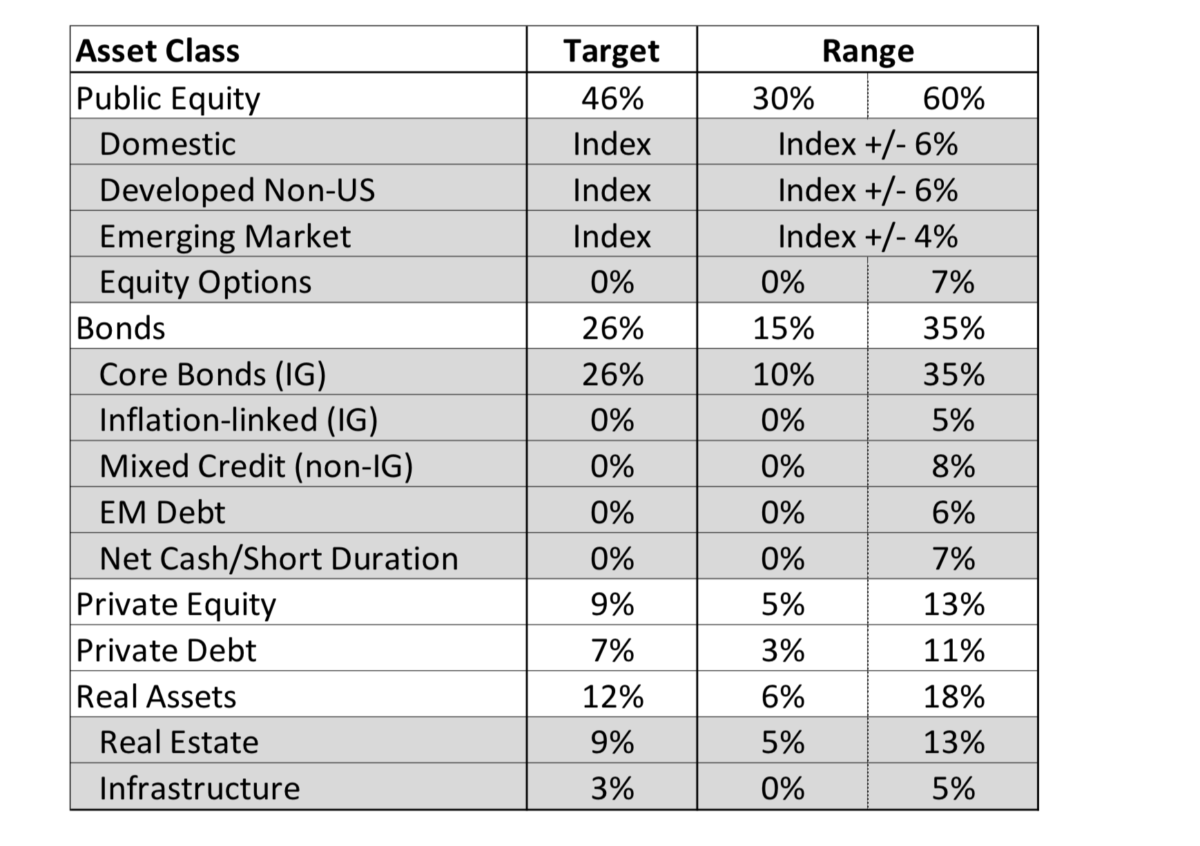

The implementation portfolio has flexibility for the investment staff to make decisions around those opportunities. The target allocation is 26 per cent in investment grade core bonds but there is a range of 15-35 per cent with potential investments in EMD, high yield and cash.

In the alternatives allocations – which is private equity (9 per cent), private debt (7 per cent) and real assets (12 per cent) – the fund spent a lot of time ensuring it built the right process including a lot of time on rebuilding investment and operational due diligence.

Albourne was hired as a speciality consultant and the due diligence is aligned with the consultant’s view of the manager.

“The more conviction Albourne has then the less independent work we do and vice versa. We want to create the confidence the manager can add value.”

Last year the fund launched a co-investment private equity program in a bid to reduce risk and enhance returns and Hitchcock says that has generated a lot of deal flow.

“In our private market portfolio we’ve been spending a lot of time on the coinvestment program and seen a lot of success in getting deal flow and that program has really taken off. We’re trying to get that to about a third of the 9 per cent allocation to PE.”

Also within private equity he says the fund has been looking to move more down market away from the mega leverage buyouts into middle and smaller end of the market.

The implementation portfolio

Change for the better

It is hoped the simplification of the asset allocation will enhance returns, reduce costs, free the investment team to be more opportunistic and increase accountability.

“We looked at how to help enhance return and freeing ourselves to focus on where we can get outperformance which is more in private markets.”

The SCRSIC has long had a focus on fee transparency and is a leader in the industry, particularly in the private market fee disclosure.

Hitchcock says the new asset allocation reduces cost. In public markets for example the fund previously spent $20-40 million a year on fees, and the portfolio is now indexed.

“And holistically from managing the firm perspective this gives you the ability to focus resources on where you’ll find some alpha.”