The finance literature has firmly established a size factor exists – stocks with small market capitalisation outperform larger stocks over the long-term. The size factor has recently come under attack from smart beta providers, for a simple reason: its performance has lagged behind that of other factors. A common recommendation is to remove size from the factor menu, to give more weight to factors with better performance.

This recommendation is in stark contradiction with the academic evidence on factor models of equity returns. The academic literature sees the size factor as an important driver of return differences across equity portfolios. The commonly prescribed models thus include the size factor, as confirmed by the most recent research. In fact, removing the size factor deteriorates explanatory power more than removing any of the other standard factors.

Where does this difference in judgement on the size factor come from? Smart beta providers typically compare the performance of size to other factors. When testing asset-pricing models, academics ask whether a factor carries information not captured by the other factors in the model. In other words, they account for interaction across factors. Similarly, investors are interested in how a factor contributes to investment outcomes when used alongside other factors. Even if it does not have the highest returns, a factor is useful if it provides diversification benefits with respect to other factors.

The Size premium

Exhibit 1 shows factor premia in US equities over the past 55 years. The size factor only had a 0.24 per cent monthly return. While this is significantly different from zero, it falls short of the returns achieved by other standard factors. The momentum and low risk factors came with premia that were roughly three times larger.

However, for multi-factor investors the relevant question is whether the size factor delivers a premium after adjusting for implicit exposures to the other factors. Among the implicit exposures, we account for the market, value, momentum, low risk, high profitability and low investment factors. Similar to the adjusted size premium, we obtain adjusted premia for each of the standard factors.

The size factor still generates a significant premium after adjustment. In fact, its premium remains unchanged compared to its stand-alone return. For the other factor premia, we observe a reduction when we account for their implicit exposures. The reduction is strongest for the value, low risk and low investment factors. This suggests that returns of these factors are partly explained by their implicit exposures. After adjustment, the size premium is at least as high as the value, high profitability and low investment premia. Only momentum and low risk still show a higher premium than Size.

Exhibit 1: Equity Factor Premia (monthly average)

The table reports average monthly returns and average monthly alpha from a six-factor model that includes all the factors other than the dependent variable. Data is for US equities from July-1963 to December-2018. T-statistics are reported in the parenthesis. Coefficients, which are significant at the 5% level are highlighted in bold.

| Size | Value | Momentum | Low Risk | High Profitability | Low Investment | |

| Average Return | 0.24% | 0.32% | 0.66% | 0.83% | 0.26% | 0.28% |

| (2.04) | (2.99) | (4.10) | (6.53) | (3.06) | (3.64) | |

| Returns adjusted for exposure to other factors | 0.24% | 0.04% | 0.59% | 0.30% | 0.24% | 0.16% |

| (2.09) | (0.45) | (3.68) | (2.65) | (3.14) | (3.04) |

We stress the finding that the implicit exposures of the size factor have no impact on its premium. That the size factor delivers returns that are unrelated to other factors, should make it a valuable component in multi-factor portfolios.

The role of size in multi-factor portfolios

We have assessed factor allocations that maximise the risk/return ratio over our long-term period of analysis. We find that size receives a weight of more than 9 per cent in the optimal portfolio, which is greater than that of value (3 per cent), and close to that of momentum (11 per cent) and low risk (12 per cent). This result is striking. Recall that the average returns of momentum and low risk were about three times higher than the returns of size. Yet, the optimal allocation to size is only slightly lower than the allocation to momentum and low risk.

Despite a lack of stellar returns, the size factor improves the risk/return properties of a multi-factor portfolio. Of course, an optimal portfolio will allocate to a factor not only based on returns, but also based on volatility and correlation with the other factors.

To assess the relevance of each factor for a diversified multi-factor portfolio, we can ask the following question: what is the hypothetical level of return at which the factor becomes unattractive to an investor? We can answer this question by gradually decreasing the return assumption for a given factor until the optimal portfolio assigns zero weight to it. If the premium of a factor were at this indifference level, investors would not get any benefits from including it in their portfolio.

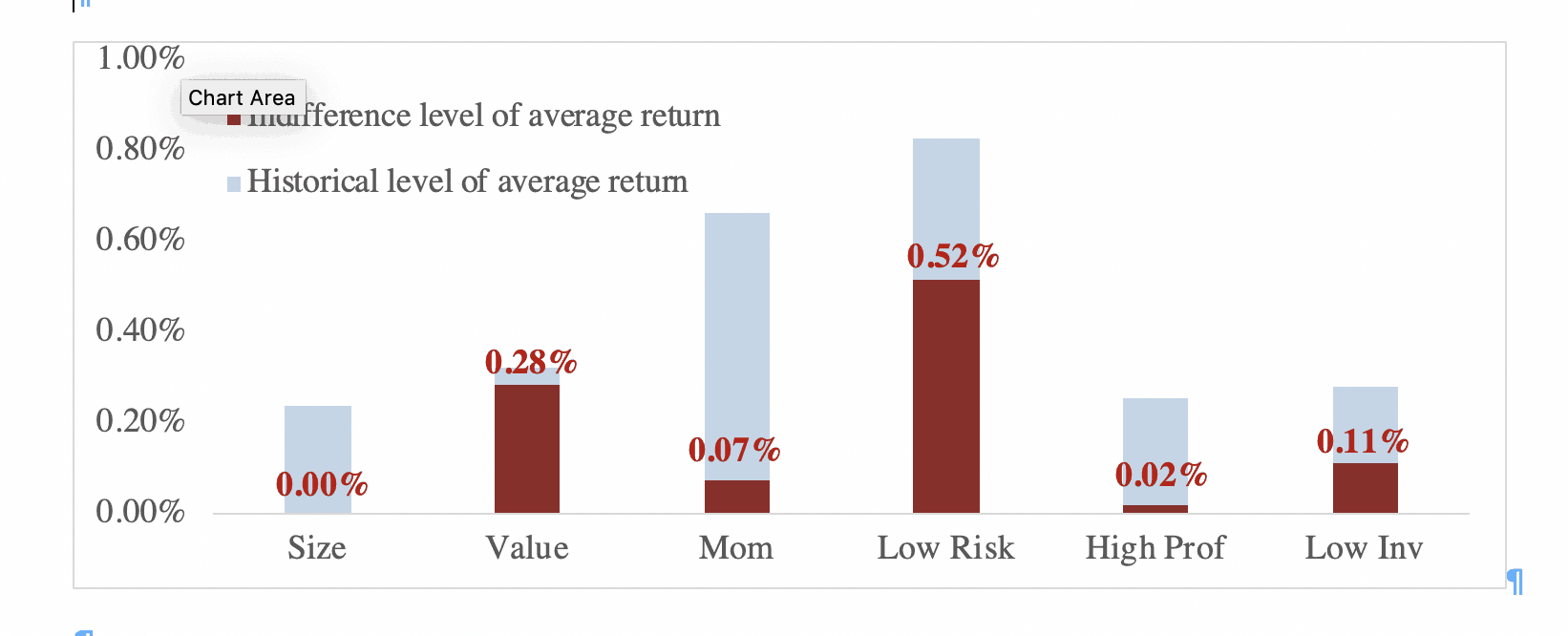

Exhibit 2 shows the indifference level compared to historical average return. Even at a return of zero, the size factor deserves inclusion in a multi-factor portfolio. In contrast, the low risk factor would cease to add any value to a portfolio even with returns as high as 0.52 per cent per month. The value factor is no longer attractive if we reduce its expected return to 0.28 per cent per month, which is only four basis points below its historical average. Somewhat similar to the size factor, the momentum and high profitability factors would tolerate substantial reductions in premium before warranting exclusion.

Exhibit 2: Indifference level of return vs. historical level (monthly average)

Reported figures correspond to expected returns at which the weight for the given factor in the mean-variance efficient (MVE) portfolio becomes zero. Data for US Equities from July 1963 to December 2018.

Why do some factors remain attractive after a sizable reduction of their premium? This is because such factors provide diversification benefits in addition to contributing to returns. A factor that provides strong diversification benefits will receive a positive weight, even if we assume that its premium is low. A low indifference premium thus reflects strong diversification benefits.

Why do some factors remain attractive after a sizable reduction of their premium? This is because such factors provide diversification benefits in addition to contributing to returns. A factor that provides strong diversification benefits will receive a positive weight, even if we assume that its premium is low. A low indifference premium thus reflects strong diversification benefits.

Size is one of the factors with the most pronounced diversification benefits. Therefore, it would be included in the optimal portfolio, even if its average return were close to zero. The fact that value and low risk need to command a relatively high premium reflects that they have low diversification benefits relative to the other factors in the menu.

We find similar diversification benefits of the size factor when accounting for macroeconomic conditions. For example, size is less sensitive to interest rate shocks than other factors. Exposure to the size factor allows investors to counterbalance the high interest rate sensitivity of factors like value, low risk and low investment.

The size factor is alive and well

If your objective had been to pick the best performing factor, size would not have been a good choice historically. However, if you were looking to hold a diversified factor portfolio, size would have been a valuable addition. Due to its low correlation with other factors, size offers substantial diversification benefits. Investors need to look beyond stand-alone performance and consider such diversification benefits when selecting factors.

The Scientific Beta white paper from which this article was drawn can be accessed through the link below:

Mikheil Esakia and Ben Luyten are quantitative research analysts and Marcel Sibbe is quantitative equity analyst at Scientific Beta. Felix Goltz is research director at Scientific Beta and head of applied research at the EDHEC-Risk Institute.