A recently released CFA Institute report entitled the Investment Professional of the Future provides answers to how investment professionals can stay relevant in the face of imminent changes to professional roles and the commensurate skills required. The first article in the series highlights those changes, while this article outlines a roadmap on how investment professionals can navigate the accelerating change and disruption affecting the investment industry.

The career flywheel

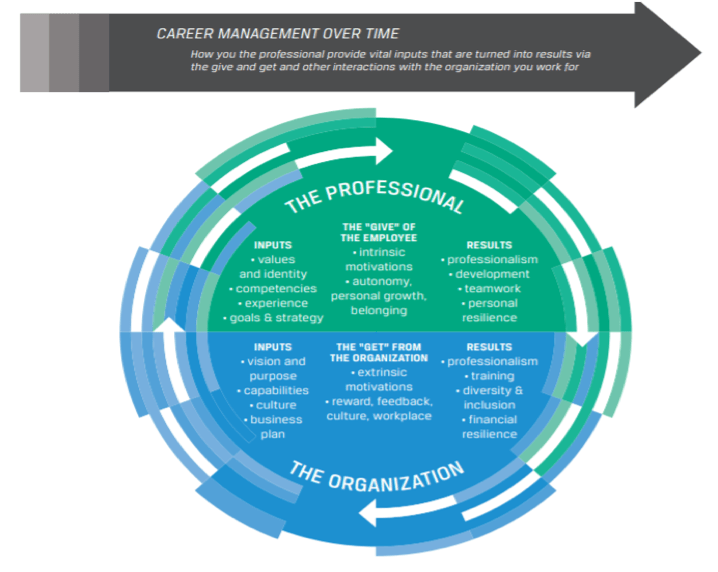

Although personal character and resilience have always been critical to advancing one’s career, 89 per cent of industry leaders surveyed as part of our research agreed that individuals’ roles will be transformed multiple times during their careers. This continual evolution of responsibilities will force investment professionals to be highly adaptable and to continually develop new skills over time. The first step in the roadmap is to keep learning and adapting and to embrace active career management by using the career flywheel.

Just like the mechanical flywheel that provides continuous energy when the energy source is intermittent, an effective career flywheel sustains its momentum through a series of intentional and appropriately scheduled intercessions and adaptations during a professional’s career journey.

THE CAREER FLYWHEEL

There are various factors that keep the flywheel turning, which are dependent on the interactions and alliances built between motivated professionals and empowering employers. Employees need to provide a combination of solid work experience, competencies, knowledge, and the appropriate skills and motivations, as well as the desire to keep learning and developing. Critical success factors include a desire to keep learning and having a growth mindset. They also require building a “give and get” alliance with each employer, giving value to the employer, and getting explicit and indirect rewards such as personal empowerment, development opportunities, and feedback for further development.

This is all done while maintaining healthy work-life integration that will help support career resilience and new development opportunities. Our report’s interactive website provides users with a 15 question self-assessment to see how their past experiences and future ambitions compare with those of more than 3,800 investment professionals globally to help them determine how they can increase their career adaptability.

Adapting to changes in professional roles also means being open to the impending role changes. This necessitates being proactive by developing a career management framework that includes the career flywheel principles and by investing time into career management and the actions necessary to maintain career resilience and mobility.

The skills pathway

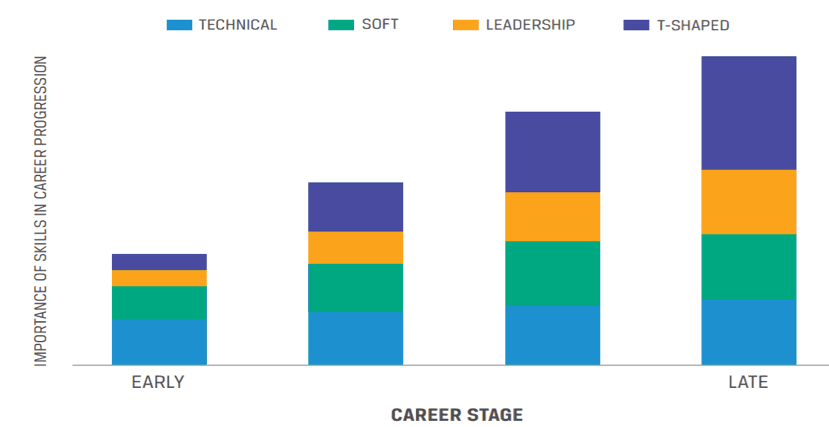

Another step recommended by our roadmap is applying the skills pathway. The pathway relates to progressively building four core skills – technical, sort, leadership, T-shaped — over time as one’s career advances. These particular skills are ones that are becoming more highly valued over time and are essential for investment professionals to take on greater responsibility and leadership positions. Another reality facing investment professionals is that escalating industry change is not just altering the importance of specific skills but also requiring professionals to build a portfolio of diverse skills and abilities.

At the start of a career, professionals should build an appropriate foundation by building a technical edge and then add increased soft skills aptitude for mid-career effectiveness. Greater upward career mobility requires improving leadership capabilities that produce value from managing and influencing others.

Over time, individuals also build T-shaped skills, meaning combining domain-specific specialist knowledge and wider professional connections, understanding, and perspective. Indeed, it is difficult to see how many senior roles in investing could exclude T-shaped skills.

SUGGESTED SKILLS PATHWAY

Although all four skills are highly valued, the investment industry leaders surveyed rank T-shaped skills as the most important future skill category (49 per cent rank these first), followed by leadership skills (21 per cent), soft skills (16 per cent), and then technical skills (14 per cent). Obtaining these skills along a career journey allows investment professionals to create a diverse skills portfolio and forward-thinking career plan.

Be tech savvy

The last step of our roadmap advocates that investment professionals become tech savvy and that they navigate and harness technology. Being tech savvy doesn’t mean simply having a facility for technology or being able to explain its use, but it is about being able to leverage technology to improve client outcomes and employer performance.

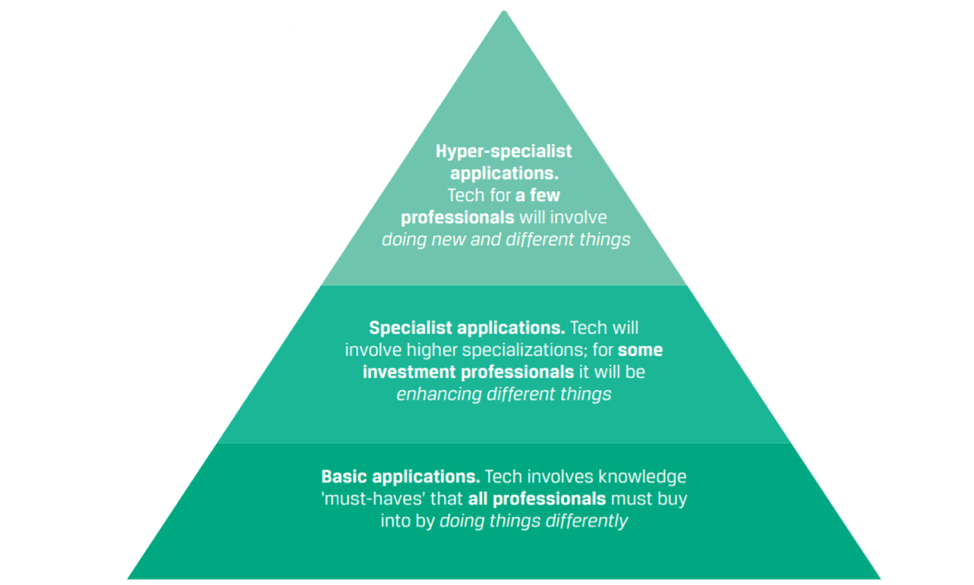

A large degree of the industry change and disruption expected in the next 5-10 years will be due to accelerating technological innovation, and the ability to work with technology is a clear necessity for all professionals. This dictates that investment professionals understand and embrace the three major effects of technology—basic, specialist, and hyper-specialist applications.

TECHNOLOGY HIERARCHY OF IMPACTS

At the bottom, the basic applications suggest that all investment professionals will have to do things differently, and they must be more comfortable using and understanding technology.

- In the middle tier, specialist applications are where investment management and technology teams work together, and T-shaped skills are more important. Here, AI can deal more and more with unstructured data and is better at identifying patterns in information, but it’s dependent on the quality and quantity of information available and humans to determine the signal from the noise.

- At the top, hyper-specialist roles will be less common but very valuable. This includes roles for data scientists, those at quant firms and AI labs.

The key point in being tech savvy is that professionals understand and use technology effectively and ensure that it serves them and their clients — and not the other way around.

Moving Forward

The investment professional of the future will need to take a more active and hands-on approach to their career management as the pace of change continues to accelerate. Professionals will need to pay attention to the changing value of skills and tech innovation to structure a development path that can fulfill the changing needs of employers and clients.

Bob Stammers, CFA, is the director of investor engagement at the CFA Institute and a member of the Future of Finance team at CFA Institute.