As the investment industry continues to experience accelerating change and disruption, what will the effect be on investment roles and required skills? What do investment professionals need to do to stay relevant, and how will organizational cultures need to adapt to attract the best talent?

These questions motivated the recently released CFA Institute report Investment Professional of the Future, which looks out over the next 5-10 years and incorporates input from more than 4,000 individuals globally—a combination of industry-leader survey respondents (more than 130), CFA Institute member and candidate survey respondents (3,800+), and 100-plus participants in a series of qualitative roundtables around the world.

This article is the first in a series and will provide an overview of our findings; articles will follow outlining roadmaps for investment professionals and organizations.

Size and growth of the market for investment professionals

In order to understand the availability of talent in different markets, now and in the future, CFA Institute commissioned Mercer to determine the market size and growth of core investment professionals, defined as those who are influential in managing investment strategy and portfolio construction, including portfolio managers, analysts, and private wealth managers, among others. This resulted in an estimate of 1.05 million core investment professionals, a number that is expected to grow to 1.2 million over the next 10 years, a compound annual growth rate (CAGR) of 1.5 per cent.

This anticipated growth rate was consistent with our industry-leader survey results. Market growth regionally is expected to vary from a CAGR of 2 per cent in Asia, to 1.4 per cent in EMEA, and 1 per cent in the Americas. India and China are expected to grow faster than the average, at 2.9 per cent and 2.3 per cent, respectively.

Changing roles and skills

Changes affecting the world of work in the next 5-10 years are expected to be significant, constant, and intensifying:

- 48 per cent of CFA Institute members and candidates surveyed anticipate that their current role will change significantly or become non existent in the next 5-10 years. This is the case for 58 per cent of financial advisers and 57 per cent of risk analysts.

- Meanwhile, 89 per cent of industry leaders believe that investment roles will transform multiple times during an investment professional’s career, making adaptability and life-long learning essential skills for future success.

- 77 per cent of industry leaders expect greater change to the world of work, including roles, skills, work methods, workplace features, compensation, and incentives.

The amount and extent of role transformation will require individuals to actively manage their skill progression, and firms will need to partner with their employees on professional development to ensure they maintain an appropriately trained staff. Among industry leaders surveyed, 61 per cent expect that investment firms’ commitment to training and development will increase. Regionally, this is higher in Asia Pacific and EMEA (71 per cent) versus the Americas (46 per cent).

Most important skills

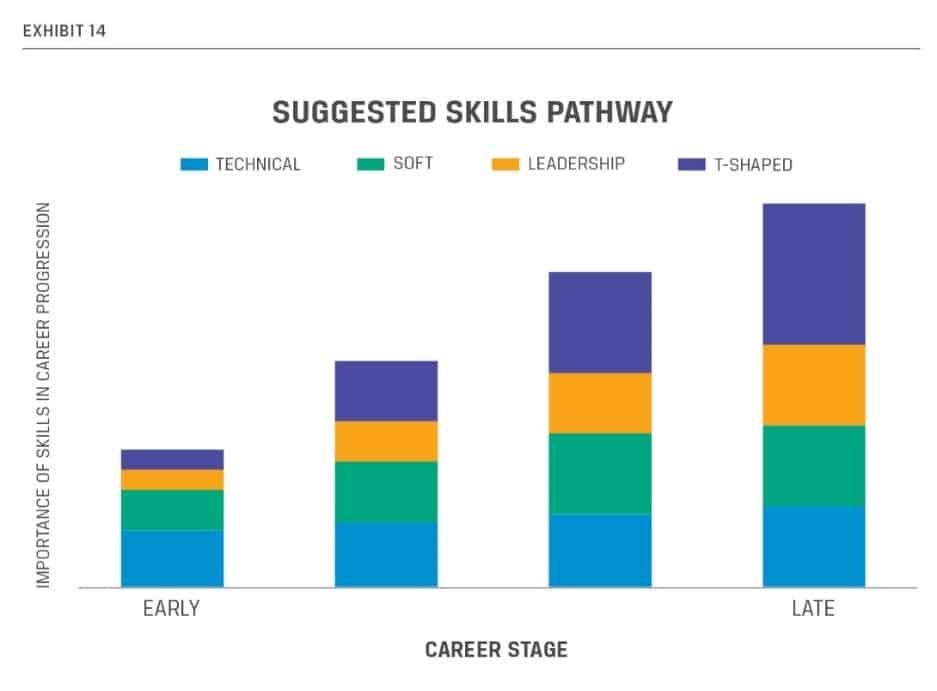

The Investment Professional of the Future describes four categories of skills that investment professionals need to develop over time to gain the experience and abilities needed for advancement.

- Technical skills are those we most often focus on through structured programs. While clearly essential to build competence, it is the category the least number of industry leaders (14 per cent) rank first in future importance. Of these, solution skills are deemed the most important, namely the ability to understand client needs and develop appropriate investment portfolios.

- Soft skills are most important to 16 per cent of industry leaders. Despite this relatively low number, soft skills are the most difficult skills to find in the industry, according to industry leaders. These include: communication, presentation, and relationship building skills, but also creativity and innovation skills, which topped the list of skills missing in the current landscape. Among the members and candidates surveyed, soft skills are the most common skills under development, which makes sense given their relevance across specialties.

- Leadership skills are ranked slightly higher at 21 per cent, and among these the ability to articulate a mission and vision ranks as the most important. Others include instilling an ethical culture, governance, and crisis management.

- T-shaped skills are considered the most important for the future by 49 per cent of industry leaders. These skills combine deep subject matter expertise (represented by the vertical bar of the letter T), and a wider knowledge of other disciplines or areas in the financial ecosystem (represented by the horizontal bar of the letter T). Examples include situational fluency and adaptability, understanding and leveraging diverse perspectives, and cultivating a valuable network of contacts. As fintech becomes more important, T-shaped teams can bring together economic intuition and technology expertise.

The mix of relevant skills changes over one’s career. In the skills pathway, technical skills are the most important on a relative basis at the beginning of one’s career, and the value of the other skills increases over time, with emphasis on leadership and T-shaped skills in the latter part of one’s career.

Next steps

Next steps

For investment professionals, active professional development is needed for career adaptability. Individuals must develop a growth mindset and put energy into actively managing their careers and skill pathways. Life-long learning is crucial to stay relevant and valuable.

The good news is that investment professionals like to learn. On the job, they spend about 30 per cent of their time learning new things versus doing familiar work. In terms of aspects of an employer that are most important to them, the opportunity for personal growth exceeds all others by a large margin, and learning new things is one of the biggest motivators for investment professionals, even more than financial compensation.

Meanwhile, there is an important role for leaders of investment firms to play. Employers committed to training and professionalism will have an edge as firm culture becomes a differentiator to attract top talent. Leaders will need to guide their firms through substantial changes in how work gets done, and in particular, they will need to communicate how technology will change their business and impact individual roles—both disrupting and enhancing career paths.

We will outline the roadmap for investment professionals in our next article and then the roadmap for investment organizations.

Rebecca Fender is head of the future of finance initiative, and Bob Stammers is the director of investor engagement at the CFA Institute. They are both members of the future of finance team.