More investors around the world are looking at how to invest with a diversity lens. Amanda White examines how investors in Japan, Sweden, the US and Canada are addressing the diversity question as part of their internal organisation and in their investments and the managers they work with.

Studies by McKinsey, Boston Consulting Group and Credit Suisse have laid out the economic reasons for investing in women. They show that companies with women on the board have more effective organisations and higher revenues, and that filling in the gender gap – women make up only 39 per cent of the global workforce – could push global GDP up by 11 per cent.

The fact that improving gender diversity can potentially boost economic growth, combined with the evidence that companies with strong gender diversity have the potential to outperform those without, was the motivator for the world’s largest investor to allocate assets to track a diversity index.

The $1.4 trillion Japanese GPIF has invested $3 billion tracking an index developed by Morningstar and Equileap that is based on 19 gender equality criteria.

The strategy allocates to 1,765 large and mid-cap equities from the US, Canada, Western Europe, Israel, Australia, Hong Kong, New Zealand and Singapore which are weighted according to both their Equileap gender equality score and their market cap.

For GPIF it is part of a $12 billion investment in two ESG equity indices, which also includes a $9.7 billion allocation to MSCI’s ACWI ESG Universal index.

Equileap is the Dutch-based provider of gender equality data and insights and measures 4,000 companies globally, which CEO Diana van Maasdijk says is enabling investors to make more informed decisions with regard to the impact of gender on the companies they invest in.

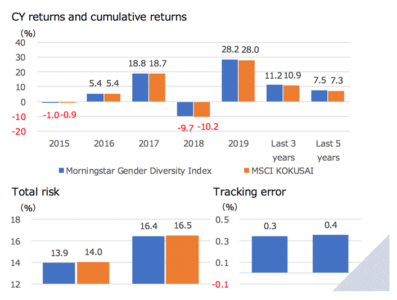

GPIF’s Morningstar Developed Markets (ex-Japan) Gender Diversity Index

It looks beyond just ownership of a firm to various metrics including gender balance across the workforce, the gender pay gap, paid parental leave and anti-sexual harassment policies. It looks at positive attributes such as training and career development, parental leave, flexible work options, women in senior positions and commitment to women’s empowerment. But it also monitors negative controversies such as incidents involving sexual harassment.

Van Maasdijk has been researching companies since the company was founded in 2016, and while every year there is an improvement she says there is still a long way to go, with the best companies still only scoring 75 per cent.

“We have seen more transparency about women and how companies employ women but still some don’t disclose that. Only 15 per cent of companies publish on the pay gap which is still very little,” she says.

In the latest data from Equileap, only 15 companies globally have closed their gender pay gap in the past year, and only 10 companies globally have achieved gender balance at all levels. “We must do better,” she says.

Groups like the 30% Club have also been working for years to make progress in listed companies and the fact there are no all-male boards left across the FTSE 350 in a victory for the 30% Club.

Jason Lamin, founder of Lenox Park Solutions that ranks asset managers on diversity data, says assessing, managing and changing diversity, equity and inclusion is set to become the data issue of the 2020s, as investors turn their attention to the power they have to advocate for change in the companies they invest in, and the firms that manage their money.

People have discussed the importance of diversity for decades and everyone understands the social good inherent in diversity. Yet the catalyst for change has only come since investors started looking at diversity through a risk lens.

“This has provided a different motivational factor,” said Lamin, citing diversity risks like group think, the inability to attract the best talent, or the reputational risk that comes with discrimination or staff harassment.

Investors such as GPIF licence the Equileap data directly as well as use the Morningstar indices. Other providers also use the data, such as the UBS Global Gender Equality UCITS ETF which has grown to more than $600 million since its launch just three years ago with $12 million.

Equileap has also been talking to pension funds in Sweden including AP2 which has been investing in diversity since its inception in 2001.

“We work with diversity because we know it creates value,” says Ulrika Danielson, head of corporate governance at AP2. “We want to spread knowledge and be part of the debate on these issues, to put diversity high on this agenda.”

Since 2003, AP2 has monitored the percentage of women on the boards and executive management of Swedish companies publishing an annual report, AP2’s Female Representation Index, which it uses primarily as an engagement tool.

Diversity is one of the four focus areas within sustainability at AP2 and it actively invests in SDG5.

Diversity is one of the four focus areas within sustainability at AP2 and it actively invests in SDG5.

“We have internally developed indices for global equities with exposure to various ESG factors such as women in leadership positions. There is an indication that the proportion of women in a company has contributed to positive return.”

AP2 also invests in a women entrepreneur debt fund, which promotes lending in emerging countries and contributes to economic growth in emerging markets focusing on women entrepreneurship. On the debt side AP2 has also invested in a social bond issued by the World bank focused on equality.

Danielson says diversity is also prioritised when the fund invests in private equity and it uses a model for evaluating sustainability in private equity with 25 assessment points which includes diversity and inclusion.

“In dialogue with managers we raise questions like: what does diversity look like in your employees and management, is the issue given priority, do you have policies and guidelines, how are they embedded? We want to drive change and monitor this very closely and continuously.”

“We want to spread knowledge and be part of the debate on these issues, to put diversity high on this agenda.”

In a sign of how seriously the fund takes this, managers have missed out on mandates because they have not satisfied the diversity criteria.

“It is important for us to have a dialogue and try to put the issue on the agenda,” she says. “To see change, that’s the most important thing, it could be that we decide not to invest.”

Holding managers to account

In a poll of more than 120 investors from 32 countries at the Top1000funds.com March Sustainability event, 59 per cent of asset owners said they already hold fund managers to account on DEI issues and a further 18 per cent said they plan to in the next 12 months.

Many investors are starting to put specific data around diversity expectations of external managers. The Australian superannuation fund HESTA for example has a target of 40 per cent female fund managers among its external managers.

Consultants are demanding more detailed data on diversity from asset management firms, on behalf of their clients, and there are now 22 consulting firms with total assets under advisement of over $32 trillion signed up to the Institutional Investing Diversity Cooperative (IIDC), which was formed at the beginning of 2021, with the belief that diverse investment teams and viewpoints enhance investment decision-making.

Do you hold fund managers to account on diversity equity inclusion (DEI) issues?

It looks beyond just ownership of a firm to various metrics including gender balance across the workforce, the gender pay gap, paid parental leave and anti-sexual harassment policies. It looks at positive attributes such as training and career development, parental leave, flexible work options, women in senior positions and commitment to women’s empowerment. But it also monitors negative controversies such as incidents involving sexual harassment.

Van Maasdijk has been researching companies since the company was founded in 2016, and while every year there is an improvement she says there is still a long way to go, with the best companies still only scoring 75 per cent.

“We have seen more transparency about women and how companies employ women but still some don’t disclose that. Only 15 per cent of companies publish on the pay gap which is still very little,” she says.

In the latest data from Equileap, only 15 companies globally have closed their gender pay gap in the past year, and only 10 companies globally have achieved gender balance at all levels. “We must do better,” she says.

Groups like the 30% Club have also been working for years to make progress in listed companies and the fact there are no all-male boards left across the FTSE 350 in a victory for the 30% Club.

Willis Towers Watson advice to asset owners

-

-

-

-

Collect data for a portfolio look-through

-

Create diversity score for context

-

Target focus areas for engagement/improvement

-

Track progress

-

Advise that they target a 50% improvement in diversity score through new ideas and engagement with incumbents

-

-

-

xx

Heier says the questionnaire asks for two sets of information. On the qualitative side what are the managers doing around DEI, recruitment, retention, pay equity, and other practices. The quantitative side looks at the product level details. If a manager has 50 products, each of those will be assessed on diversity by measure of ethnicity, gender and veteran and disablement.

“So far about 18 per of the eVestment database has been assessed. So there is some room to go my personal goal – I want to get to 50 per cent by June 30,” she says.

Critically by the consultants all coming together in a coordinated and standardised approach, it makes it easier for asset managers to provide data and get critical mass.

Despite the progress there are a number of firms that still haven’t provided diversity data – with only one of the top 10 firms committing so far (Wellington).

“The bulk of the assets are in the top 10 managers – Blackrock, State Street, Wellington, Vanguard etc, and only one of those firms is participating at this point – only one of those top 10 firms is involved. I’m really surprised they haven’t been more forthcoming,” Heier says.

In the paper, Diversity in the asset management industry, Willis Towers Watson outlines its manager research process which incorporates an explicit assessment of diversity with a goal of identifying managers with optimal cognitive diversity. Since 2018 the consultant has completed more than 100 culture reviews of which inclusion and diversity is a key component.

The initial findings of its assessment show a positive link between diversity and performance outcomes. It has looked at information on a cohort of 400 products across a number of asset classes over several years, including benchmark-relative returns, tracking error and diversity, and found that investment teams with diversity, in particular ethnic diversity, tend to generate better excess returns.

Co-founder of the Thinking Ahead Institute at Willis Towers Watson, Roger Urwin says fundamentally, investment is a human-talent endeavour.

He says while the industry has shifted knowledge and power from the individual to the collective – to teams over stars – but investment organisations have not focused enough on the important dynamics of teamwork and team thought, or cognitive diversity, as part of this shift when building more diverse workforces.

“This is surprising, given the industry’s challenges are becoming increasingly complex, multi-layered and inter-connected, and in need of multiple insights in order to be successful,” he says. “The critical starting place should be with diversity in its sophisticated form of diversity, equity and inclusion (DEI). And with an understanding that diversity is the presence of differences; equity is the respect for differences; and inclusion is the leverage of differences.”

Racial diversity

Canadian institutional investors managing more than $2.3 trillion in assets have signed the Canadian Investor Statement on Diversity & Inclusion.

The statement looks at the role that institutional investors can play in contributing to inequities in Canada by taking intentional steps to promote diversity and inclusion across portfolios and within their organisations.

Signatories to the statement, which include some of the largest institutional investors in the country, acknowledge the existence of systemic racism and its impacts on black and indigenous communities and people of colour, while further acknowledging the existence of inequities and discrimination based on other factors including, but not limited to, gender, sexual orientation, age, disability, religion, culture and socio-economic status.

Kim Thomassin, executive vice-president and head of investments in Québec and stewardship investing at CDPQ, said long-term investors have an important role to play in engaging portfolio companies towards best practices in terms of diversity.

“It has been shown that diversity is a lever for improving performance, which is why CDPQ has positioned diversity and inclusion as a pillar of its sustainable investment strategy. Moreover, we understand how inclusion is closely related to equal opportunity and social justice. We encourage our peers to make this subject a priority,” she said.

Another Canadian investor, the C$204 billion PSP Investments, is also focusing its efforts on anti-racism and equal opportunity, and has signed the BlackNorth Initiative, by which it pledges to work toward ending anti-Black systemic racism. It also introduced a Veteran Integration Program pilot program which includes a personal development plan, coaching, mentoring and sponsorship support.

Over the past few years the largest fund in the US, the $444 billion CalPERS has engaged 733 companies on the lack of diversity on its boards in the last five years, 53 per cent of those companies have added a diverse director to their boards.

In an interview that is part of a podcast series Sustainability in a time of crisis chair of the fund, Henry Jones, also outlines the fund’s plan to look at racism in its portfolio.

“This is both a moral imperative and economic necessity and corporate accountability is vital. We welcome the attention brought to this issue in business, and tracking racism,” he said, adding that CalPERS is undertaking a new research project to identify where to focus attention to make progress.

“Mapping racism as a systemic risk means we should track this across the portfolio, but right now we don’t have the tools or the data. It is not unlike where we were on climate as a systemic risk; we didn’t have the information and had to build a data model and action plan with our partners. We need to do that with addressing racism and have commissioned research on this.”

Internal hiring and nurturing

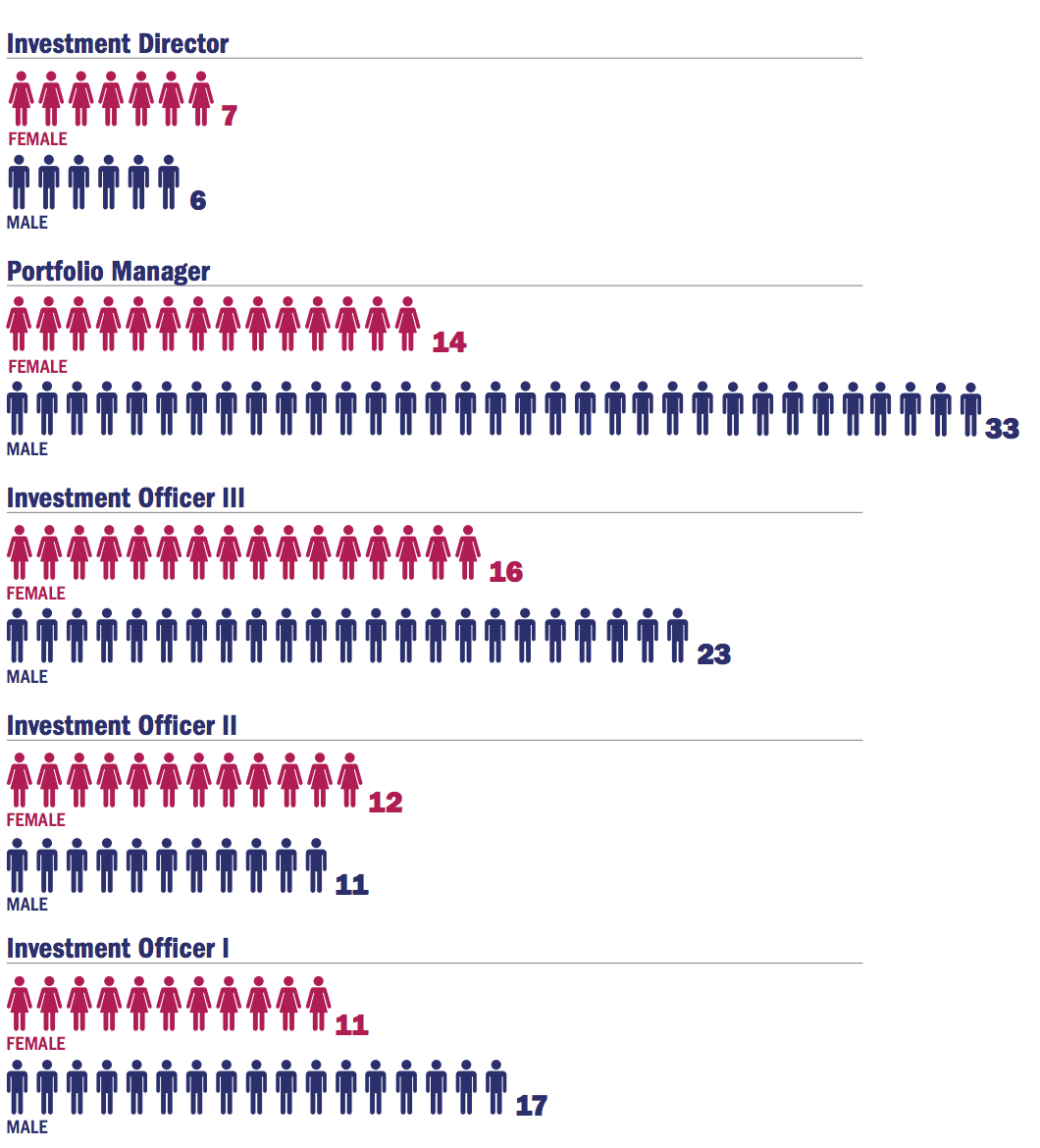

In a shout out to Peter Drucker’s mantra of what gets measured gets managed, one of the leaders in transparency around diversity is the $306 billion CalSTRS, which has published an annual diversity report for more than 10 years. It outlines the progress of the fund with regards to diversity including the rare feat of (almost) gender parity in its investment team, and the establishment of an internal diversity steering committee consisting of leaders across the investments branch whose first task included examining and redefining diversity in investments.

CalSTRS also engages investee companies for more diversity on boards – including voting against companies with zero women on their boards – and holds diversity and inclusion workshops with CalPERS (of which there is one this week) while continuing to support emerging managers with more than 15 per cent ($15.5 billion) of its externally managed investments with emerging managers.

Chris Ailman, the fund’s CIO, says investors should be measuring and managing diversity as a critical part of their human capital management efforts.

“Just as we would not hesitate to measure and manage the diversity of our portfolio risk, we need to do the same with our investment teams,” he says.

“Second is pipeline, parity and promotion. I believe human capital is the most important asset in the investment management industry. Diversity of people brings diversity of thought and that leads to better risk adjusted outcomes and better investment decisions. Therefore, diversity is critical to our industry and a key requirement to improving results.”

The Human Capital Management Coalition is a cooperative effort among a diverse group of influential institutional investors to further elevate human capital management as a critical component in company performance.

The HCMC is led by the UAW Retiree Medical Benefits Trust, with CalSTRS co-leading the group of 29 institutional investors representing more than $4 trillion in assets under management.

CalSTRS investment team by gender

In a survey of investors at the Top1000funds.com Sustainability conference in March, asset owners were asked what percentage of their own internal teams were women. The results demonstrate there is still a long way to go before asset owners reach the heights they are expecting from their managers and companies they invest in.

But diversity is more than gender, and successful inclusion is more than hitting a target. Kresge’s Ohmer says it is incumbent on the organisation and existing executives to change the culture of an organisation, not the new diverse employees.

What percentage of your investment team are women?

“Once they are in your organisation you have to listen to the diverse people and change your organisation to accommodate them. If drinking wine or playing golf was the thing, then it is incumbent on you as the leader to find something to bring them inside the loop,” he says.

“Expecting the diverse person to change their behaviour to accommodate you is furthering the problem, you have to be just as thoughtful.”

Kevin Ubelein, the outgoing CEO of AIMCo and chair and founder of the AIMCo Foundation for Financial Education, agrees that creating an inclusive culture has to come from within.

“If you’ve already got a foothold no matter what it is, then unleash the power of those individuals,” he says. “Ask for their help, have them form a diversity and inclusion council which is one practical thing we have done and it’s been reverberating. They will make demands on the organisation and help you.”

He also believes change needs to be driven by the top and be part of a live, ongoing engagement to change behaviour.

“We have had training on unconscious biases, but if it’s a once and done then it has a half life. Now at a senior level we want to pause and ask ourselves ‘does that have a recency or similarity bias? Is that seeping into our decision making?’ Unconscious biases lead to a lack of inclusion.”

Many asset owners are looking at focusing on diversity not just through optics but with a light shining on cognitive diversity. (See a case study on the Future Fund’s approach to cognitive diversity)

“We all work in an industry where we understand the real power of diversified asset classes,” Ubelein says. “None of us would buy a bond and think it was going to add to our risk return if it behaved exactly like an equity, and yet so often we hire people that optically look like they are diverse and yet think and behave the same as us. We are focusing on the ways for us to train ourselves that cognitive diversity is messy and takes longer but we get better outcomes as a result.”

Excellent story. The progress made is astounding. In 2006, we created DiversityFund.net a diversity investing approach and portfolio to promote corporate diversity while targeting women and minority investors for economic empowerment. See: https://www.impactinvesting.online/2017/02/first-socially-responsible-investing.html and https://diversityfund.net/