Engagement and stewardship are topics of increasing important to asset owners, either directly for the assets they manage or indirectly through their external asset managers. Historically, the focus has been public equities although interest is rapidly growing in fixed income as well.

Left out in the cold is private equity. I find this curious for three reasons. First, this is a growing asset class. Preqin estimates that in June of 2018 there were $3.41 trillion in assets (with roughly $1 trillion in dry powder) and 82 per cent of fund managers were expecting this number to grow. While there are thousands of PE firms, according to Private Equity International the top 300 have $1.7 trillion in AUM and the top 10 have $403 billion.

Second, it is an increasingly important one to the 7,600 institutional investors, half of which are in North America, because of the long period of superior returns this asset class has provided compared to public equities and public debt, even with prevailing fee structures. As a result, most investors are looking to increase their allocation in order to get the overall returns needed from their portfolios to meet their obligations to their beneficiaries. In North America, for example, the current median allocation is 6.1 per cent and expected to grow to 10.0 per cent.

Third, this asset class has built-in levers for engagement. The GP has complete control of its portfolio companies and can appointment the chair, CEO, and often has a partner who sits on the board as well. There is frequent contact between the GP and portfolio company and the GP can ask for whatever information it feels is necessary to monitor and grow the value of the asset. While the cost/benefits of information must be taken into account, one cost which doesn’t exist is the concern about the glare of public markets. Here, in particular, I’m thinking about the material environmental, social, and governance information investors are increasingly demanding from the public companies in their portfolios. They want this because of the growing body of empirical research that shows how strong ESG performance contributes to financial performance. I see no inherent reason why the same shouldn’t be true for private companies.

So what does engagement look like in this situation of a growing asset class with high returns and where the foundation is already in place for the asset manager to act on behalf of the asset owner for strong engagement? While there are exceptions, the most that asset owners seem to be doing are sending out ESG due diligence questionnaires (DDQs) when they are considering a new fund, either from an existing GP or a new one. The GPs spend a lot of time filling out these DDQs, each of which is unique, but they seem to have little to do with the selection process and there is little if any follow up once the money has been allocated.

On the GP side, ESG is finding itself a bigger part of the due diligence process when considering an investment. It is also being considered more in monitoring the portfolio company, although typically not in terms of “sustainability” or ESG and is done more informally.

There is an easy way to improve this situation. A collection of leading LPs could come together and agree upon a framework for ESG reporting, such as based on the work of the Sustainability Accounting Standards Board (SASB), by which portfolio companies would report to the GP. This would form a solid basis for engagement. It would enable the GP to compare its portfolio companies in the same industry. If this information were anonymized and put into a database, the GP could benchmark its performance against other GPs. LPs could have access to this information as well, either in aggregate or granular form.

I’ve had informal conversations with both GPs and LPs about this. The former has acknowledged the potential benefits, albeit raising some concerns about costs. They’ve also made it clear that if the LPs were to demand them to do so, they would certainly oblige. So what do the LPs say? “Yes, this is a very interesting idea and we’d love to see it happen. But I certainly don’t want to be out front on this since the GPs I want into will cut my allocation.”

My response is “Wow, PE sure is a great business to be in, at least for now. But you’ve got to be kidding me!! LPs can get the levels of engagement they’re seeking in public equities but are failing to do so out of fear?” Yes, leadership is hard and involves risks. But if the LPs never take leadership here, they shouldn’t complain when PE returns decline due to the lack of proper information from and engagement with portfolio companies.

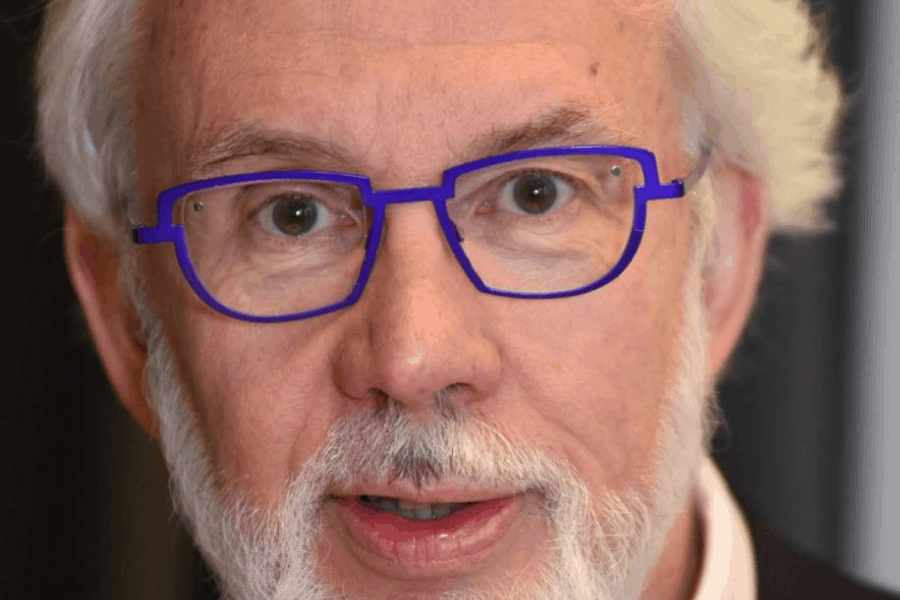

Bob Eccles is Visiting Professor of Management Practice, Said Business School, University of Oxford