Multi-asset strategies have reinforced their ascendancy in the last few years, with the growth in assets under management matched by abundant product launches. Liquidity, transparency and fees lower than for many other liquid alternatives have made multi-asset strategies attractive for constrained investors, such as defined contribution pension schemes with liquidity and fee guidelines and small institutional investors with governance constraints.

Meanwhile, larger, less constrained investors have also found a place within their portfolios for these strategies, particularly where they can demonstrate diversification benefits within the broader asset mix.

Mercer separates multi-asset strategies into four main universes: core multi-asset, idiosyncratic multi-asset, risk parity and diversified inflation. This article focuses on the first two categories (which in some regions have been labelled as diversified growth funds), as we discuss the range of options available, the different sources of risk and return, and the potential role that these products could play in an investor’s portfolio.

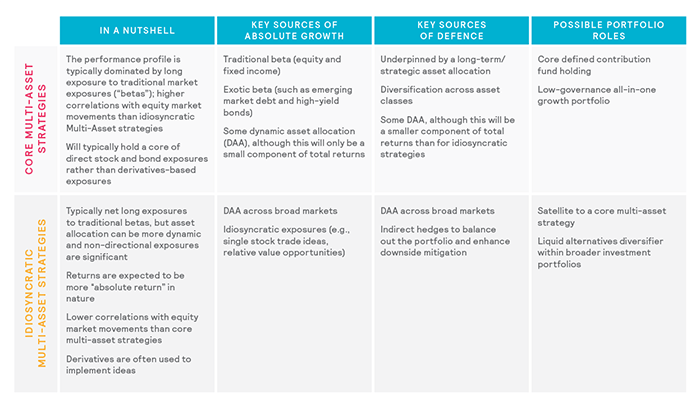

In 2014, Mercer created these two subcategories. We summarise their key points of difference in Table 1.

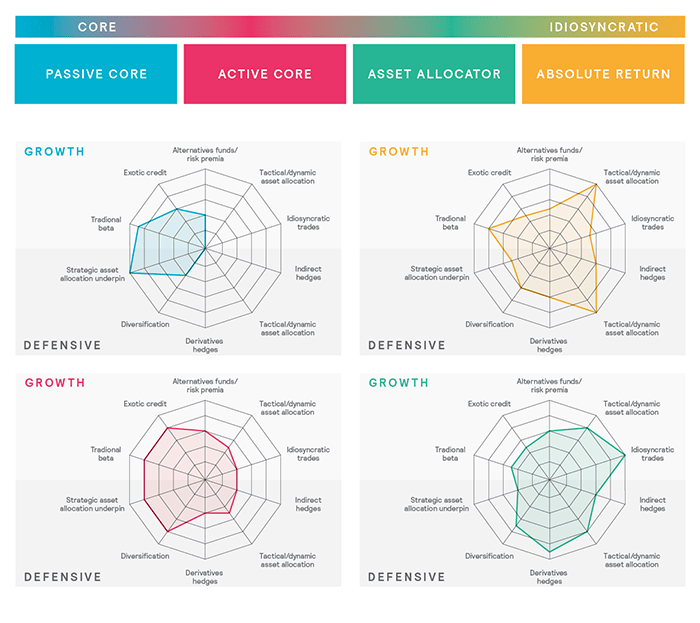

As the market has evolved, providers have continued to innovate and push the boundaries of these two categories, and we believe that the multi-asset space should be seen as a spectrum of strategies. The extent to which a strategy uses underlying active management, exploits dynamic asset allocation, and/or relies on market directional and non-directional return drivers all affect this breadth of options. To help understand the key characteristics of this diverse range of strategies, we informally separate them into the four further subcategories shown below. The radar charts show the biases (which Mercer has qualitatively assessed) for a typical strategy within each category.

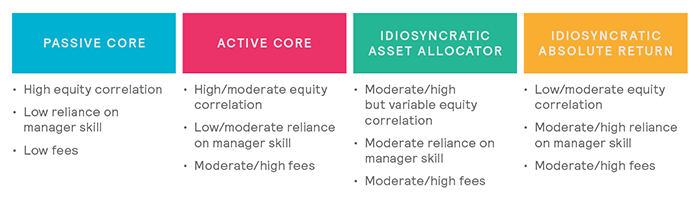

As with all investments, we believe it is important to understand the associated costs of each option when allocating to multi-asset strategies. To help assess value for money, we have looked at the relationship between the sources of return within a strategy and the total cost of investing in that strategy. Overall, we believe a higher fee can be justified more easily for strategies that rely heavily on manager skill than for those driven by traditional market beta (primarily equity markets).

Core multi-asset: a ‘smooth ride’

In our view, the most common objective of investing in a core multi-asset strategy is to achieve a ‘smoother ride’, relative to a pure equity portfolio, by introducing exposure to a range of other traditional market betas.

Traditionally, these strategies have been popular with two types of investors: those searching for a low-governance, all-in-one portfolio solution and those with a long-term investment horizon that want equities to remain the main driver of returns. For governance-constrained investors looking for equities to remain the main driver of returns, we recommend passive corestrategies to gain core beta exposures in the most cost-efficient way possible. For those looking for an all-in-one portfolio solution, we believe our highly rated active corestrategies remain an appropriate option.

Idiosyncratic multi-asset: diversified growth

The key objective of an idiosyncratic multi-asset allocation is to introduce differentiated return drivers into a portfolio, thereby diversifying an investor’s growth assets away from traditional market exposures – in particular, equity market beta. To achieve this, investors generally have to rely heavily on strategies driven by manager skill and/or multiple alternative betas. Asset allocator strategies do this by using dynamic asset allocation to such a degree that it becomes a significant driver of returns, although they remain predominantly reliant on traditional asset classes. Meanwhile, absolute return strategies rely far more heavily on non-market directional trades to drive portfolio returns.

Although we see idiosyncratic strategies as a useful option for investors looking to represent their liquid alternatives allocation, we also believe they do not fully capture the available opportunity set. In our view, the purest and arguably best method of achieving this objective is to allocate to a diverse pool of hedge funds. This is particularly true for those investors that do not have any governance, fee or liquidity constraints.

The emergence of more liquid and fee-conscious alternatives strategies, such as alternative risk premia and Undertaking for Collective Investments in Transferable Securitieshedge funds, grants all investors – including those that have relied on multi-asset strategies because of constraints – a much wider range of strategies to choose from to ensure they can access the broadest range of return sources. Therefore, we see idiosyncratic multi-asset strategies as only one part of the range of options investors should consider when building their liquid-alternatives allocation.

Idiosyncratic strategies introduce a greater reliance on manager skill (relative to more beta-driven mandates), which introduces a degree of manager-specific risk – in particular, when large allocations are made to a single manager. It is not uncommon to see allocations of more than 25 per cent of a portfolio to a single idiosyncratic strategy. If a manager were to have a period of weak performance, it would have a significant and material impact on the investor’s returns. Therefore, we recommend investors diversify their allocation across more than one manager, and across styles, with no one strategy accounting for more than 10 per cent of a portfolio, to mitigate these risks,.

For more information see: Making Sense of Multi-Asset.

Kishen Ganatra is Mercer’s European strategic research director and Shailan Mistry (pictured) is a consultant in Mercer’s hedge fund research boutique.