The A$133 billion ($105 billion) Future Fund could manage money on behalf of other institutions, said the chair of the fund, Peter Costello, who did not rule out the idea of managing money for a default super fund.

“The Future Fund is a sovereign wealth fund and all of the money is owned by the taxpayers through the government of Australia,” said Costello, at the fund’s end-of-year results briefing. “It is not a superannuation fund. That means the Future Fund can’t run a super fund, it can’t mix other money into this sovereign wealth fund, it also doesn’t have the mechanism to secure money, keep members accounts or pay out money. But could the Future Fund manage money? Maybe it could do that.

“If someone else sets up ‘default super’ and [the fund is] looking for managers, it could go to, say, MLC, or I suppose it could come to the Future Fund.”

How the Future Fund would manage money for another fund is unclear. By law, the Future Fund has to outsource investment management, and it employs about 117 investment managers. It does pride itself on adding value, in part, through good manager relationships, and has a reputation for close relationships that enable it to get the most out of managers, in terms of both investment ideas and value for money.

The Future Fund has generated $73 billion on top of its seed capital of $60 billion, and in the year to June 30, it returned 8.7 per cent against a target of 6.4 per cent. Its 10-year return is 7.9 per cent a year.

Later draw out date, new return target

In the last year, there have been two changes to the Future Fund’s mandate that could affect the way it runs its portfolio. First, the government will now not draw out money before 2026, six years later than the original mandate of 2020.

The implication of this, Future Fund chief executive David Neal says, is that the fund can now maintain its allocation to unlisted markets – which is 11.6 per cent in private equity and 8 per cent in infrastructure and timberland – rather than becoming more liquid.

“We were keen to have the announcement because we were about to have to do things differently, now we don’t have to,” he said.

In the second change, the government has moved the expected return target of the fund to CPI + 4 to 5 per cent, down from CPI + 4.5 to 5.5 per cent.

“While this is still extraordinarily challenging, it is more commensurate with expected returns over the next decade,” Costello said. Costello served as a member of the House of Representatives from 1990 to 2009 and was Treasurer of the Commonwealth of Australia from March 1996 to December 2007

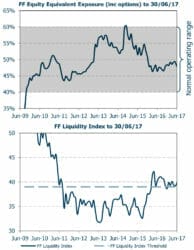

The Future Fund continues to have a fairly conservative asset allocation, Neal says, which has changed little in the past year.

“Risks are a little elevated and expected returns are a little depressed, so it is prudent to carry a little less risk than normal,” Neal said.

In the last year, the fund has taken off risk and, at the same time, moved to become more liquid.

Neal explained: “This is the other part of our strategy, to be more nimble, and we have increased the [ability] of the portfolio to react.”

More venture and growth activity

The fund has retained its high allocation of 21 per cent to cash. This is partly because sovereign bonds are viewed as expensive, so cash is the lower-risk investment for the fund.

Neal said, however, that the high cash weighting should be viewed in the context of the fund’s assets in property, debt and infrastructure, which are all higher risk/higher return-seeking than normal.

In the last year, there has been activity within the fund’s asset sectors and a fair amount of selling.

For a portfolio highlight from the last 12 months, Neal pointed to the Future Fund’s purchase of a 50-year lease on the Port of Melbourne, with a consortium including QIC, Global Infrastructure Partners and OMERS (the Ontario Municipal Employees Retirement System) last September.

There is expected to be more activity in the Future Fund’s venture and growth portfolio, which Neal said the fund was looking to build.

“There is a disruption theme that this plays into, but [these assets] are also very diversifying,” Neal explained. “They are inherently risky but uncorrelated to the broader economy. What matters is if it’s a good idea or not. We are building this with good managers.”