As adept at giving orders as taking them, REST Industry Super’s Brendan Casey juggles his dual careers in military operations and investment operations with aplomb.

Managing $42 billion in investments at one of the country’s largest superannuation funds is a big job but, even on its toughest days, the pressure pales in comparison to working under enemy rocket fire in Afghanistan.

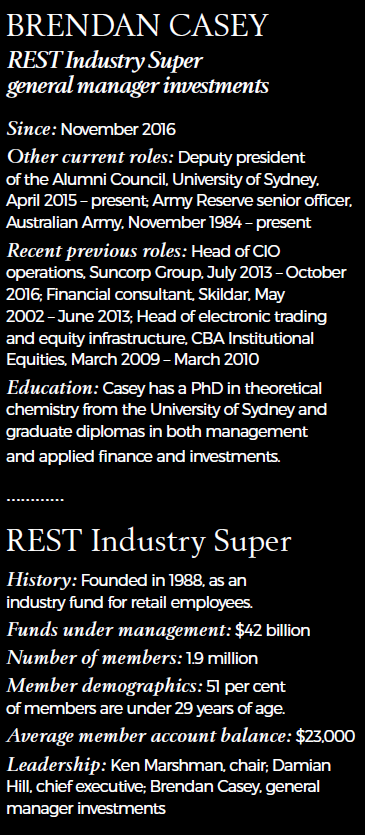

REST’s recently appointed general manager investments, Brendan Casey, says 32 years in the Australian Army Reserve, including an active deployment overseas in 2011, have shaped him for the biggest civilian leadership role to date of his varied career.

“Leadership, planning and resilience are the qualities the army has given me,” says the former chemical engineer turned quantitative analyst, turned stockbroker, turned asset manager, turned investment operations expert.

A defence background that has taught Casey how to both lead and follow orders is set to prove invaluable in working with the REST investment committee – well known as one of the most hands-on in the industry.

Casey recently sat down with Investment Magazine at REST’s Sydney offices, in his first media interview since joining the superannuation fund on November 1, 2016.

He painted a picture of himself as a man not easily ruffled.

“[In Afghanistan], I went through six months where every other day people were rocketing our base,” he says. “People were dying every day. That was such an extreme level of stress. I can’t imagine anything happening here that could come close… It is much easier working in a civilian environment…much gentler.”

“The beauty of that is that I’m always calm and it’s hard to stress me.”

Immediately prior to joining REST, Casey spent a little over three years at ASX-listed insurance and wealth management firm Suncorp as its head of investment operations.

At REST, he fills the fund’s top investments job, which had been left vacant for five months following the departure of Ronan Walsh in May 2016, after just six months in the position.

REST independent chair Ken Marshman told Investment Magazine Casey’s “terrific” background in investments and investment operations made him an ideal candidate for the role, and that he was also impressed by his life experience beyond the financial services industry.

“He has a very diverse set of backgrounds and interests; a wellbalanced but very active life,” Marshman says. “He appears to be driven to excellence…and his track record shows a high level of mental agility.”

Casey started his professional life as a chemical engineer working internationally for DuPont and gained a PhD in chemistry, specialising in polymers. A dearth of career opportunities for senior scientists at home in Australia, where he and his wife, who also holds a PhD in chemistry wanted to raise their family, led to a career change.

After answering a advertisement in the Sydney Morning Herald titled ‘Move from science to finance” Casey landed a job as a quantitative analyst at County (now Citi) and never looked back, proceeding to rise to head of portfolio and trading, then moving on to various roles with Commonwealth Bank of Australia before landing at Suncorp and now REST.

Former Suncorp chief investment officer Nick Basile, recruited Casey as his deputy at the insurer, having previously been his boss at CBA.

Military precision

Military precision

Basile says Casey has a “firm but fair” management style that “gets things done.”

“Probably the best recommendation you can give someone is to hire them again,” Basile says. “He tends to have very high expectations of his team, but he communicates goals early and clearly and delivers.”

Basile says Casey was always clearly ambitious and sought out career development. And as he was building his career in the financial services sector, he was simultaneously progressing up the ranks in the Australian Defence Force.

At the age of 19, Casey was already commanding a 10-man section in the infantry. Today he is responsible for 14,000 high school cadets as the commander of the NSW Australian Army Cadet Brigade. The plan is that his next assignment will see him promoted to brigadier general in the Army Reserve, in charge of 5000 adult service personnel.

It is notable that someone so ambitious and experienced at leading others is also comfortable following orders.

Most super funds of REST’s size employ a CIO to lead their investment strategy, under the guidance of the board’s investment committee. At REST, the investment committee, working closely with the fund’s longstanding asset consultant JANA, has always taken a much stronger role.

Casey says the fact the fund was recruiting for a general manager investments to implement its strategy, rather than a traditional CIO to set the strategy, was exactly what appealed to him.

“The job description matched me so perfectly,” he explains. “The investment committee fills the role of a strategic CIO and I fill the role of an operational CIO.

“Day-to-day decisions a CIO might make, I make. But longer term decisions go to the investment committee, which meets monthly.”

REST’s investment committee is led by fund chair Marshman and comprises five other trustees, plus JANA founder John Nolan, who sits on the investment committee as a non-voting member.

JANA executive director John Coombe, head of research and investment outcomes Steven Carew, senior consultant Matt Griffith and consultant Matt Gadsden also attend REST investment committee meetings.

The industry fund’s ties with its National Australia Bank-owned asset consultant, which has held the mandate for 26 years, clearly run deep.

Marshman is a former chief executive and chair of JANA.

So far, Casey is finding the close working relationship with the investment committee and its advisers constructive.

“JANA obviously have a house view but they’re willing to challenge that thinking on [how well it applies] for us,” he says. “They definitely speak their minds, especially John Coombe – he is not one to be handcuffed.”

Tilt to cash

Tilt to cash

The portfolio strategy Casey has been tasked with implementing over the short term is to tilt away from equites towards cash and credit securities.

REST is already holding 6 per cent of the portfolio in cash, ready to buy bargains in the event of a market dip.

This is driven by a view that equity markets are overvalued in a low interestrate environment and fear of heightened geopolitical risk, following Brexit and the election of Donald Trump as president of the United States.

“There are different views within the investment committee on whether things are going to be positive or negative because of Trump,” Casey says. “A lot of people think there will be a short-term boost in the US economy, but there is concern as to whether it can sustained…and what effect his policies might have in other markets.”

Another element of REST’s investment model that is different to other funds is its heavy reliance on subsidiary Super Investment Management (SIM): a separate, but wholly owned, externally operated funds management business.

“Across the industry, there is a push towards in-sourcing, but REST has always had a pseudo-internal investment team,” Casey says.

REST does not manage any investments internally, but has about 20 per cent of its mandates with SIM, an arrangement set up more than two decades ago.

Since its creation, SIM has been forbidden from taking on any clients other than REST.

“That is a philosophical approach in that we want them purely focused on REST and returns for our members,” Casey says.

It is also REST policy that SIM cannot be the fund’s exclusive manager in any asset class, with the exception of cash management, to keep the business on its toes.

“We perform due diligence on SIM, receive monthly reports, and assess them against benchmarks and their peers, just like any other manager,” Casey says.

The REST model of having a powerful investment committee fulfilling the strategic CIO role, a general manager investments focused on implementation, and external fund managers (including the wholly owned SIM) carrying out the day-to-day trades is unique in the industry.

“It is not typical, but it has obviously worked very well, as can be seen by how well the fund has performed and the great returns delivered for members,” Casey says.

The fund’s MySuper option – REST Core – was the top-performing growth fund in Australia over the 10 years to June 2016, with an average annual return of 6.4 per cent.

Casey hopes to add “a couple” of new roles to his team of 11 direct reports at REST, but says he is more concerned with building capability than headcount.

“The biggest area where I want to work with my team on lifting their capabilities is improved project planning skills,” he says. “Defence is all about planning…the finance sector not so much.”

With $42 billion in funds under management, REST is placed as the ninth-largest super fund in the country by funds under management.

But with more than 2 million accounts, it ties with its biggest rival ($103 billion AustralianSuper) as the super fund with the biggest membership.

This fact hints at one of the biggest challenges for REST’s executive management: looking after the interests of members with meagre balances.

REST is the default fund for some of the biggest employers in the retail and hospitality sector – such as Woolworths, Coles and McDonald’s.

More than half (51 per cent) of REST’s members are under age 29. Most members were automatically signed up to the fund when they got a low-paid casual job early in their working life.

Educating young members about the importance of super and how small contributions made early in life can add up to a better retirement is an important focus for the fund.

The demographics of REST’s membership also have a direct impact on the investment strategy Casey is tasked with implementing.

“Our members have got a long future ahead of them, so our style is to focus on growing long-term returns,” he says. The fund’s core MySuper strategy has a 78 per cent allocation to growth assets.

Frustratingly for Casey and his team, one of the most important drivers of total net returns for their most vulnerable members is completely beyond their control.

It is required by law that all super funds automatically sign default members up to a group life-insurance policy that includes three types of cover: death, total and permanent disability (TPD), and income protection.

The relative merits of default group life insurance, particularly for members with low balances – for whom the premiums leave a heavy dent in their retirement savings – is the subject of hot debate.

Insurance dilemma

Insurance dilemma

Each year, some default members with low balances pay out more in insurance premiums than they receive in investment earnings.

It’s a perverse situation, where default insurance premiums are eroding the retirement savings the scheme is intended to protect.

This is particularly challenging at the moment, when sluggish global growth means super funds are likely to struggle to deliver the type of average annual investment returns members have grown used to in the past decade over the 10 years ahead.

Casey told Investment Magazine that the insurance conundrum is an issue he has discussed with REST chief executive Damian Hill, who is a contributor to the Insurance in Superannuation Industry Working Group established in December 2016 with the goal of producing a new code of conduct by the end of 2017.

REST now has the simplest and cheapest default group life-insurance policy of any super fund in the market.

“That is intentional, because it is arguable whether very young people get much benefit from default life insurance,” Casey says.

Basic cover for total and permanent disability and income protection tends to represent good value to most members, but for the large swathe of REST’s members, who are aged under 25 and don’t have any dependents, the value of death cover is highly questionable, he says.

In the coming months, a parliamentary joint committee will examine the question of whether death cover should remain a mandatory default inclusion for default super members.

“It’s a question that is definitely worthy of a review,” Casey says.

This article first appeared in the February print edition of Investment Magazine. To subscribe and have the magazine delivered CLICK HERE. To sign-up for our free regular email newsletters CLICK HERE.